Warning Signal

Another leading indicator spells trouble for the stock market: Shares of Sotheby’s, which had predicted every crisis in the past decades, have lost 34% from this year’s all-time high.

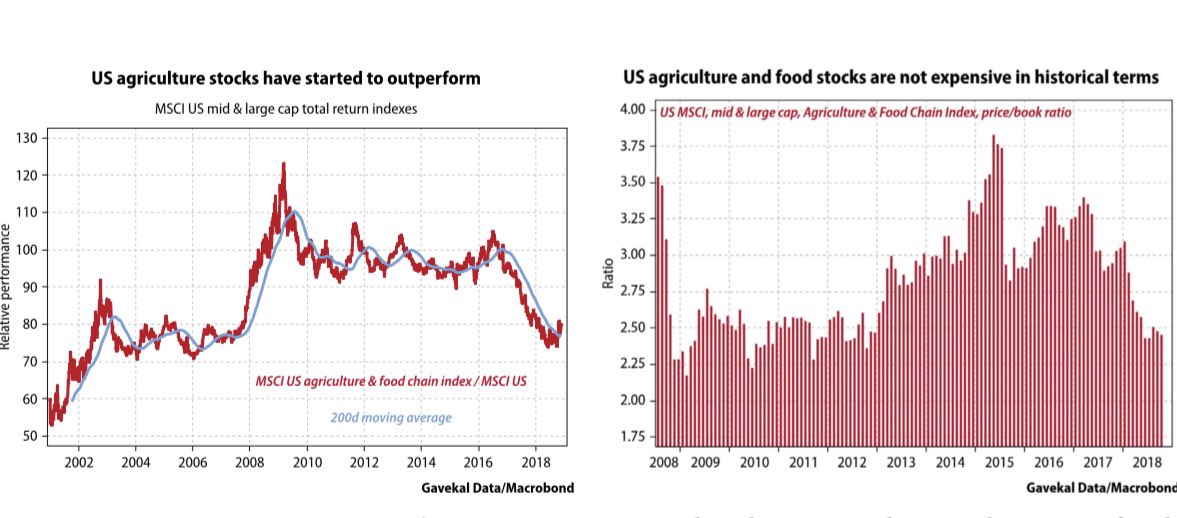

Finally an Undervalued asset class

Thinking about potential outperformers in 2019. How about Agriculture stocks? They have suffered big time from the USD rally and the trade conflict. They look cheap by historic standards, tend to outperform in bear markets, and who knows..maybe there will be a fancy trade deal…

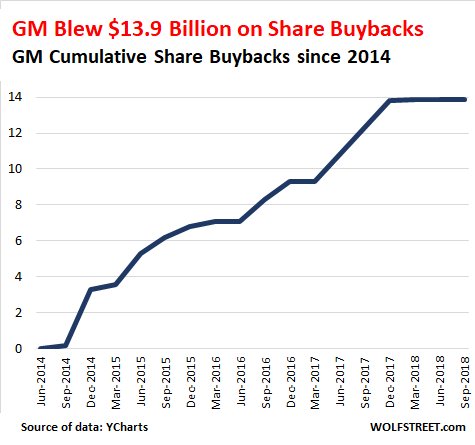

Gone

Gone down the Drains

After Wasting nearly $14 billion on Share-Buybacks, GM Prepares for Carmageddon & Shift to EVs, Cuts Employees, Closes 8 Plants. A big shift, at a cost of $3.8 billion – which it now has to borrow.

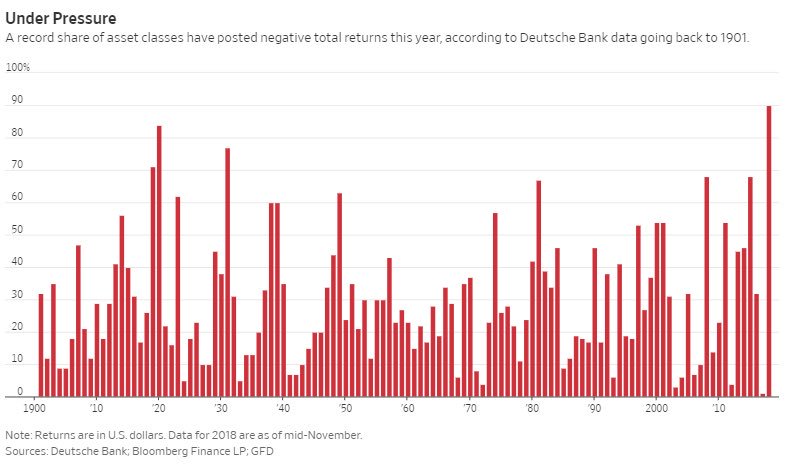

No place to hide

Record share of asset classes have negative return so far this year so don’t listen to experts on correlations, afterall it is your hard earned money