Markets are getting nervous and investors are getting itchy. Too many assets have lost too much money in a very short period of time.

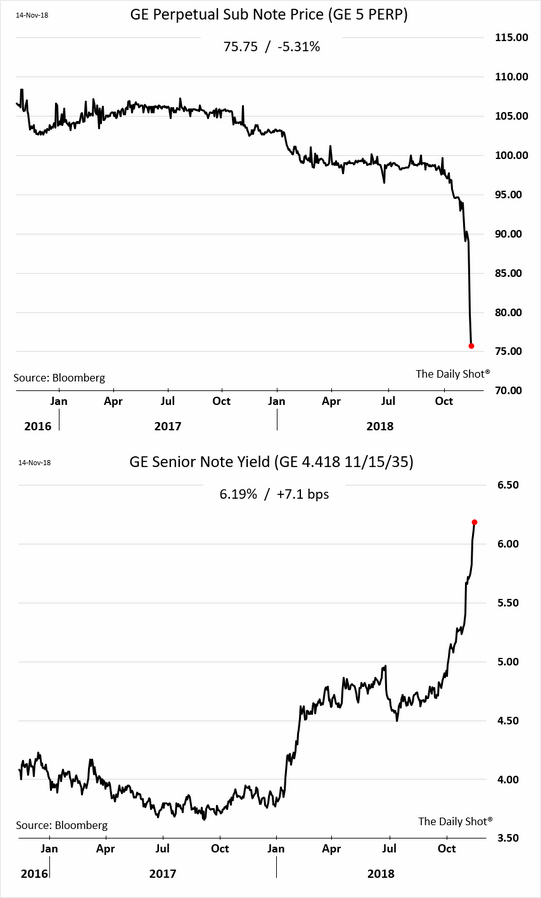

General Electric bonds are still investment grade with BBB+ ratings and are part of lot of fixed income portfolios. Below is the price of perpetual bond and bond yield

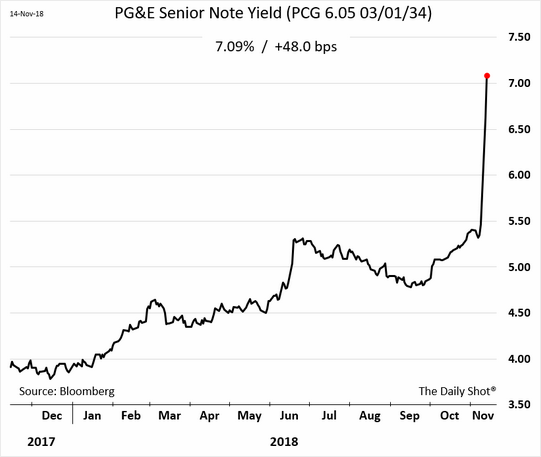

PG&E is Californian utility company and not the only one to see these kind of losses……. don’t know why ? massive fire in California and all utility companies have drawn down their bank limits.

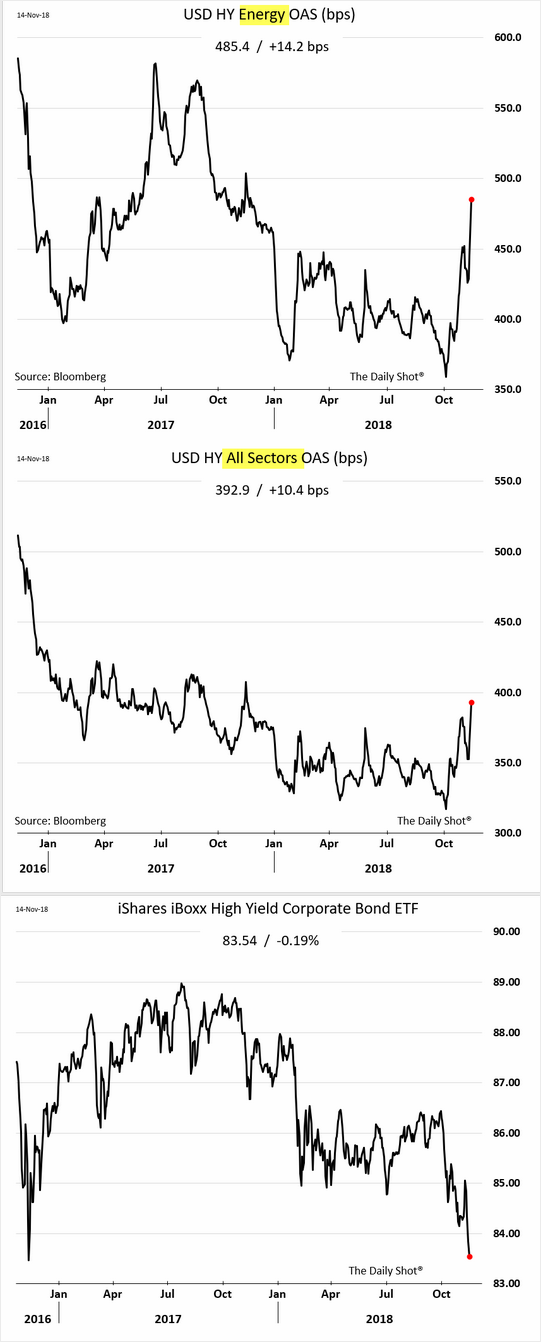

Everybody knows about the losses in crude oil complex. below is the chart of high yield energy/corporate bond index ( see the spread widening over treasuries) and price of the ETF tracking these assets.

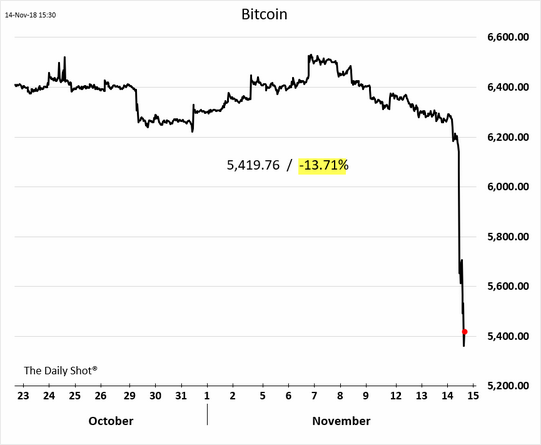

Bitcoin, blockchain anyone… well the entire cryptocurrency crashed yesterday and yes…. there are investors who are still invested in this asset

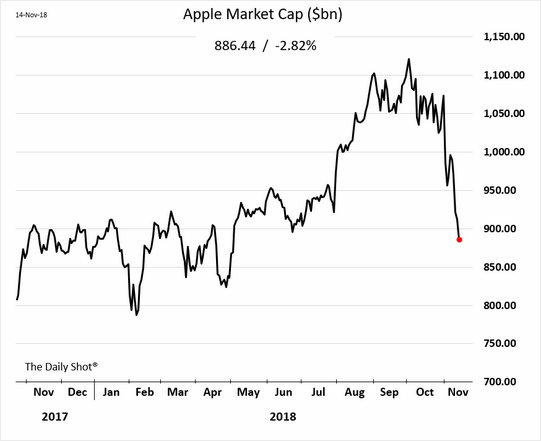

Finally everybody’s favourite stock apart from Amazon and since the prices were going up, investors pushed the prices up more and made it a trillion dollar marketcap….. but I guess consumers are finally tapped out. The fall is more severe in supply chain of APPLE.

When so many assets loose so much money then investors become more risk averse and start cutting on positions leading to vanishing of liquidity and widening of bid/offer spreads.