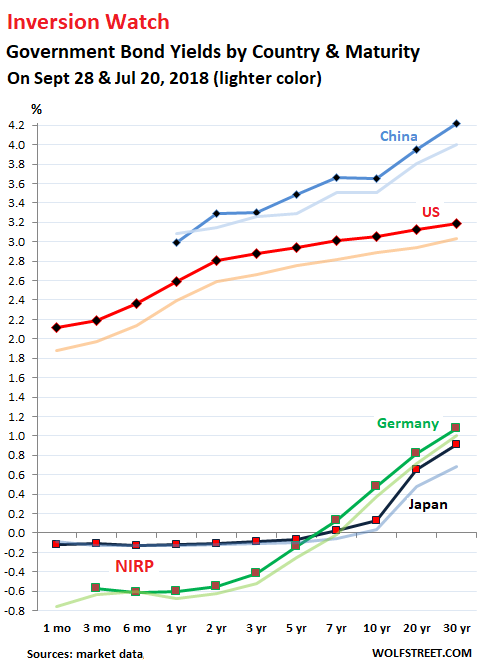

Yield curve is actually a function of expectations. US is having the flattest yield curve,whereas china, Germany and Japan continues to see steepness in the curve.

The only difference between monetary policy of these four countries is ….. US FED is the only one hiking rates along with shrinking balance sheet, whereas central bankers in other three are still continuing with balance sheet expansion. Investors wants a term premium for longer maturities for these three countries govt debt hence yield curve is steep

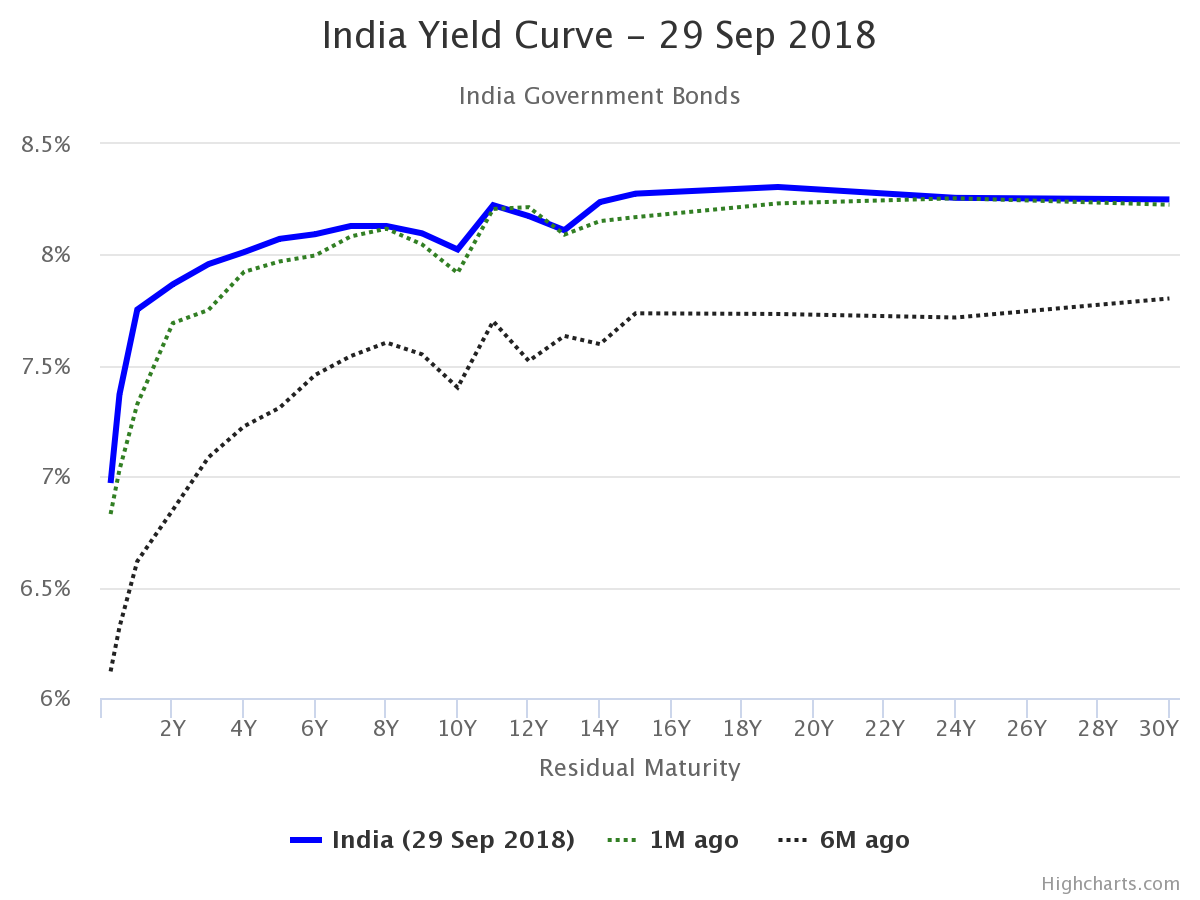

India’s govt bond curve has also flattened since RBI has started hiking the rates

Expectation of hiking rates along with real rates in positive territory is akin to containing inflation along with moderating GDP growth. US is hiking inspite of a shit load of debt burden and India will be hiking to maintain the value of currency,but in both cases it is also to make govt debt attractive to investors in face of rising deficit.

Till US and India continues to do rate hikes, long bond yields might not rise and yield curve may actually invert .

what is coming after the yield inversion will be explained once the curve inverts