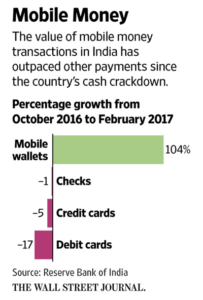

The value of mobile money transactions have more than doubled since the nullification of 86 per cent of India’s cash in circulation in November, while those made with credit and debit cards has fallen, and cheque purchases have barely budged. Mobile payments still make up only a small percentage of overall transactions, but their surging popularity is being noticed

At this rate, cards and automated teller machines could be redundant in India by 2020, predicted Amitabh Kant, head of NITI Aayog.

Mobile wallets could be the next example of countries pole-vaulting to the latest technology, in the same way that some emerging markets went directly to using cellphones. More merchants already accept payments from Paytm, India’s largest mobile-payment company, than accept credit or debit cards in India. There are only 2.5 million card-scanning machines in the country, while 5 million merchants accept Paytm through their smartphones.

Paytm aims to more than double that number this year. “In the future, everything will be mobile,” said Vijay Shekhar Sharma, chief executive of Paytm parent company One97 Communications. Mobile payments will become “bigger than plastic,” he said.

Indian shop owners and consumers can download any one of more than 10 competing apps, of which Paytm is the market leader, with 218 million mobile wallets.The company counts China’s online retail behemoth Alibaba among its backers and is set to receive a new investment of more than $US1.5 billion from SoftBank in a deal that could be announced as early as this week. ( again a case of winner takes all and a privately owned company)

While many Indian families have access to a bank debit card, a vast majority only use it to get cash out of ATMs, if ever. Credit cards have been in India for decades, but there are still only 30 million in the country. In 2014, fewer than 5 per cent of Indians over 15 had credit cards, while 60 per cent of Americans did.

“Cards had their time,” but they never took off in India, said Vivek Belgavi, partner and financial tech specialist at the Indian arm of PricewaterhouseCoopers.