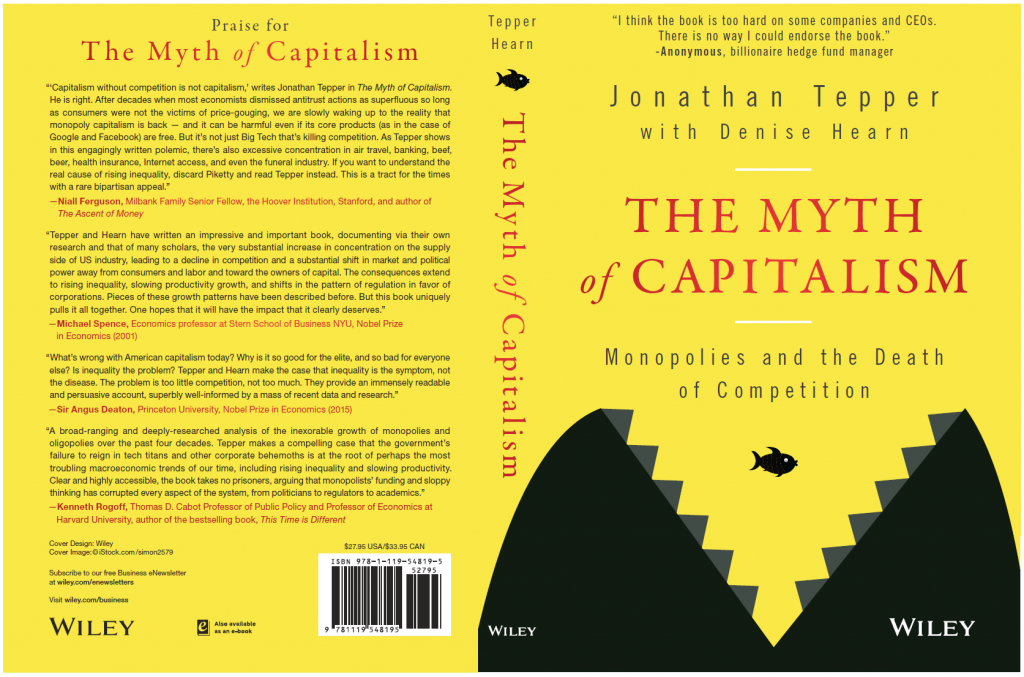

The Myth of Capitalism – A Book by Jonathan Tepper

Jonathan Tepper and Denise Hearn: The Myth of Capitalism, an excellent plea for more competition and free markets.

MoC deals with a subject that has increasingly captured the attention of political and economic observers in recent years: the growing quasi-monopolistic powers of a small (and shrinking) number of large corporations that have seemingly succeeded in exempting themselves from competition. (think Reliance JIO)

They are often aided and abetted by government imposing regulations certain to suppress competition from less well-funded upstarts and smaller firms. At the same time governments are creating loopholes which only the biggest established firms with international operations are able to take advantage of.

Don’t get us wrong – we have no problem with loopholes as such: to paraphrase Mises, they allow capitalism to breathe. Problematic is only that the benefits granted to the most powerful players are denied to their potential competitors; we wouldn’t want to see these loopholes closed, we would like to see them extended far and wide.

Restoring Consumer Sovereignty

MoC is not focused on questions of monopoly theory. The book is actually quite a page turner, at the same time informative, entertaining and infuriating. It is primarily concerned with practical problems and discusses what might be done to overcome them. The proposed solutions may be open to debate, but the book’s main aim strikes us as being well beyond it: namely the restoration of consumer sovereignty.

Many on the left are looking at the growing concentration of economic power from a Marxist perspective, believing it to be the inevitable outcome of what Marx called the “anarchy of capitalist production”. But this is erroneous: if not for misguided government intercession on behalf of established industries, even the largest companies would be facing the harsh winds of competition – and we would all be better off for it.

In an unhampered market economy an incumbent enterprise could not just sit on its laurels, regardless of how well-funded it was. Companies would certainly not be able to afford to run rough-shod over their customers by worsening the quality of their services or by imposing censorship (the latter has become a nasty habit of large social media platforms and powerful payment service providers).

Not only a handful of well-known internet giants in social media, search and retail have become quasi-monopolies or oligopolies: airlines, beverage companies, banks, health insurers, beef producers, pesticide makers, corn seed manufacturers, high-speed internet access providers and media companies have all joined the trend toward extreme concentration.

As Jonathan points out, entrepreneurs who manage to rise to the top by winning in an industry that was ripe to be taken on by an innovative competitor will quite often turn into anti-capitalist defenders of a monopoly-like dispensation as soon as they themselves are rich and well-established. ( once competition is decimated then consumer will pay through the nose)

A Matter of Interventionism

To be sure, Marx did in fact assert that the capitalist system would inevitably experience a concentration of economic power in the hands of fewer and fewer big players. For a long time this idea could be shown to be erroneous. However, a shift became detectable around the turn of the millennium, right after the tech mania blew out.

At first the shift was subtle, as only a noticeable deterioration in average economic output growth became detectable. But then the GFC struck and the pace of new company formation suddenly fell off a cliff. But what was the GFC, if not a vivid demonstration of an utter failure of government intervention in the economy?

MOC believe the Fed should not even exist . The absence of a “lender of last resort” with unlimited money issuance powers would no doubt be a very strong disincentive to the type of reckless speculation that attended the mortgage credit boom of the 2000s. (or the current mortgage liquidity crisis where everybody except central bank wants central bank to bail out these shadow banks)

Identifying the Problems

Here is a quick list of the main problems (both symptoms and causes) identified in MoC as growing obstacles to competition and hence economic progress:

The main symptom is the emergence of oligopolies (rather than monopolies) in the US economy ( applicable to india also …. telecom, cement, airline, utilities, retail, auto, banks, insurance,even MF…..) – these can and do collude with consummate ease, so they might as well be monopolies (cement is a great example, pay penalties without admission of guilt if caught). The companies concerned may benefit from this, but it is certainly detrimental to the economy at large.

These firms divide up turf like the mob (and they only need to watch each other carefully to do so).

Innovation and diversity are on the decline as a result of this concentration of economic power. Higher prices, fewer startups, lower productivity, lower wages, higher income inequality, less investment, and the withering of American towns are all symptomatic of the disease.

Workers have become punching bags: a huge surge in non-compete agreements, a growing number of monopsonistic buyers of labor, the inability of workers to sue their employers on account of hidden clauses in their contracts, are all elements contributing to stagnating wages and rising inequality (and the political backlash it generates).

The biggest US tech companies – which together have a market cap exceeding the GDP of all of Western Europe – particularly so-called platform companies, have become so rich and powerful, they are setting the rules. There is no longer a way to out-compete them. Consumers are presented with an illusion of choice, but the platform firms are actually akin to unavoidable toll roads – and that is costly.

Government’s anti-trust enforcement is de facto non-existent (CCI is an example of toothless regulator in India)

Patent and intellectual property laws have become an enormous impediment to innovation and economic progress. They favor amply funded giant corporations that can afford to fight endlessly and costly court battles, not to mention a growing army of patent trolls.( thank god India has a chequered record in implementing IPR and Patent so we don’t have to worry about it)

Government is an active participant in fostering inequality (we think “root cause”). Whether through lobbyists or its infamous revolving doors, government is always there to grant favors to wealthy and politically well-connected players ( recent defense deal is a great example) Its regulations often seem deliberately designed to selectively smother competition from upstarts and cement monopoly-like structures in the process.

Stock ownership has also become highly concentrated – oligopolistic shareholders are holding most of the shares in oligopolies – an “oligopoly layer cake” as Jonathan calls it. Stock buybacks are continually exacerbating wealth redistribution from the many to the few ( US buybacks announcement crossed $1 trillion this year.. highest ever). Consumers and employees both are increasingly hostage to dominant corporations, which have grabbed a historically inordinately large share of the economic pie.

Central bank interventions were a major driving force fostering and exacerbating these trends. As Jonathan puts it, the way some central banks acted, it might have been simpler to just wire the money directly to the wealthiest people instead of going the more-or-less circuitous route of purchasing corporate bonds (ECB) and even equities outright (SNB, BoJ)….. now you know WHY YOU ARE NOT RICH.

Economic and Political Freedom

The following words by Milton Friedman are quoted in the first chapter of MoC, and Jonathan elliptically returns to them in the final chapter of the book, entitled Economic and Political Freedom:

“Economic freedom is a necessary condition for political freedom”.

This is undoubtedly the case. When the political machinery is for sale to the highest bidders and enacts laws and regulations that protect these wealthy incumbents to the detriment of all others actors in the economy, neither economic nor political freedom remain fully operative. Jonathan notes:

“The difference between communism and socialism is that under socialism central planning ends with a gun in your face, whereas under communism central planning begins with a gun in your face.”

The discussion of the historical record in MoC segues into a list of basic principles on competition, followed by policy proposals and a short list of what people as consumers can personally do if they want to hasten change – after all, the marketplace is an instant direct democracy in which consumers continually vote with their wallets.

This has serious implications for country like India because monopolies and oligopolies don’t create jobs, In fact they destruct jobs by concentrating power and eliminating competition.

what happens to a million graduate who passes out every month in India???

Read More