By Apra Sharma

Can we bank upon the banking sector and other financial institutions today? The U.S. Chamber released a Financing Main Street report in which they surveyed more than 300 corporate finance professionals to understand the ongoing impact that financial regulation has on broader economy.

Quoting from the special report by Better Markets published on 9th April, 2019, “To save the hardworking Main Street Americans from economic catastrophe that would have resulted from the collapse of financial system and economy in 2008, policymakers claim that without bailing out the gigantic financial institutions, another Great Depression was inevitable, which would have been worse than the Great Recession those financial institutions did cause – a recession that will cost the U.S. more than $20 trillion just lost in GDP.”

“At least $29 trillion was lent, spent, pledged, committed, loaned, guaranteed and otherwise used or made available to bailout the financial system during the 2008 crisis.”

As per Executive Summary of report from U.S. Chamber,

“American businesses are reporting that their ability to access capital is

steadily improving and generally they are optimistic about their expected

performance over next 12 months. In order to promote sustainable economic

growth, our financial system must be as vibrant and diverse as the businesses

it serves. U.S. capital markets play a critical role in providing debt and

equity financing to American businesses. A

key component of a strong financial system is a regulatory structure that

promotes economic growth.”

They further add, “Unfortunately, the post 2008 financial crisis regulatory response imposed enormous costs on the economy while doing little to fundamentally reform the U.S. financial regulatory system. As a result, Main Street businesses found it more difficult to access the capital they needed to innovate, grow and hire new employees.”

For years big financial institutions engaged in high risk transactions, manipulated regulations, committed crime and settled it all against fine. Their deeds led to the crash of 2008 yet they sang their songs of innocence and were bailed out by transferring huge wealth from Main Street to Wall Street and as Better Markets puts, “The banks showed no gratitude, no remorse and no willingness to reform their activities. They didn’t bother to end their systemic, widespread and brazen illegal conduct.”

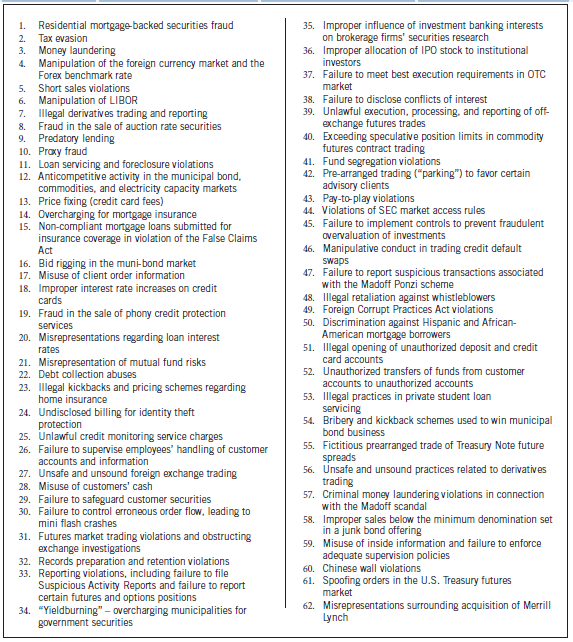

The chart shown is from Better Markets and it is not still an account of the entire list of actions. These are only a few classic ones.

We have contrasting view by Brett Milano who wrote on Harvard Gazette about the seminar conducted by Niall Ferguson and quoted him, “Of the common theory that the crisis happened because of deregulation, ‘You should dismiss that as a cartoon.’”

Ferguson carried on, “That’s a fantastic example. Bernanke had studied Great Depression, so as the crisis intensified he was in the position to identify and recognize the symptoms of something much bigger than anyone in the room had experienced in their lifetimes. You could have anticipated the choices Bernanke made (addressing to Harvard students who were his students) and would have known that the Fed (in 2008) would do exactly the opposite of what the Fed did during the Great Depression, because they did everything wrong the first time.”

As per Ferguson, “One of the main reasons another depression was avoided was a global component, the stimulus money U.S. received from China. The relationship survived the crisis despite some pretty nasty rhetoric; we called them currency manipulators. But China didn’t sell their great accumulation of U.S. bonds. China may well be next source of global crisis and the decline of China – U.S. Relations may prove the tipping point. The best case scenario is that China’s growth rate steadily declines. In worst case, there is a crisis. Either way, the outlook is bleak one.”

Milano concluding the seminar writes, “During the audience questions afterwards, one student asked Ferguson if he’d neglected to mention the role of fraud and other white collar crime in triggering the 2008 crisis. Ferguson replied that almost no bankers ever went to jail.”

Ferguson added, “Is that because we decided to turn a blind eye to white collar crime, or is it because they committed no crimes, they only bent the rules? I think it’s the latter. It is really hard to get convictions when people were essentially complying with the regulations. As long as they were compliant, nobody felt any compunction about doing things that were morally wrong, if not technically criminal.”

Report from U.S. Chamber deduced, “Overall, businesses report that while there have been improvements in accessing short term credit, their ability to raise long term debt as well as equity has become more difficult. Companies are also more pessimistic about the overall economy than about their own performance: More than one – third expect the economy to worsen over the next 12 months, with interest rates and trade related issues cited as the top two concerns.”

“Businesses have long relied on financial system for traditional banking and lending products, but they increasingly rely on financial institutions to manage currency fluctuations, hedge risk through derivatives and raise large amount of equity or debt. Unlike in other countries – where traditional bank lending remains the primary source of corporate finance – the U.S. capital markets play a critical role in helping companies meet both short term and long term obligations.”

A huge amount of taxpayer money has gone in ongoing bailout of financial system. As per ProPublica, their database accounts for both broader $700 billion bill and separate bailout of Fannie Mae and Freddie Mac.

As per ProPublica, a few companies failed to repay the government and all other investments either returned a profit to the government or might still be repaid. Recipients of aid through TARP’s housing programs (such as mortgage servicers and state housing orgs) received subsidies that were never intended to be repaid. There have been 980 recipients with $632B in total disbursement, with $390B total returned and total revenues from dividends, interest and other fees account for $349B.

“The eight large U.S. banks received Treasury Department’s initial round of capital investments – money described by Treasury officials not as a bailout but rather as funds to help ‘bolster heathy banks’. “

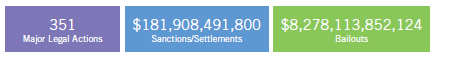

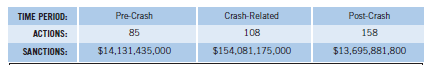

Out of these 8 large banks in U.S. Better Markets focussed on six megabanks, Bank of America, Citigroup, Goldman Sachs, JP Morgan Chase & Co., Morgan Stanley and Wells Fargo, they committed several illegal acts and were subject to more than 350 major legal actions which resulted in almost $200 billion in fines and settlements. They received more than $8.2trillion in bailouts!

Better Markets noted, “Some eye – catching cases are like the infamous LIBOR manipulation. Among others, Citibank and JP Morgan Chase were also involved in this scandal with Citigroup paying a whopping $175 million civil penalty to CFTC.

In May 2015, the DOJ announced that Citigroup, JP Morgan Chase, Barclays and Royal Bank of Scotland pled guilty to charges of conspiring to manipulate the price of U.S. Dollars and euros exchanged in foreign currency exchange spot market. Together, they paid more than $2.5 billion criminal fine. This scam impacted every consumer in US as FX markets are used by virtually every company producing goods that are purchased in US and also used by those in connection with anyone traveling overseas.

In December 2015, SEC imposed $267 million in penalties against JP Morgan Chase for fraud, failure to disclose conflicts of interest and breach of fiduciary duty by its wealth management institutes. The misconduct extended from 2008 to 2013.

In September 2018, a federal judge approved a class action settlement to resolve claims that Bank of America improperly charged overdraft fees amounting to interest which when annualized far exceeded the limits on maximum interest rates set by National Bank Act. They paid $66 million in reimbursements and debt relief.

In Wells Fargo, a federal judge in May 2018 and in September 2018 approved a $142 million in settlement and $480 million in settlement respectively for customers and shareholders who were harmed by fake account scandals.”

The number of cases increased in post-crash compared to pre-crash. U.S. taxpayers didn’t provide their money to bail out the banks and save them from bankruptcy so they can continue their illegal conduct. In fact, it appears that these fines and settlements are speed bumps in their business and not a mistake to them.