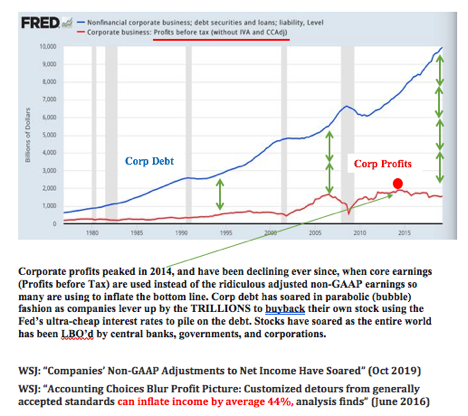

Corporate Management teams are LBO’ing themselves with cheap debt (Thx Fed) to reduce share counts and increase stock values (time shift) now to enrich themselves at the expense of employees and future investors stuck with all the debt.( @MI_investments)

Why low interest rates do not encourage Investment but promote consumption (Gavekal Research)

What do Dijbouti, Niger, Republic of Congo , Kyrgyzstan, Laos, Cambodia, Maldives have in common? They all owe China debts worth more than 25 % of GDP.

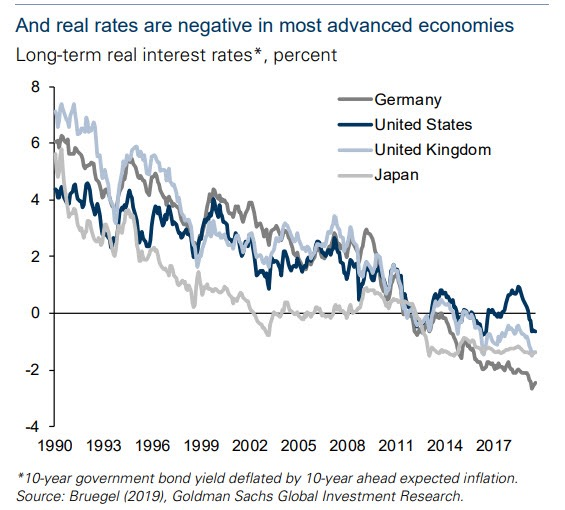

Real rates are now negative across the developed world. Government wants you to borrow, spend and consume.Smart people are running into assets which have positive yield.This is why there is relentless bid in different asset classes irrespective of fundamentals