Going back in time when markets fell in 2007-08 Financial Crisis, US Dollar rebounded when the dust settled and Dollar continued to dominate world foreign exchange reserves followed by Euro. Surprisingly, Euro managed to capture only 20 percent of market share till today. Such difference in dominance is credited to higher liquidity of Dollar by Commission.After 2018 rate hikes in US, US Dollar surged 9 percent since April 2018 but it is now back to its 200 daily moving average yet the Euro/USD volatility is nearing to 15 year low. Unfortunately, Euro has become a puppet of risks and vagueness of Europe’s indecision.

While Pound is expected to remain volatile owing to ambiguity surrounding Brexit in March 2019 and is bearing an intense selling pressure accompanied by weak economic data, Euro is shrouded by negatively moving clouds which are not settling anytime soon. The risks causing Euro’s fickle movements are found in nearing Brexit day, German auto tariffs, US – China trade war and Russian sanctions so it’s not hard to imagine volatility in European markets.

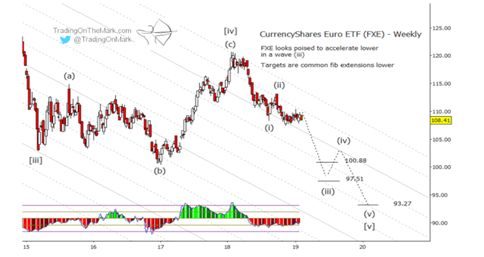

The bearish outlook of Euro is also revealed in Elliot wave patterns and it is quite revealing. The chart is very bearish Euro and bullish Dollar as can be seen below.

Above shown are plots of Euro ETF and British Pound ETF indicating clearly the weakness of Euro in comparison to Pound which recently surged after indecision on Brexit came into view.

This month, the Bank of England issued its strongest warning to EU that “its lack of adequate planning for Brexit has created growing risks for almost 70tn pounds of complex financial contracts. EU firms have about 69tn pounds of outstanding derivatives contracts that are handled through a process known as ‘clearing’ in UK while as much as 41tn pounds maturing after Britain exit EU in March 2019.”

Conclusion

A weak currency is a boon for exporters and also leads to higher imported inflation but eurozone GDP is not only stagnating its exports are also struggling, not to mention falling inflation and inflation expectations . I would have expected eurozone equities to get a tailwind but most European indices are showing weakness compared to US equity indices. I am firmly of the opinion that capital is leaving Europe for US shores and this is not good news for Euro or Eurozone assets. If our view is right, then we expect to see parity on Euro/Dollar before this year is over.

Sources:

- https://www.tradingonthemark.com/2019/02/12/is-the-euro-getting-ready-to-fold-special-newsletter-edition/

- Brexit – Band Aid Report by Bear Traps Report

- https://www.reuters.com/article/us-eu-oil-usa/eu-brings-industry-together-to-tackle-dollar-dominance-in-energy-trade-idUSKCN1Q21WB

- https://www.theguardian.com/business/2018/oct/09/bank-of-england-warns-eu-brexit-risk-financial-stability-derivatives