Prerequisite Capital writes in their newsletter

Perspective around World & US Equity markets, before launching into an expanded discussion of the required Portfolio Strategy elements that are likely to be well suited to the next 25 years

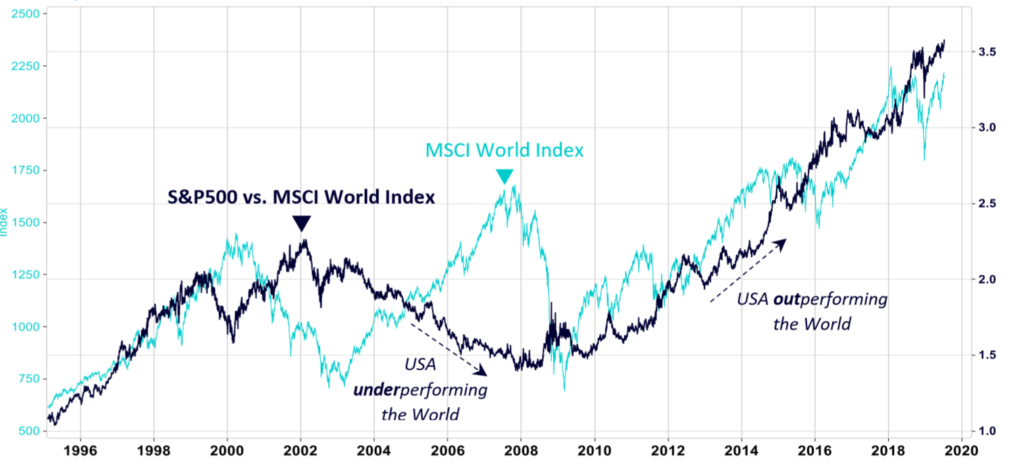

Global Equities: the USA vs. the World Here is the simple ratio of the S&P 500 vs. the MSCI World Large Cap Equity Index that shows the relative outperformance of the S&P 500.

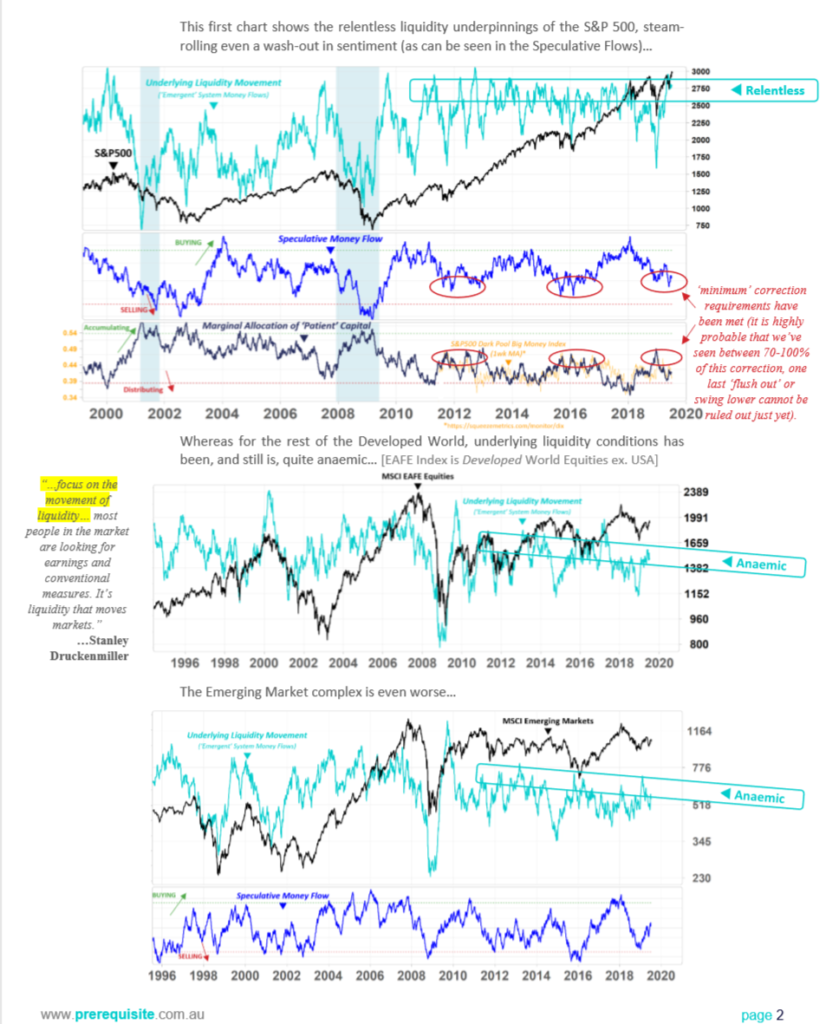

PCS explains the many underpinnings of this dynamic, and its prospects moving forward. But for the purposes of this Letter, one of the ways you can ‘see’ the relative differences of conditions is by looking at the Underlying Liquidity pictures of the USA vs the Rest of the World (see next page).

Valuation multiples are an ‘effect’, whereas Capital Flows are the ‘cause’ (when capital concentrates into an asset class or a security, valuations are naturally bid up, when it disperses valuations fall). Investors are trained in ‘Valuation’ methodologies but Capital Flows & Liquidity remain a blind spot for most. Although it goes beyond the scope of this Letter, the USA still has tailwinds in place for P/E multiples to be more resilient than people realise, whereas the rest of the world still has headwinds to their multiples. Europe & EM in particular remain potential value traps.

full newsletter

http://www.prerequisite.com.au/wp-content/uploads/2019/07/2019-07-14-Quarterly-Client-BRIEFING.pdf