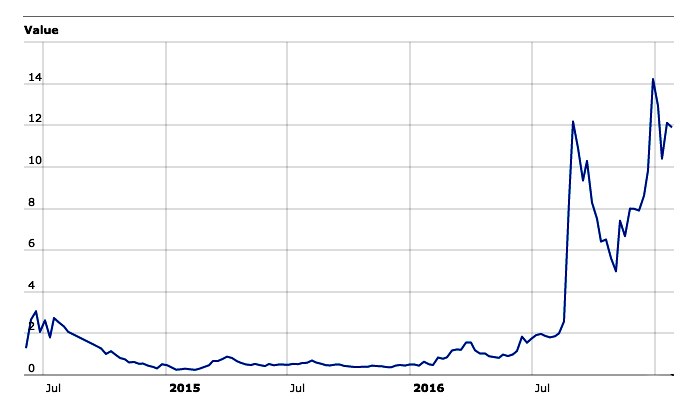

Move on Bitcoin…… this cryptocurrency grew 26 times last year

Bitcoin is synonymous with cryptocurrency but there are other like Ethereum whose price shot up 10 times last year. A little known once-obscure cryptocurrency called Monero outpaced all of them, multiplying its value around 27-fold. The source of that explosive growth seems to be Monero’s unique privacy properties that go well beyond the decentralization that … Continue reading “Move on Bitcoin…… this cryptocurrency grew 26 times last year”