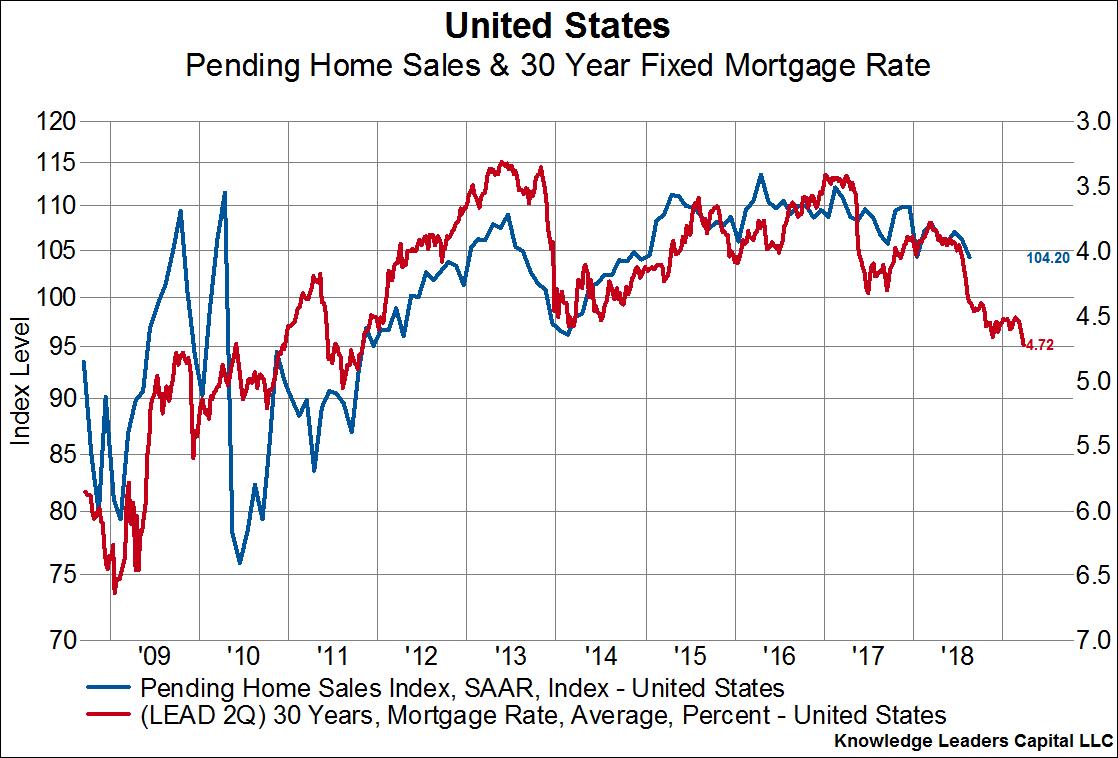

Knowledge Leaders write…The effects of higher long-term interest rates in US are starting to be squarely felt in the housing space. Pending sales, mortgage applications and new construction have all been weak and look set to get even weaker in the quarters to come as the lagged effects of higher mortgage rates set in. Home prices have yet to respond since inventory levels are still moderate, but inventories aren’t the support they were just two years ago. Meanwhile, affordability levels are no longer very supportive. All this suggests that the housing sector, which has been a bright spot of this recovery over the last five or six years, may not be the same source of wealth accumulation and growth over the next few years, or as long as higher mortgage rates continue to take the juice out of this sector.

This is one reason I believe that yields have still not bottomed out and we might still see a final low in 30 year US bond yield possibly with inverted yield curve.