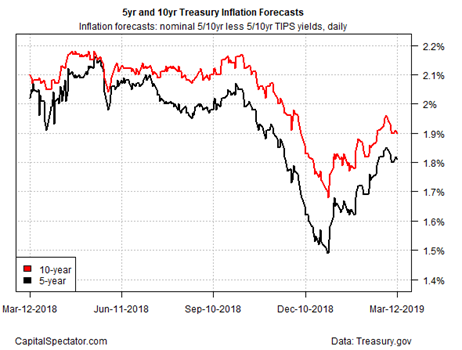

The most widely used hedge for stocks is the US Treasury market which is currently seeing a flattening trend and sending mixed signals to the investors. The stocks have rallied for quite a few sessions now yet only two sectors, XLU ( utilities) and XLRE (real estate) have been trading above its 2018 highs. XLU has rallied over 17.3% and one of the contributing factors was lower treasury yields. Generally speaking, a positive correlation between stocks and long term treasury bonds is viewed as a bad sign for stocks. As fed took a dovish stance and Powell told CBS, “We want inflation to be anchored at 2 percent”, the expecting investors waiting for yield curve to steepen met with disappointment.

The curve tend to remain flat and could only steepen if there is a rate cut (last year there were 4 rate hikes) as expectation of rate cuts first leads to bullish flattening and then steepening depending upon inflation expectations. Bloomberg noted that the forward curve have already priced in a steepening of the yield curve doubling to about 30 basis points on Wednesday when the above spread was at about 15.5 basis points.

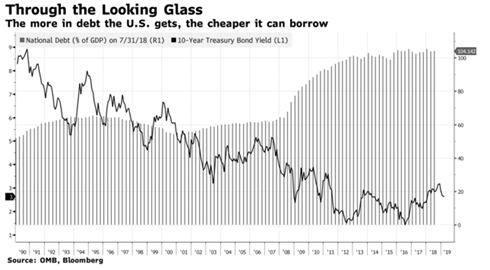

US government has been borrowing heavily with budget deficit figure close to $1trillion a year. The inflation target is vehemently kept at 2 percent to avoid deflationary trap whose target has been Japan and recently Europe. Powell said in his March 8 speech, “The fed could adopt a make – up strategy – letting inflation run above target during good times like now to offset the periods of slower price rises.”

Both the 5 year and 10 year TIPS yield show curve wanting to settle around 2 percent. Currently long term bonds are viewed as a good hedge for stocks. Term premiums was 0.72 percentage point for 10 year treasuries above the all-time low of July 2016. A lower term premium means lower bond yields which in a healthy market should be followed by higher stock returns.

Hence based on term premia the bond market appears cheap compared to equity markets.

(with inputs from Apra Sharma)