Swerving around from two year long recession which ended in 2016 to one of the best performers in emerging markets, Brazil under the newly elected right wing populist President Jair Bolsonaro is refreshed and optimistic about its future which is also evident from the rally in the Brazilian markets.

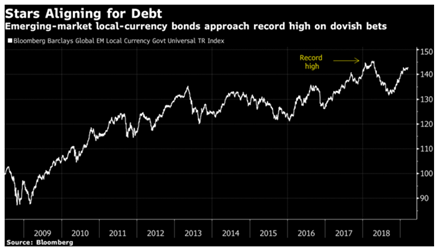

Many investors are investing in emerging markets which is currently led by Brazil in order to gain from potentially weaker US Dollar. EM countries are witnessing global liquidity turning into favour and countries tied to China’s shifting buying preferences are gaining most from this mix.

Gordon Fraser of BlackRock Inc. says, “Emerging market equities are highly correlated with currencies and bonds so domestic players will benefit from weaker dollar. When a currency weakens or bond yields increase, typically equities go down. So if we have become positive on a currency, firstly a perfect way to express it is through an equity. The key things riding the dollar last year are now out.” Bloomberg cited

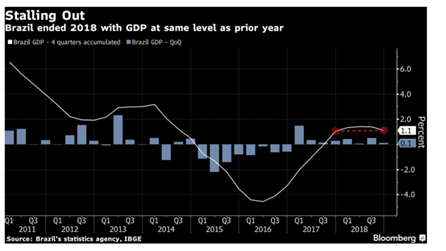

Long term bulls on Brazil and buying on dips have been giving them profits until now and they expect the rally to continue for quite some time. However there is a flip side to Brazil. The growth is expected to stay sluggish and people’s confidence depend on how the reform challenges are dealt with. Bloomberg cites that the Gross Domestic Product expanded 0.1 percent in the fourth quarter, down from a revised 0.5 percent in three months through September, the national statistics agency said Thursday. The result was the slowest quarterly pace since the third quarter of 2017 and was in line with the median estimate from economists surveyed by Bloomberg. In the full year of 2018, GDP rose 1.1 percent, same as prior year.

With slow growth and inflation below target, markets do not see a tightening cycle in Brazil before mid-2019. The foreign reserves dipped from nearly $383 billion in May 2018 to $374.7 billion in December. That is the lowest since December 2017 but still covers nearly 15 months of imports and is equivalent to nearly 9 times short – term external debt.

Brazil today still outperforms other emerging markets and its currency, the real, rose since the second round of voting on October 29, 2018. The MSCI Brazil index, which fell 8 percent in 2018 while MSCI EM as a whole dropped 17.5%, is up 16.5% in 2019 versus a 4.5% gain for MSCI EM. The optimism was boosted when the pension reform plan was announced. Current retirement age is 55 and pension reform retirement ages is expected to be 62 for women and 65 for men. This is going to amount up as 1 trillion real in savings.

The two right wing populist leaders, Trump and Bolsonaro meeting is considered crucial for both the countries and ways to enhance of bilateral ties will be on the agenda. US is Brazil’s second biggest trade partner after China. Matias Spektor, professor of international relations at Sao Paulo’s FGV business school said in a seminar, “Knowing that Bolsonaro has Trump on his side will be important for investors, especially if Brazil has a bumpy financial year.” Win Thin, global head of emerging market strategy with Brown Brothers Harriman said, “To someone who has been following Brazil for three decades, the huge rightward shift is simply amazing.” He added, “With inflation likely to remain low and central bank on hold for much of this year, we think Brazil will continue to outperform.” Brazil has played its card well in the recent US china dispute by staying under the radar and still a beneficiary of a this trade dispute as china shifted some of its agri buying from US to Brazil.

(with inputs from Apra Sharma)