Indian media and Portfolio managers always like to spin a bullish story and the current bullishness stems from the collapse in oil price. Afterall rising oil prices for a country which imports almost all of its oil requirement is bad for discretionary consumption and its currency . Conversely, lower oil prices are good for the Indian economy as trade deficit comes down giving stability to the currency,retail oil prices come down giving breathing space to household budgets. But Nedbank breaks this Myth and their strategist Mehul Daya and Neels Heyneke writes …”Many market commentators are indicating that it is time to look for a bottom in the relative performance between EMs and DMs. History, as a guide, suggests that EM vs DM performance is still way above the 1988 and 1998 lows ( in short the bottom is far off)

• EMs underperformed in 2011-15, followed by a risk-on period in 2016-17 after the G20 meeting in February 2016 in Shanghai. Hence the interest in the upcoming G20 meeting to see whether the US and China can come to an agreement on global trade and re-engineer another risk on phase. We believe it will be difficult amid the number of headwinds facing the global economy.

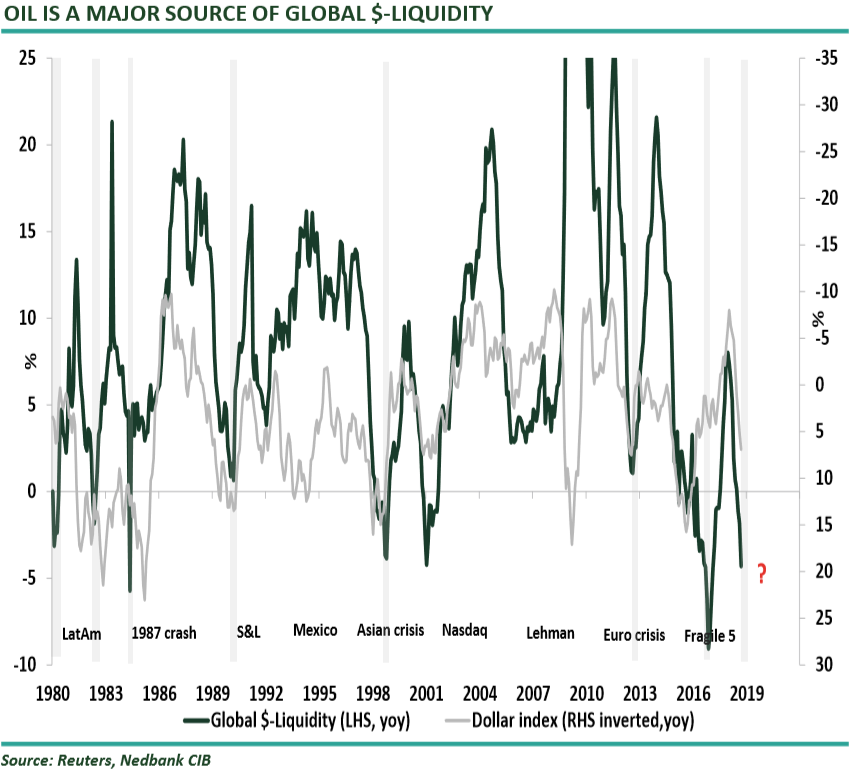

• The underperformance started in 2011, long before the Trump victory; it is not just about trade, but also about $-Liquidity. As long-time readers know, we believe investors are underestimating the role that $-Liquidity (money supply) plays in risk assets.

• An agreement between the US and China should boost failing global trade, helping dollar creation and increasing $-Liquidity. This would trigger a setback in the value of the dollar (EURUSD targeting 1.18), providing relief for EM assets in the near term. However, we still believe structural dollar shortages will continue to plague the market in 2019; hence, in the longer term, we remain bearish on EMs. We also remain concerned about China and its dollar debt burden, as Chinese corporates are heavily indebted with cross-border dollar debt. Hence, China cannot afford a stronger dollar or an escalation in the trade war with the US.

My two cents

Before you hop on to the boat of EM outperformance vs DM rotation ,look at the above chart. When dollar liquidity is ample, capital moves to higher yielding EM in search of returns and when the dollar liquidity contracts, the same capital is forced to sell EM assets as dollar rises.

so pray for a G-20 deal between US and china. it might just give you one last bounce in EM assets to get out because after that the door will be shut

“However, we still believe structural dollar shortages will continue to plague the market in 2019.” Why so? Is it due to the winding up of QE finally and higher growth in the U.S.?

no because world foreign exchange reserves are not growing anymore for the first time coupled with repatriation of dollar lying abroad due to tax cuts

Last one month things seem to have stabilized – at least for India. FII flows have turned +ve and forex reserves have started to grow (this week would provide further data). Certainly lower crude prieces has build up expectations of more moderate CA deficit and currency pressure has eased, and hence pushed FIIs into buy mode again. Looks like the headwinds may have passed for now, even if it is just kicking the can down the road… Thoughts??

India needs dollar liquidity to kick the can down the road and shrinking dollar liquidity ( combination of tightness in euro dollar market and shrinking global fx reserves) does not leave too much time for markets to adjust.

And which is why I am surprised by renewed flows into India. It is not as if fundamentals are looking better – seen a couple of news reports that indicate Sensex/Nifty earnings have been cut by 3-5% post 2Q. So liquidity coming into EMs like India might indicate global liquidity position is also improving. Might be a false +ve but question yet remains – what is driving FII flows into India.

this is ETF money which moves like clockwork. if seeling US then buying EM. if US bond yields are coming off then buying EM bonds. secondly asset managers have not made money this year hence they are desperate to buy any asset which gives them return. market is convinced that US fed is close to done hiking rates and that means buy India. doesn’t matter whether eps upgrade or eps cut