Lewis Johnson writes ….China’s annualized steel production in March was a staggering 800 million tons, more than eight times the size of U.S. production and a new all-time high representing nearly half the world’s steel production. The world’s steel markets simply cannot accommodate the full weight of Chinese steel exports seeking higher prices elsewhere. Something’s got to give.

One possibility is falling global steel prices in the face of sustained oversupply from China. In this scenario, Chinese steel flows outward responding to higher prices available elsewhere. Another scenario is the rise of populist driven protectionism that legislates competitive advantage through tariffs and other trade restrictions. Such a policy would elevate prices in protected regions while depressing those without similar protection.

The second approach appears very possible in the United States given that in recent days the Trump Administration announced the unprecedented use of Section 232 (passed in 1962) of the trade code directing the U.S. Department of Commerce to investigate the national security implications of higher U.S. steel imports. Assuming this investigation results in a favorable determination (a fair assumption), we could see tariffs and other such measures create a protective price umbrella under which U.S. steel producers could prosper despite the continuing menace of oversupply from China.

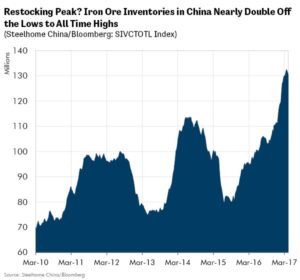

The preconditions for a peak in the inventory cycle are now in place, just as they were in 2008, 2011, and 2014. Will the peak arrive a bit early – now only 33 months from the last peak? Or is our caution premature? Timing is the hardest part of investing. The truth is that no one can see the future

Chief Conclusion: Key leading indicators in the commodity markets support our expectation for a mid 2017 peak in the inventory cycle. Steel offers the best insight into this cycle and the slowdown that we expect to unfold in other markets, such as credit.