Engineered to fail: Are IT recruits untrainable because they cheat in college?

It all started with a statement by Srinivas Kandula, chief executive of information technology major Capgemeni India, at a business event in Mumbai earlier this month.At the event, Kandula said: “I am not very pessimistic, but it is a challenging task and I tend to believe that 60-65 per cent of them [IT recruits] are just not trainable.” Then Dheeraj Sanghi, a professor at the Indraprastha Institute of Information Technology-Delhi, wrote a blog post on the quality of the country’s information technology engineers attributing this to alleged copying in engineering institutions across the country. The professor, who has also taught at the Indian Institute of Technology-Kanpur, wrote that information technology and computer science students in India are falling behind because they have not learnt much in engineering college. He wrote: “I have always been amazed at the Indian software industry. That it can grow so fast and become so big despite the abysmal quality of education in our colleges. “A lot of people have talked about poor quality curriculum, poor quality faculty, poor infrastructure, poor school education, and so on. I disagree. There is a much simpler explanation for this: Copying in our colleges, besides laziness.”

Read More

https://scroll.in/article/830400/are-information-technology-recruits-not-trainable-because-they-cheat-in-college-even-in-iitsRead More

India sales manager index .. at odds with GDp data

The Sales Managers Index provide the earliest monthly data on the speed and direction of Indian economic activity. The Indian Sales Managers Index for February, shows the after effects of the December demonetisation policy which was intended to crack down on corruption and “black money”. The February Headline SMI has fallen to an index level of 60.2 in unadjusted terms, the lowest level in over 3 years. Managers are reporting a big drop in monthly sales for both the consumer and industrial sectors, with small to medium size businesses that predominantly deal with cash transactions, being hardest hit. February SMI data suggests an erratic situation for Indian businesses as they meet market challenges with considerably lower levels of confidence, slower monthly sales and higher prices caused by the currency situation. This data by worldeconomics is contrary to the GDP numbers published by Govt this week which shows that demonetisation did not have any adverse impact on the economy ……..strange indeed

Read More

http://worldeconomics.com/SMI/India-SalesManagersIndex.efp

Art Bubble bursting……Russian Billionaire Takes 74% Loss on $85 Million Gauguin

Russian billionaire Dmitry Rybolovlev paid €54 million or $85 million for a landscape by Paul Gauguin in a private transaction in June 2008. This week in an auction, he incurred a whopping 74% loss on his store of value “investment” as reported by Bloomberg: The Gauguin was one of four Rybolovlev pieces offered for sale on Tuesday. Another work, a Mark Rothko painting, will be auctioned March 7. Rybolovlev — with a fortune of about $9.8 billion according to the Bloomberg Billionaires Index — invested about $2 billion in 38 works, from Leonardo da Vinci to Pablo Picasso. They were procured privately by Swiss art dealer Yves Bouvier, known for creating a network of tax-free art storage warehouses in Singapore and Luxembourg.

He has already sold three for a loss totalling an estimated $100 million. The five works at Christie’s, all estimated below their purchase prices, were expected to deepen the loss. In May 2015, bouvier warned about the bubble in the fine art “investment market or indeed the Hyperinflation in Art Investment Market after a Picasso sold for $179 million.

https://www.bloomberg.com/news/articles/2017-02-28/that-85-million-painting-bought-as-an-investment-now-down-74

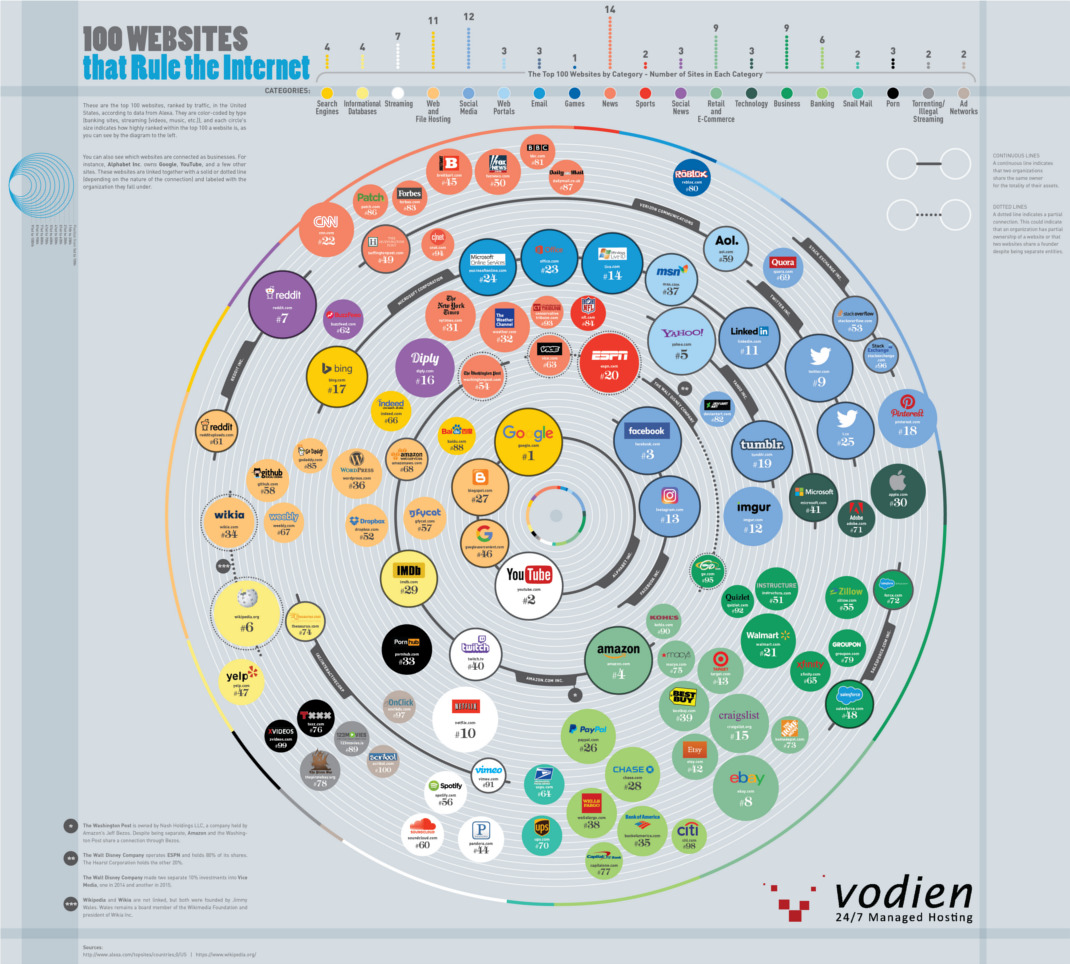

These are the biggest tax havens of earth

In some places around the world, even rich residents don’t pay income taxes.

An analysis of personal top income tax rates released Thursday by Howmuch.net revealed that residents of some countries — many of which are in the Middle East — don’t pay any income taxes at all. The analysis cross-referenced the country’s top personal income tax rates with gross domestic product per capita to highlight countries with both low taxes and a healthy economy.

While Bermuda has “the most extreme combination of tax rate and GDP per capita in the world,” it’s got other downsides like a high cost of living, a 14.5% payroll tax for some employers and high customs duties that are typically 25%. The Cayman Islands also have a high GDP per capita and no personal income tax, though companies do have to provide pensions for employees, the report reveals. Many of the countries on the list of tax havens are in the Middle East. While the governments in these countries may not tax income, “these countries often have significant oil resources which are taxed by the government,” the report reveals. In Qatar, for example, oil and gas businesses get taxed at a 35% rate. UAE is also a favourite destination for millionaires leaving India for greener pastures.

Read More

http://www.marketwatch.com/story/top-10-tax-havens-around-the-world-2016-02-11