Lance Roberts writes……Debt Doesn’t Create Real Growth

The massive indulgence in debt has simply created a “credit-induced boom” which has now reached its inevitable conclusion. While the Federal Reserve believed that creating a “wealth effect” by suppressing interest rates to allow cheaper debt creation would repair the economic ills of the “Great Recession,” it only succeeded in creating an even bigger “debt bubble” a decade later.

This unsustainable credit-sourced boom led to artificially stimulated borrowing which pushed money into diminishing investment opportunities and widespread mal-investments. In 2007, we clearly saw it play out “real-time” in everything from sub-prime mortgages to derivative instruments which were only for the purpose of milking the system of every potential penny regardless of the apparent underlying risk. Today, we see it again in accelerated stock buybacks, low-quality debt issuance, debt-funded dividends, and speculative investments.

When credit creation can no longer be sustained, the markets must clear the excesses before the next cycle can begin. It is only then, and must be allowed to happen, can resources be reallocated back towards more efficient uses. This is why all the efforts of Keynesian policies to stimulate growth in the economy have ultimately failed. Those fiscal and monetary policies, from TARP and QE, to tax cuts, only delay the clearing process. Ultimately, that delay only deepens the process when it begins.https://realinvestmentadvice.com/the-economic-consequences-of-debt/

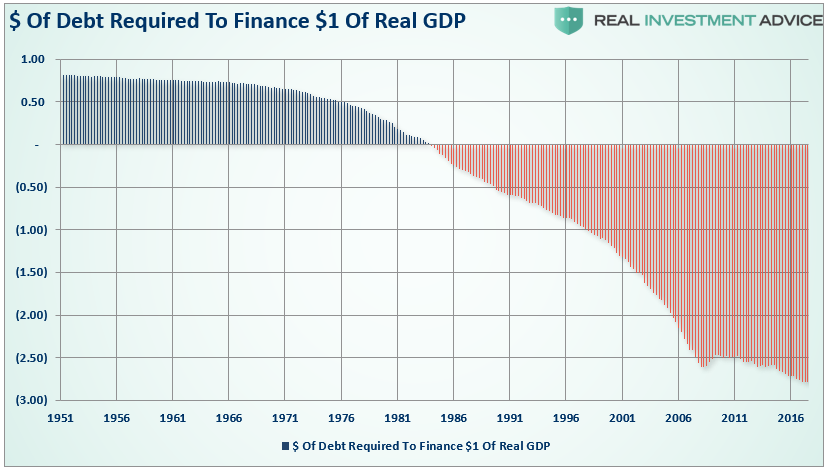

The biggest risk in the coming recession is the potential depth of that clearing process. With the economy currently requiring roughly $3 of debt to create $1 of economic growth. A reversion to a structurally manageable level of debt would involve a nearly $40 Trillion reduction of total credit market debt from current levels.