Martin Armstrong writes in this must read post ….I understand this can get confusing because there are so many people who talk without any real-world experience. The Fed MUST raise rates to help the crisis in Pension funds. It raised the Fed Funds Rate (what banks charge each other) 25 basis points to 2.25-2.5%. While the Fed indicated there would be two more rate hikes in 2019, what has gone over everyone’s head is exactly what I have been warning about. We are witnessing indeed not a Currency War but a Central Bank War.

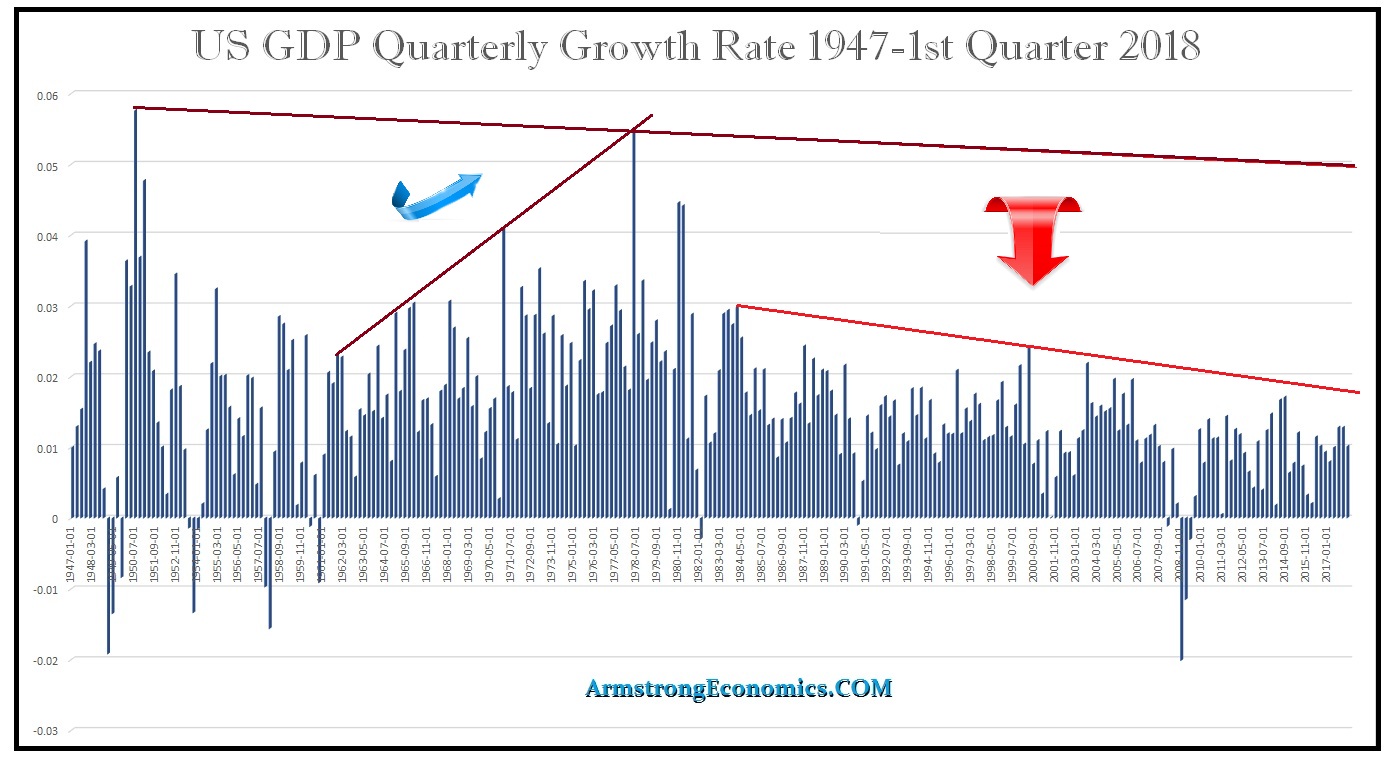

This is a brand new Central Bank War that nobody seems to get I suppose since I may be the only person who actually speaks to central banks outside the USA. All the various central banks and the IMF have been lobbying the Federal Reserve since 2014 pleading with it NOT to raise rates. I have stated many times that the rate hikes by the Fed have NOTHING to do with economic growth, inflation, or trying to stop a speculative bubble in stocks. We can see that GDP growth since the high back in 1978. That may come in the future when the stock market rallies, but not now.

I cannot say this any stronger! The Fed is dealing with reality. It MUST raise rates, not for the economy but in order to NORMALIZE interest rates because lowering rates makes it cheaper ONLY for borrowers while it destroys the philosophy of saving for your retirement when you cannot earn enough interest to buy a nice dinner. Then pension funds are going belly-up like the fish in a polluted pond. State pension funds then turn to their respective governments who then raise taxes lowering the standard of living (i.e. California & Illinois). The ECB is trapped and I have warned that it is the ONLY central bank that can actually go bankrupt because all central banks do not have the same structure. I have made it clear that by their very own standards, the ECB itself is insolvent.

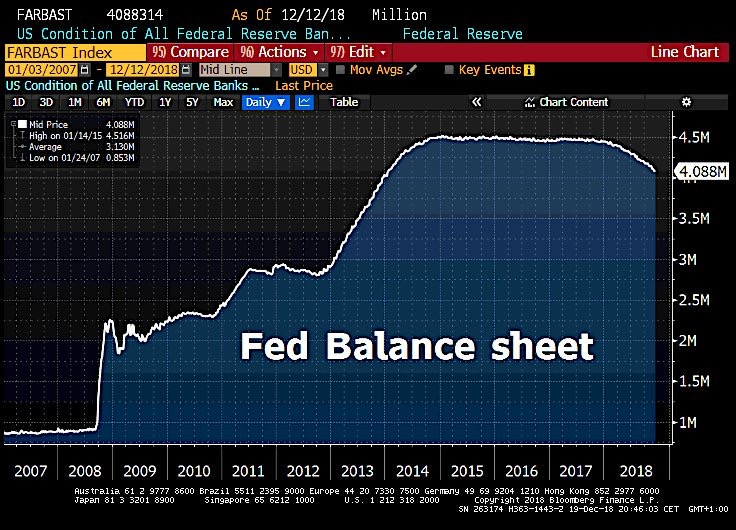

At the end of 2017 in the USA, total household debt exceeded $13 trillion. Total non-financial business debt stood at $6.1 trillion at the end of 2017. The Fed’s balance sheet was $4.4 trillion of which $2.4 is US Treasuries – the bulk of the rest is simply excess reserves. The national debt stood at $20.5 trillion at the end of 2017. That meant the actual Quantitative Easing was not $4.4 trillion, but $2.4 or about 10% of annual GDP compared to Europe at 20% and Japan over 100%. If we look at this perspective, this means the money supply is $41.6 trillion just using the debt. If we then add M2 (all accounts & money market accounts) which stood at $13.8 trillion at the end of 2017, this brings us to a liquid money supply of $55.4 trillion. The Fed’s balance sheet does not even reach 10% of that figure and the QE portion is less than 5%.

Now let us add the stock market, which is liquid. That reached $30 trillion by the end of 2017. Therefore, the liquid assets/cash position stood at $85.4 trillion at the end of 2017. Then let us add total personal real estate (homes) in the United States which stood at $31.8 trillion

Raising rates is NECESSARY for the Fed also realizes that come the next economic recession, the only tool they have is to lower rates. They do NOT share this theory running around that full employment will only take place with NEGATIVE rates at -4% to -5%. The ECB is looking at that BECAUSE they cannot raise rates. Why do you think the IMF is now telling everyone to adopt cryptocurrency? That way they end hoarding and can ENFORCE negative rates outlawing all private cryptocurrencies. Where politicians in Australia have called for the removal of the $100 bill claiming cash is for criminals, the Reserve Bank of Australia (central bank) has defended the embattled $100 note arguing that criminals prefer $50. The response is eliminate both.

Conclusion

This is why we are in a Central Bank War. There are a lot of problems taking place and the Fed knows the Pension Crisis is taking down state and municipal governments. True, they raise rates and government debts explode. But the failure to raise rates means pension funds collapse and bailouts become necessary while states raise taxes which lower economic growth as disposable income declines. So if you can move to one of the state that do not have an income tax, do so while you still can.