Global economy is weakening and may be on the verge of recession by third quarter of this year. The jump in global growth during Oct- Dec quarter ( 2018) was due to inventory rebuilding as companies increased their buying to beat US tariffs. Unfortunately it lead to upfronting of GDP in last quarter and final sales in US ,Europe , China etc does not paint a rosy picture going forward. Somehow it looks like that the global consumers are tapped out and will rather be saving than continuing on their borrowing binge to support the GDP. Citibank economic surprise index across globe continues to paint a grim picture.

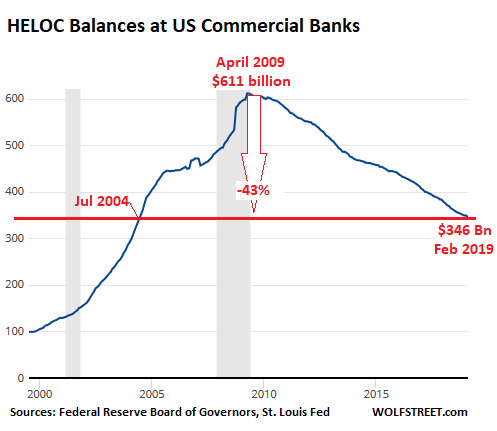

The following graph is quite stark where HELOC balances of US banks is now at 15 years low. US household have been single large buyer of Global goods and they are tightening their belts

Canadian economy was also the beneficiary of US consumer tariffs in last quarter with Chinese buyers of Agricultural commodities deciding to step up purchases from Canada at the expense of United states. The employment generation continues in Canada although we can question the quality of jobs which are getting created ( low pay jobs). The Canadian housing market is feeling the ripples with withdrawal of Chinese demand from Vancouver real estate where sales volume has just come to a standstill amid lower prices. The lethal mix of highly indebted Canadian consumer who is more leveraged to real estate than equity markets mean that Canada is at higher risk of recession then its neighbor. The Canadian dollar continues to weaken and looks expensive along with Canadian growth stocks. On the other hand Bonds are quite cheap compared to equities across north America and we could actually see a bullish flattening in the curve over next few months.