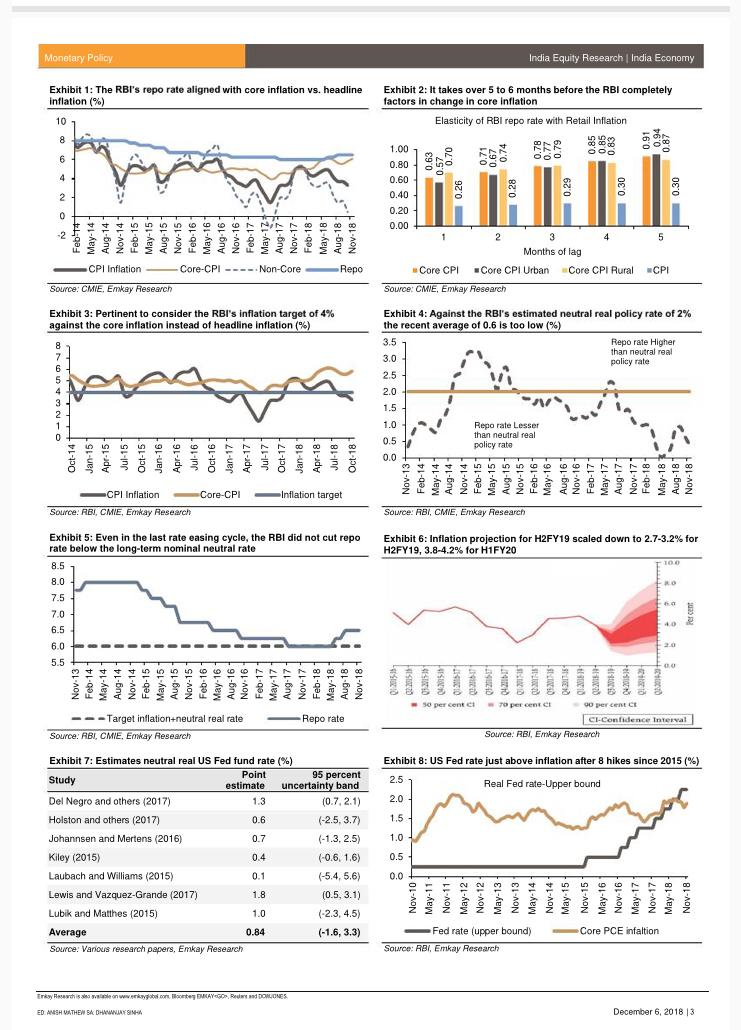

Dhananjay writes “The persistent focus of the RBI and the markets on headline inflation is a misnomer in the context of monetary policy management. It is high time that the RBI starts articulating its stance based on core inflation. Given the sticky nature of core inflation, it is unlikely that the RBI will change its “calibrated tightening” stance in a hurry unless unanticipated negative demand shocks lead to a 100-200bp decline from the current 6% plus. As of now, most lead indicators cited by the RBI suggest an upside risk to core inflation.”

Some interesting charts from EMKAY report

My two cents

I look at only one set of data to determine the trajectory of interest rates and that is the difference of deposit and credit growth rate. The credit growth YOY stands at 13% and deposit growth stands at 8% YOY. This is unsustainable for a long period of time but for time being RBI is filling this gap by doing aggressive Open market operation. Reserve money is getting created out of thin air by monetizing the Govt deficit (worst quality of credit).

The gap between deposit and credit will only get narrowed when saver ( local or global, investing through banks, MF or insurance ) feels the rates are high enough to postpone consumption in favor of saving and that is when this difference gets narrowed and system equilibrium shifts to lower inflation and finally lower rates.

The lack of deposit growth is telling RBI that rates are not high enough to substitute consumption with savings.

Rightly said, but in the current scenario what other alternative does RBI have. Because of the financial distress in the market and increasing fiscal deficit they have to do open market operations.

I agree I am just making a point about interest rates and why they need to remain sufficiently high so that consumption can be channelized into savings