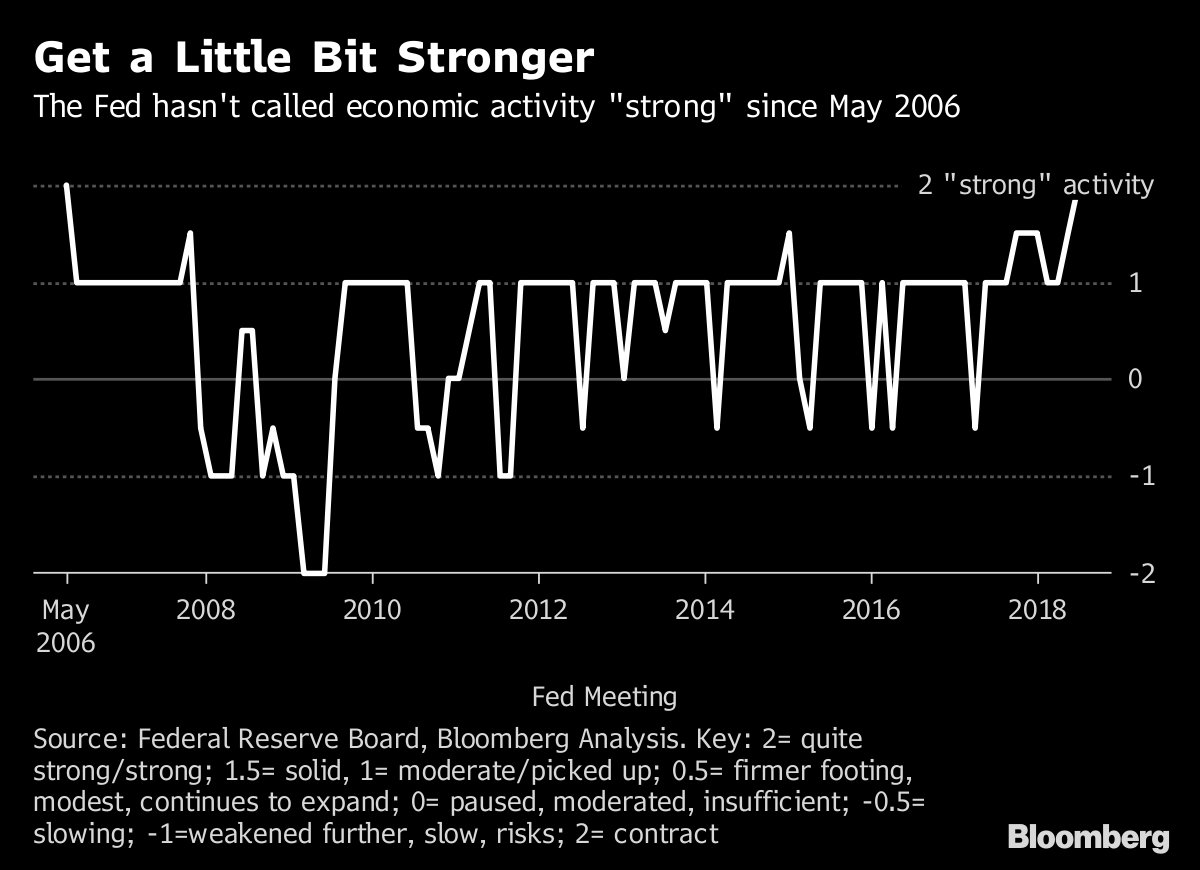

Martin Armstrong writes ” The talk behind the curtain remains that the Fed is still under pressure to PLEASE don’t raise rates. The lobbying continues from the IMF, ECB, and Emerging Markets. Meanwhile, the Fed leaves rates unchanged, but it upgraded its view of the US economy to ‘strong’ which remains a signal that the Fed is still prone to raise rates if the stock market continues to rally.

The Federal Open Market Committee voted unanimously to keep the target range for its benchmark rate at 1.75 percent to 2 percent. Still, the committee said that “economic activity has been rising at a strong rate,” which is a more bullish view than the June characterization of “solid” growth. Consequently, this statement also noted that household spending has “grown strongly.”

While many believe that as major central banks continue to push ahead with monetary policy normalization of raising interest rates, they wrongly think that raising rates will hurt the credit market and create a downturn. What they fail to grasp is that rates can rise with no impact provided the economy is expanding, but rates can also rise because there is no demand and government is forced to keep offering higher rates to find buyers of their debt in the real world. It all depends upon what people believe. This is why low rates in Europe have FAILED to stimulate demand when people lack confidence in the future, they will NOT borrow at any rate. Expectations of profit MUST exceed the level of interest rate before people will borrow. They function differently than governments which are addicted to debt and borrows all the time with no cyclical expectation.

The bottom-line remains clear. The US economy is holding up the entire world and lowering taxes has helped to bring capital home and attract foreign capital as the USA remains actually a tax haven outside of the world reporting system agreements.