How Ridiculously high salaries at Indian Unicorns are ruining careers and job scene in IT

Indian unicorns may have severely messed up the compensation patterns for young technology workforce in India. In a country where the starting salary for an engineer hired by large IT companies could be as low as Rs. 300,000 per annum, unicorns were, till recently, doling out hard-to-match remunerations. Now, with funding and profitability hard to come by, these companies are laying off workers by the hundreds. And those laid off are finding it difficult to find new jobs because most prospective employers are puzzled by the salaries they have been earning.

“After receiving over 1,000 applications for jobs from Snapdeal or xSnapdeal employees, our experience is that aside from exceptions, 1) high-quality talent 2) overpaid by approximately 1.5-3x. No wonder why these start-ups are failing (sic),” Anjli Jain, managing partner at early-stage investment fund EVC Ventures, wrote in a LinkedIn post last week. Bengaluru-based social wellness platform Zoojoo.be, as a policy, avoids interviewing candidates from “a bunch of startups that we know overpay their employees,” said founder and CEO Avinash Saurabh, who often comes across resumes of engineers with just a year’s experience but “crazy expectations” of earning Rs15-20 lacs per year. “They are talented folks, I am sure, but they are not for us,” he said.

Read More

https://qz.com/928466/with-their-ridiculously-high-salaries-unicorns-may-have-ruined-the-job-scene-in-the-indian-tech-sector/

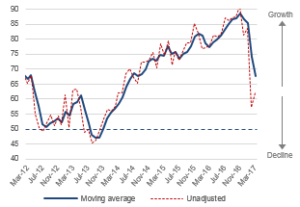

Domino’s doing best at what they know………Making pizza and delivering them hot

you may not be surprised to learn that pizza production at Domino’s hasn’t changed much in the 57 years since the company was founded. It’s still essentially hands on the dough and in the cheese. But whereas pizza making remains high-touch and traditional, pizza marketing is anything but. There, Domino’s Pizza Inc. has decided that modern works better than authentic and for the past five years, the company has been emphasizing all the ways you can order pizza with minimal human and maximal digital contact. It’s introduced more ordering methods—Facebook, Twitter, Twitter with emojis, Apple Watch, voice-activated, “zero click,” wedding registry—than new items on its menu. Customers can track their pizzas online, starting as they’re being made, and in San Diego (for now; likely nationwide soon) they can track their drivers. If an Australian want to pick up her order, a GPS system can monitor her approach so the pizza is hot on arrival. Domino’s has spent millions to trick out a fleet featuring “the ultimate pizza delivery vehicle”—the DXP, a Chevrolet Spark subcompact with special side doors and warming ovens. An independent franchisee in New Zealand is testing delivery by drone and robot. In 2015, for the first time, more than half of Domino’s orders were placed online, and half of those came via mobile. As the company has built up its tech cred, its financial fortunes have been rising. Since the end of 2008, when Domino’s was threatened by declining sales and distressed franchisees, its share price has increased 60-fold. The company is now worth $9 billion. They know what they are good at, which is making pizza and they are getting better at delivering that Pizza.

Read More

https://www.bloomberg.com/features/2017-dominos-pizza-empire/

The finance world’s short-termism will destroy our communities, economies and the planet.

Central banks and governments haven’t controlled the volume of money in the economy for quite some time now. Instead, it has largely been dictated by private financial institutions. Today, in most developed economies, some 95% of the money in circulation is created by private financial institutions. This is not down to fraud, but thanks to the legitimate creation of wealth through investment and lending. It is a result of what is known as the multiplier effect. This is interesting, because it tells us something about both power and money. When financial institutions decide whether or not to invest or to lend, they literally make most of the money they are investing not as an individual institution, but as a consequence of our financial system. This gives them far more collective power over the economy – and therefore people’s lives – than if they were just lending money that already existed. But this oversized power has not been matched with equal measures of responsibility. Instead, financial institutions continue to react in a way that is short-term and this creates instability. When financial liquidity is most needed, the supply of money is halted – banks stop lending during recessions because investments are less likely to make short-term gains. When money supply needs to be restrained because the economy is heading towards a bubble, the prospect of short-term gains pushes financial institutions to pump money into the economy. If we take a longer view, we stop being scared of lending during a recession and in doing so we reduce the impact and duration of that same recession. If we work towards an economy that functions for everyone, it functions for us.

Read More

https://www.weforum.org/agenda/2017/03/the-finance-world-s-short-termism-will-destroy-our-communities-economies-and-the-planet/

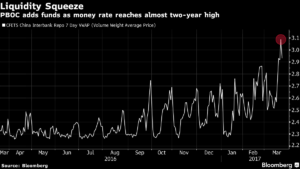

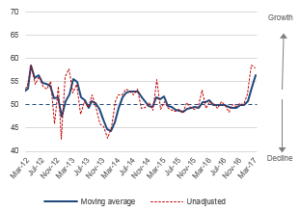

Chinese miracle is over now come hard times

Chinese Premier Li Keqiang told the National People’s Congress that China’s GDP growth rate would drop from 7% in 2016 to 6.5% this year. In 2016, the country’s growth rate was the lowest it has been since 1990. The key part of Li’s statement signalled that the Chinese government has not been able to stop the decline in its economy. That means more economic pain is on the way. Put another way, there are hard times in China that will likely become worse. China’s dilemma, like Japan’s, is that it built much of its growth on exports. Both China and Japan were poor countries and demand for goods was low. They jump-started their economies by taking advantage of low wages and sold products to advanced economies. In 2008, China was hit by a double tsunami. First, the financial crisis plunged its customers into a recession that was followed by extended stagnation. Thus, demand for Chinese goods contracted. Second, China’s competitive advantage was cost, but it now has lower-cost competitors. China’s deepest fear was unemployment, and the country’s interior remained impoverished. If exports plunged and unemployment rose, the Chinese would face both a social and political threat, emanating from immense inequality. It would face an army of the unemployed on the coast. China must also determine how to manage international forces (particularly the United States), which are challenging China and its core interests. China is trying to convince the world that it remains what it was a decade ago. That strategy could work for a while, but many still view China through a lens that broke long ago. But reality is reality. China is no longer the top owner of US government debt; that honour goes to Japan. China’s rainy day funds are being used up, and that reveals its deepest truth. China carried out a great—and impressive—surge. But now, it is just another country struggling to figure out what its economy needs and what its politics permit.

Read More

https://www.forbes.com/sites/johnmauldin/2017/03/14/chinas-miracle-is-over/#566a2acc5a9c