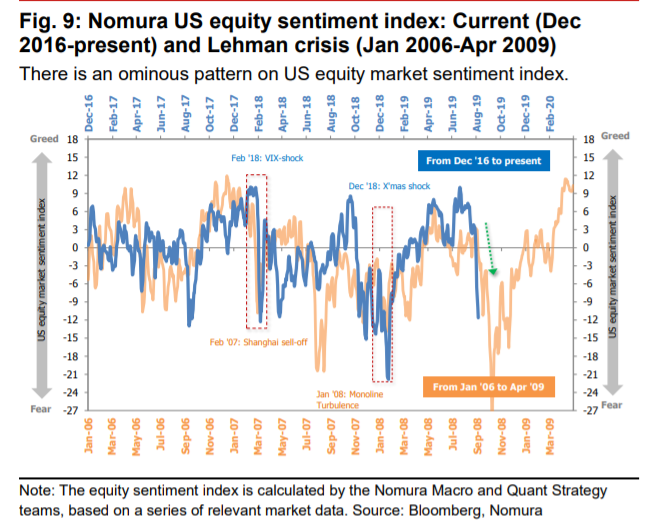

Nomura on US equities

“We would expect any near-term rally to be no more than a head fake, and think that any such rally would be best treated as an opportunity to sell in preparation for the second wave of volatility that we expect will arrive in late Aug or early Sept”

Government Bond- Negative yielding crosses $15 trillion

We will either look back at this period as the new normal or an insane period of irrationally low inflation expectations.

Junk Bond

Spreads on US junk bonds widened yesterday by the most since 2011. Important to watch, since it highlights how quickly the credit risk in high-yield bonds can re-price amid a deteriorating backdrop (On an absolute basis the most since Aug. 2011; percentage basis most since 2007.) Lisa Abramowicz

“Midcycle adjustment” seems off the table. Markets expect another four Fed rate cuts in the coming 12mths