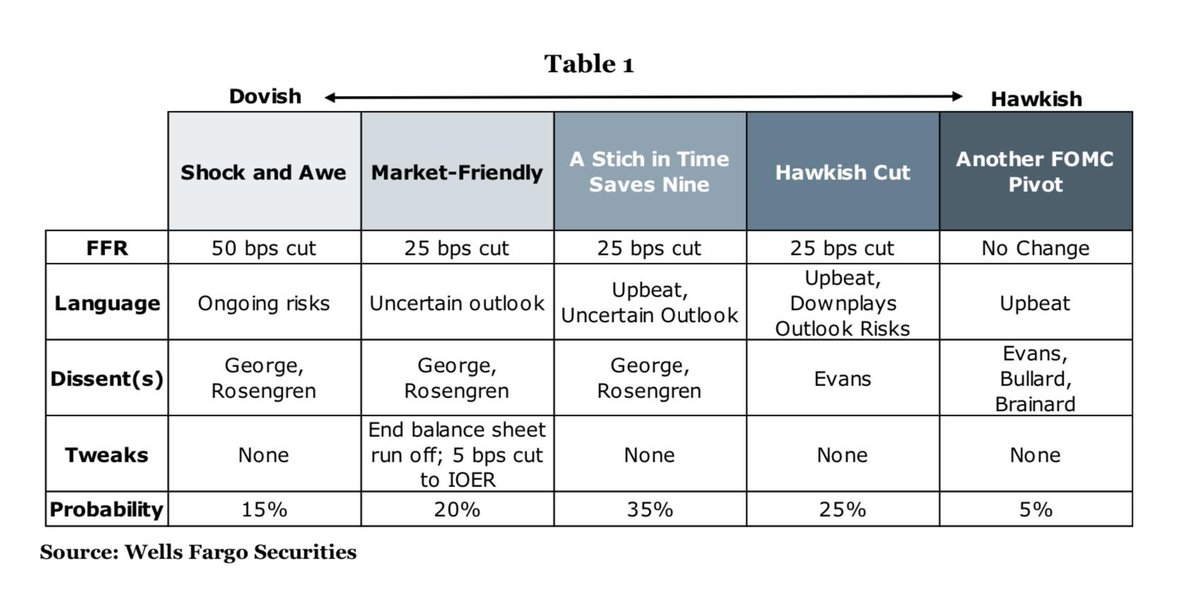

Pick and choose your poison. An economy which is growing at 3% and an unemployment rate of less than 4% will see rate cuts in next week Fed meeting. We are truly on the verge of a currency war

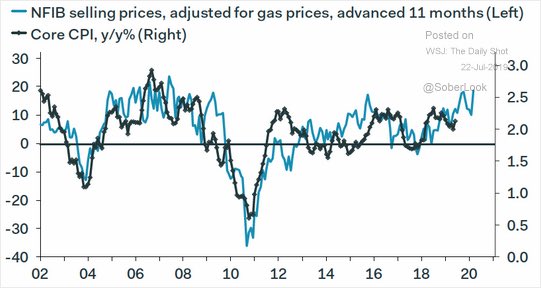

Small business selling prices suggest higher inflation to come @PantheonMacro@SoberLook

BusinessInsider: “Covenant-Lite Leveraged Loans in Europe now 90% of Total” Bloomberg: Japan’s Central Bank owns 77% of the ETF market Central banks: “We tried Penicillin, then morphine, then Opioids, but nothing cured the patient’s broken arm?’

Silver ETFs holdings have hit fresh all-time as investors are betting that silver will catch up with the performance of Gold. These kind of price chasing along with 91% bullish sentiment amongst traders normally leads to a violent pullback or consolidation for sometime.