Tamal writes “Frankly, all three possibilities are real—a quarter percentage point rate hike, a half a percentage point rate hike or even no hike (and let the impact of post two hikes sink in). The market will be surprised—not shocked—if RBI goes for a half a percentage point rate hike or chooses to maintain status quo. And, of course, status quo will mean the current situation in the domestic market cannot be taken lightly.More than the rate action, RBI’s guidance will hold the key. It has hiked the policy rate at two successive MPC meetings, citing future uncertainties, and kept the neutral stance unchanged. It’s time to tell the market little more or change the stance if it wants to preserve the relevance of the policy rate.”

Just before last policy SBI increased its deposit rates to align with market and this time HDFC has just increased the mortgage rates by 10 bp based on its cost of funding. The same has gone up sharply since ILFS and NBFC fiasco so mortgage rates will again rise next month based on previous funding cost.

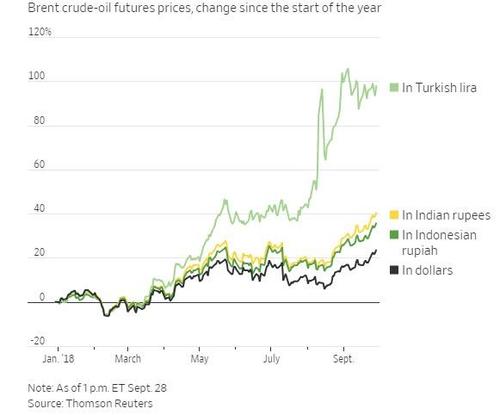

One more headache for RBI is rising crude prices because it creates a Feedback loop where rising prices are spurring higher inflation and expanding already large current-account deficits, further exacerbating the economic hit. An increasing import bill further widens the deficit, which puts further pressure on currency.

“Oil is definitely a risk for those pressured by current account funding issues,” said Sacha Tihanyi, deputy head of emerging-markets strategy at TD Securities in New York. “If we see oil continuing higher, we’ll have to see further monetary and nonmonetary measures in order to help stabilize the external deficit strain.”

In my view RBI will do a carrot and stick approach.

Provide liquidity when and where it is needed but raise the cost of LIQUIDITY to align with global developments and buy insurance cover against a rising inflation next fiscal year.

The last line is most illuminating – what the RBI should do ideally – liquidity and not the cost of liquidity is the key challenge currently. Hope the RBI also appreciates the diff, and is able to communicate the same to street