Russell is one of my favorite economists and this post is heavy on economic fundamentals. He talks about a new and emerging world . A world in which companies having dollar liabilities will find it difficult to pay back their Dollar loans as US look to reduce its current account deficit .This will lead to much higher Dollar v/s other currencies. This post ties up with what Peter Zeihan writes on world without US protection in “The accidental Superpower”. After all if the only bully in class leaves then everybody wants to be a bully

By Russell Napier

The USD will rise as US growth slows. That is clearly not a consensus view. The consensus believes that the strength of the USD rests largely, if not solely, on the prospect for increasing interest rate differentials between the US and other key jurisdictions. Most investors expect that this has to be higher growth in the US, leading to higher interest rates that must underpin a further rise in the USD. Almost always investors seeking to profit from exchange rate movements focus on growth/inflation/interest rate differentials in planning where to place their bets. Thus, in recent weeks the USD has fallen on the international exchanges as concerns have grown about the President’s ability to deliver on his growth agenda. It is almost always correct to focus on growth/inflation/interest rate differentials in assessing the outlook for exchange rates, though it is a pursuit fraught with difficulties. Sometimes, if rarely, it is the wrong business to be in and the consequences are disastrous. Those who spent 1970 speculating as to whether the newly appointed Fed Chairman, Arthur Burns, was brewing one or two rate rises are not remembered kindly by history. That myopia led them to miss an event that determined investment returns for at least the next decade – the collapse of the global monetary system/Bretton Woods Agreement. Investors focusing on growth/inflation/interest rate differentials today are missing the fact that, once again, the global monetary system is breaking down. The continuing breakdown of our current system, driven by the inability or unwillingness of developed world nations to run current account deficits, will continue to push the USD higher as growth in the US falters.

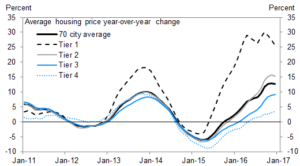

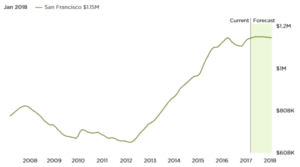

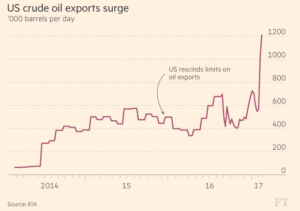

In previous quarterly reports The Solid Ground has focused on the key structural changes that have led to a US economy that grows without a worsening current account deficit. These key forces include a shift in the consumption of services from goods by the baby boom generation, a rising savings rate – albeit rising at a glacial pace – and the shale oil and gas boom. These three factors are pushing the US economy towards a current account surplus even as the economy grows. Should the economy slow, then the normal cyclical forces would rapidly quicken the pace of that current account contraction. Based on recent market reaction, some investors would sell the USD as US growth slows and the likelihood of interest rises decline. However, this Pavlovian reaction ignores the fact that such a growth slowdown would further reduce the US current account deficit with profound negative impacts for Emerging Markets (EMs) and the stability of the current global monetary system.

A profound US economic reality has changed without investors paying it much attention. From 1992 to 2006 there was one economic certainty – if the US economy grew, the country’s current account deficit, relative to GDP, would also increase. A growing economy combined with a current account deficit that grew even more quickly produced large and growing current account surpluses elsewhere. Where those surpluses occurred in countries managing their exchange rates relative to the USD, they forced domestic liquidity creation through the process of the accumulation of foreign exchange reserves. Of course the capital account, whether in surplus or deficit, also played a role in determining the scale of liquidity creation in those jurisdictions managing exchange rates. As we have now seen in many cycles, capital, particularly short-term capital, is pro-cyclical in nature and tended to flow towards those countries witnessing high growth, boosted by their success in trade. The alchemy forced money creation in EMs while their central banks financed the US current account deficit by buying ever more Treasury securities. This ability of the US to run ever larger current account deficits as it posted high levels of domestic growth was the cornerstone of a global monetary system that was stitched together post the Asian economic crisis. That cornerstone has now collapsed, as the US current account deficit has collapsed, and that is the key to calling a bull market in the USD. That is a bull market that intensifies as US growth slows, the current account contraction accelerates and the stress on the current global monetary system becomes ever more apparent.

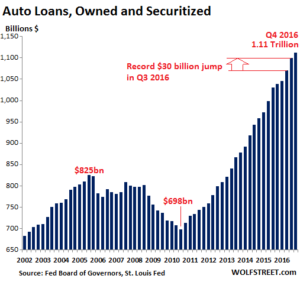

Our current monetary system, based upon EMs managing their exchange rates relative to the USD, was constructed in a very different age. It was an age when higher US growth meant higher US current account deficits but that age is over. The last US economic contraction ended in June 2009 – almost eight years ago. By June 2009 the US current account deficit had already collapsed from 5.94% of GDP in 3Q 2006 to just 3.6% of GDP. In 4Q 2016 the US current account deficit was just 2.55% of GDP. After almost eight years of growth the US current account deficit, relative to GDP, is smaller than it was when the economic expansion began. This is a new way for the US to grow and it has profound impacts on global financial stability and the outlook for the USD. With Euroland and Japan also running surpluses, the global monetary system, as currently constituted, is bringing tighter monetary policy to EMs and, more importantly, is structurally redundant. This matters in a world where EMs accounted for 79% of world GDP growth from 2010-2015 and the world’s debt to GDP ratio has reached new all time highs. The prospects that the lack of developed world current account deficits creates a global growth slowdown and a debt crisis are thus high.

That tightness of monetary policy in EMs is not necessarily steadily applied as sometimes EMs receive bursts of net capital inflows that offset the problems associated with the lack of developed world current account deficits. Sometimes it works the other way, as net capital outflow exacerbates the tightening of EM monetary policy as central banks act to defend their exchange rates. However, the condition of EM current account deficits goes to the robustness of the system and determines the extent to which EMs are impacted by shifts in capital flows. The deterioration in EM current accounts since 2009 has been marked. In 2009 EMs posted combined current account surpluses of US$238bn, but by 2016 this had become a combined current account deficit of US$79bn. That combined deficit stops the creation of more EM money through the mechanism of foreign exchange intervention, unless they are recipients of more than offsetting net capital inflows. As the US produces an annual current account deficit close to US$500bn, any contraction in that deficit can lead rapidly to major EM current account deteriorations and a further monetary squeeze. From 2008 to 2009 the US current account deficit shrank by US$306bn in what was obviously a severe recession. While a US growth slowdown is unlikely to have such a dramatic impact on the current account today, it will come at a time when EMs are in current account deficits and not the huge surpluses reported the last time US economic growth began to slow during 2008. Now that Ems’ large current account surpluses have been eradicated, they are much more vulnerable to any contraction in the US$500bn current account deficit.

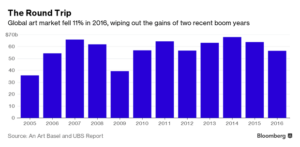

A move to an even smaller US current account deficit, hastened by a US growth slowdown, all but guarantees that our current global monetary system, dominated by EMs’ insistence in managing their exchange rates primarily relative to the USD, would be further tested and result in either devaluations or deflation. Either form of adjustment, in a world where debt-to-GDP ratios have reached all-time highs, would produce debt defaults and a rush to de-gear. As we saw in 2H 2008, any move to a de-gearing results in a rise in the USD as a world repaying debts is a world that is a net buyer of USD. The Bretton Woods system collapsed as the US ran ever-larger current account deficits, undermining faith in their ability to maintain the dollar’s link to gold. Today the failure of the current monetary system is due to the inability of the US and other developed world nations to run sufficiently large current account deficits. This breakdown in the system comes in a very different world from the late nineteen- sixties, when the global monetary system was last breaking down. Today EMs account for 56% of global GDP and 79% of the growth in global GDP; a monetary tightening in those jurisdictions has profound impacts for global growth and inflation.

Creating insufficient monetary growth, due to lack of developed world deficits, in the EMs managing their exchange rates relative to the USD forces them to either devalue or deflate.Most politicians chose the path of devaluation rather than the pain of internal deflation and the USD moves ever higher as the USD price of exports from EMs moves ever lower. When the Bretton Woods system collapsed, inflation erupted as the fetters on money creation in the US and elsewhere were lifted. As our current monetary system collapses, through major devaluations relative to the USD, we should initially expect deflation as the USD price of globally traded goods collapses and as some EMs are crushed under their huge foreign currency debt obligations. With interest rates and inflation at such low levels, faith in the ability of central bankers to summon a cure for this deflationary shock will likely be very low.

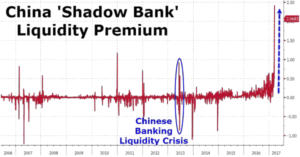

Subscribers to The Solid Ground will have read about the key structural forces that are undermining the value of the Yen (insufficient savings to fund the state), the RMB (the end of mercantilism), the Euro (a recognition that the political union to support the currency union cannot progress) and the currencies of key EMs that have seen insufficient improvement in their external accounts to make their foreign currency debt burdens sustainable. It is these structural problems outside the US that will fundamentally drive the USD higher, putting ever further pressure on those whose currencies are linked to the USD. Adding a US growth slowdown and an even smaller US current account deficit to this equation will only act to push the USD higher.

Of course, the forecast for a continuation of the USD bull market could be wrong. The route to a weaker USD is a scale of US economic acceleration that produces a rapid widening of the current account deficit. The failure of the US current account deficit to widen throughout the 2009-2017 economic expansion provides significant evidence that no such blow-out in the US current account deficit is likely. It seems that the President would be minded to take direct action to attack any such deterioration in the US current account as he seeks to put ‘America First’. So of course a weaker USD is possible, but it remains not probable. It is also worth remembering that even during such periods of growth before, the USD still managed to rise from 1982-1985 and 1995-2001. So the USD can rise if US growth slows or if it accelerates! That will sound too good to be true but it is based upon the fact that the US economy has changed for the first time since the end of Bretton Woods. This is a country that can grow without increasing the size of its current account deficit. That one fact changes the world and changes the USD.

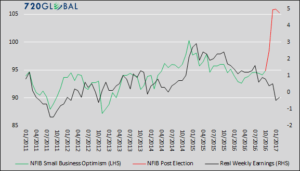

There has been a very dramatic change in the consensus on markets since February 2016. Even before the election of President Trump the market had changed to reflect reflation and discount deflation. This analyst sees no reason for such optimism unless there is a rapid and material deterioration in developed world external accounts and, in particular, in the US external accounts. China has been the seat of global reflation since February 2016 but its policy makers’ ability to dictate higher back lending and money growth must ultimately be entirely incompatible with its commitment to manage its exchange rate. That incompatability is evident in the surge in key RMB interest rates since the election of President Trump. Across EMs the stark choice remains for either deflation or devaluation and both are entirely contrary to consensus thinking. Those betting on accelerating global growth and a higher USD are missing the key problem that developed world growth is seemingly incapable of producing worsening external accounts. Until that changes, it is better to expect deflation than inflation and any slowing of US growth will increase deflationary forces and push the USD higher. The more that happens, EMs face a simple choice regarding their exchange rate management regimes – ‘cut it loose or let it drag em down’. They’ll ‘cut it loose’ and the chaos associated with the political necessity of formulating a new global monetary system will begin. Then the answers to all the questions that count can only be found not in growth/inflation/interest rate differentials but in the political system that for all investors is ‘the darkness on the edge of town’.

‘Tonight I’ll be on that hill `cause I can’t stop

I’ll be on that hill with everything I got

With our lives on the line where dreams are found and lost

I’ll be there on time and I’ll pay the cost

For wanting things that can only be found

In the darkness on the edge of town

In the darkness on the edge of town’