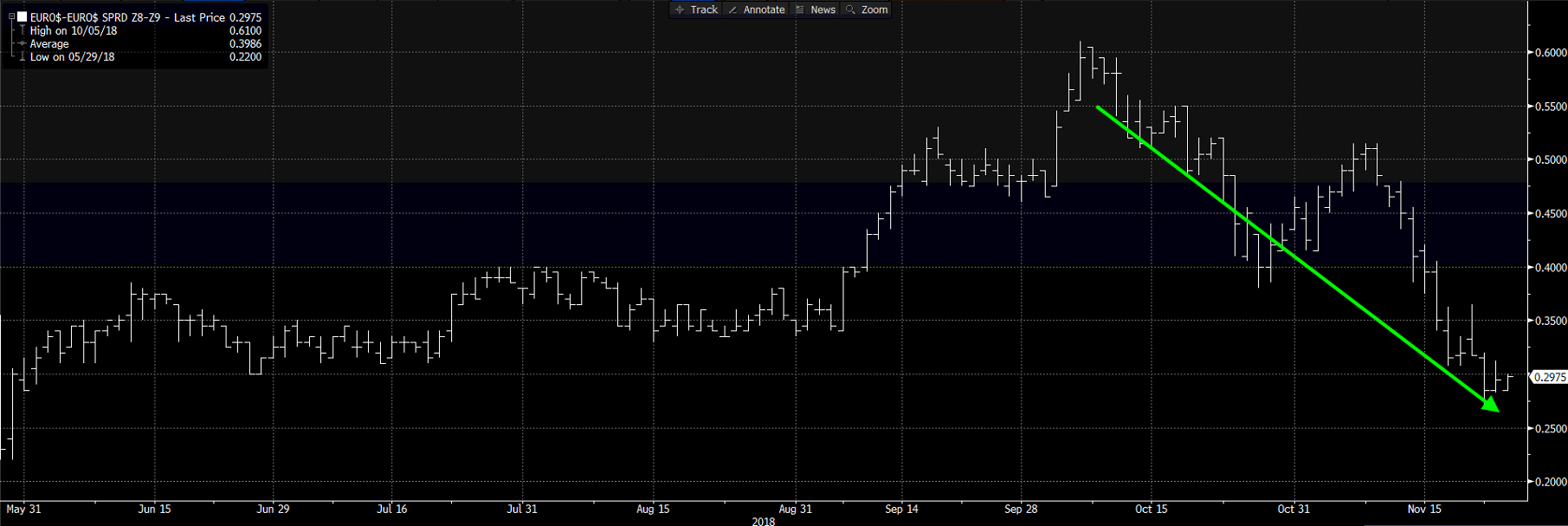

Albert Edwards latest this week was more like “WINTER IS COMING” from game of thrones ( I still remember his ice age thesis). So lets jump on to him. But before that, look at this chart from BLOOMBERG which is now pricing in just one more FED rate hike in 2019 .

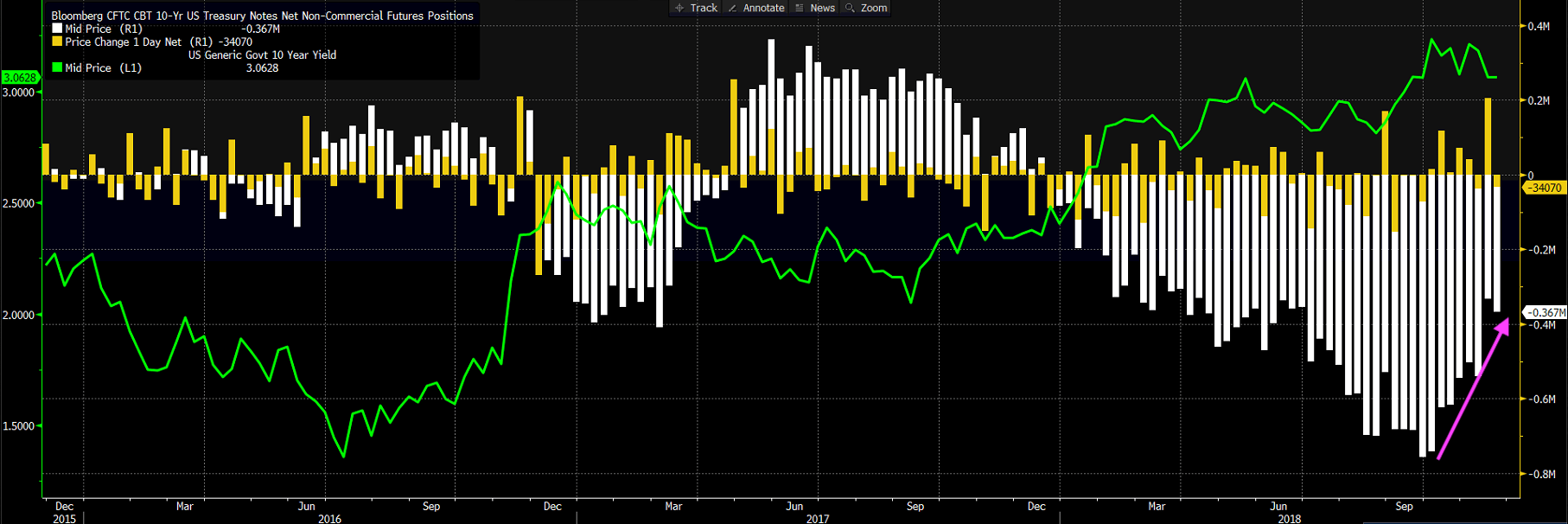

Heisenberg writes “Albert also flags the recent aggressive paring of the spec short in the 10Y, which was rebuilt slightly in the week through last Tuesday after being trimmed by the most since April 2017 in the week ended November 13”

But why is suddenly the narrative changing and market becoming confident that FED is almost done and bond positioning becoming bullish?

Albert comes to rescue again and writes

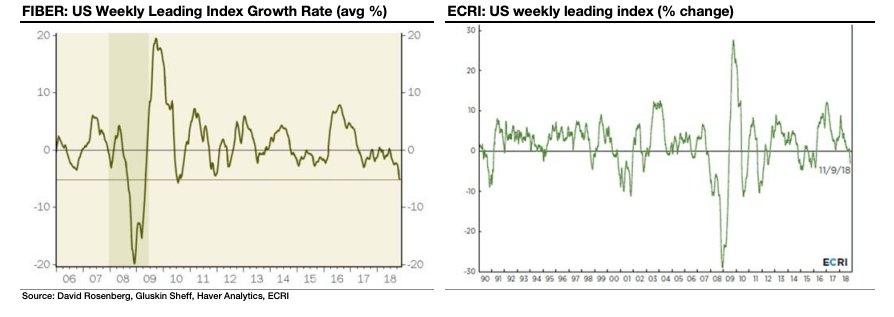

“One of the joys of following David Rosenberg on Twitter (@EconguyRosie) is that he always seems to come up with new indicators I have never seen. His latest is the FIBER leading economic index (link, see below), which confirms the slowdown the ECRI is also flagging”.

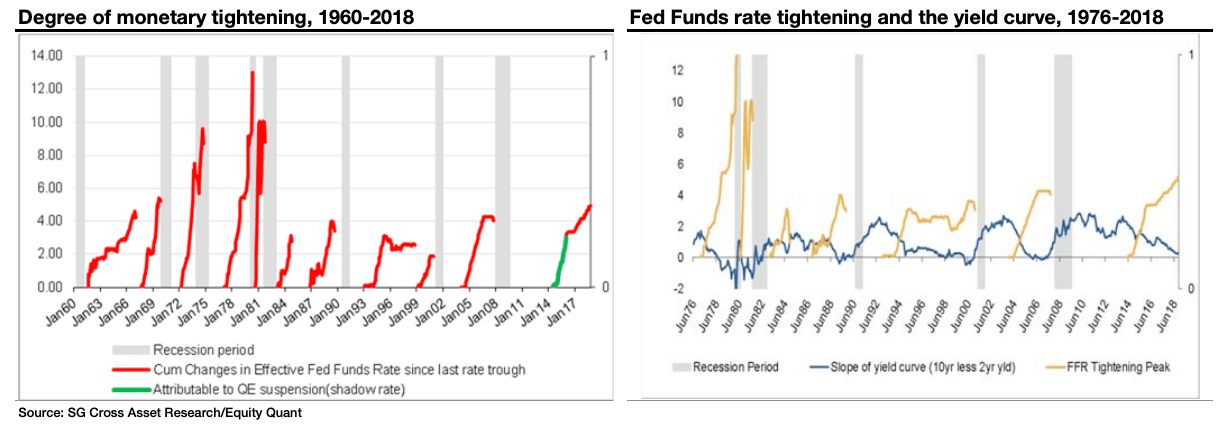

He finally sticks SOCGEN necks out by writing “Our very own Quant guru, Solomon Tadesse, did some really interesting work back in May this year showing that the Fed’s monetary tightening was already close to what would historically trigger a recession”

My two cents

I have been bullish bonds (early I guess) but evidence is now falling into place.I still think that couple of more rate increase by FED will first lead to inversion of yield curve and hence long bond is great place to be positioned till the FED continues tightening. This will give way to steepness as and when FED signals rate pause and rally in the Belly of the yield curve

Somewhere the two cents may also include the likely impact on India, since FIIs invest there when the tide goes out in the West. Please consider.

sure will do Regards