I know nobody wants to listen about Blockchain anymore, but the contrarian in me decided to understand more about this technology.

Below is the transcript on the Blockchain technology in an interesting discussion with Mark Yusco

Some interesting comments which caught my eye

I think this is the most critical point that investors need to think about. I think that all great networks in the future will run on blockchains, and Bitcoin is one of the first great networks. And what people forget is that 5 of the 10 largest companies today aren’t simply companies in the traditional hierarchical sense, they are networks. The value of a network rises in a different way than a traditional company, they grow in an exponential way, because of Metcalfe’s law and networks function in unique ways relative to traditional assets, derive their value from different elements and, therefore, must be valued differently.

One of the challenges to institutional adoption is that most of the people in crypto today are what some refer to as the “crypto kids”, young people who have experience in tech, but very little (if any) experience in the traditional investment business. They look across the river at the stodgy institutional people and they don’t want to work with them because they are too different from themselves. And the institutional people who have all the money are looking back at the kids wearing black t-shirts and saying they don’t want to work with them either. Stalemate.

I think that eventually there will be an intersection of these communities and I think it will be big. It reminds me perfectly of the first time I introduced the idea of investing in hedge funds to the board of Notre Dame back in the early ‘90s. They said “absolutely not’ because that was where all the “bad people” were. Morgan Creek, and other companies, helped people get comfortable with the notion that you have to follow the talent, even when the talent is migrating to a space, that’s not exactly where you want to go. I’ve only seen this once before in my career, and that was in the early ‘90s when tons of really smart people left great jobs in great industries and flooded into the Internet, and it literally changed the world. I believe the Blockchain evolution might be even bigger

Mark view on markets

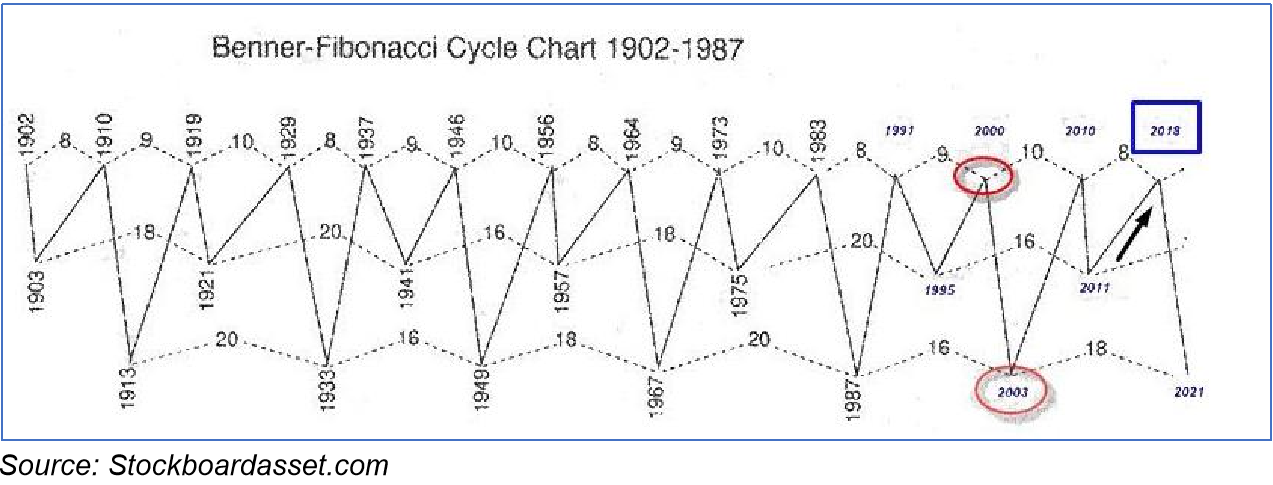

The bottom line is that I think we will have a slowdown in 2019 and markets might roll over pretty hard.

I think bonds and stocks will struggle, and I think it’s a time to explore alternatives. My focus lately has been real assets, like gold and commodities. They are the cheapest they have ever been versus paper. In the game rock, paper, scissors, paper always beats rock. However, I think that in this new abnormal world, as a result of the debt super cycle, rock will beat paper. Real assets will crush paper assets over the next decade. And I think crypto will be somewhere in the middle.