“U.S. Stocks Tumble 11% in Worst Week Since Crisis,” read the Friday evening Bloomberg headline. A Wall Street Journal caption asked the apt question: “U.S. Stocks Were at Records Last Week. What Happened?”

A Friday Bloomberg article (Lu Wang) is a reasonable place to start: “It’s a stat so shocking that it’s difficult to believe: In a century spanning the Great Depression and Financial Crisis, the current correction is the fastest ever. To understand how it happened, you need to recall how euphoric markets very recently were. Hard as it is to remember now, as recently as two Wednesdays ago, with coronavirus headlines everywhere, Apple Inc. was capping off a rally that had added $600 billion to its value in eight months. Lookalike runups in all manner of tech megacaps pushed valuations in the Nasdaq 100 to a two-decade high. In just three months, Tesla’s market cap shot from $40 billion to $170 billion, while a pack of dodgy microcaps, hawking space vacations and fuels cells, were trading hundreds of millions of shares a day.”

Manias are accidents in the making. And after an agonizing week, markets crave for emergency central bank stimulus – yet another rash morning shot of the “Hair of the Dog.”

“The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.” Statement from Fed Chair Jay Powell, Friday, February 28, 2020

February 28 – CNBC (Jeff Cox): “Former Federal Reserve Governor Kevin Warsh said Friday he expects the Fed and other central banks around the world to act soon in response to the coronavirus outbreak. Warsh, occasionally rumored to be a candidate for Fed chairman after Jerome Powell’s term expires, spoke Friday morning to CNBC… He recommended the Fed act as quickly as Sunday to assuage financial markets that have been in an aggressive swoon all week as the virus has spread. ‘This thing’s moving pretty darn quickly,’ he said. ‘At the very least, a statement on Sunday night before Asian markets open would buy them a little time and let us all learn a little bit more about where things are.’”

Friday afternoon saw the President weighed in: “I hope the Fed gets involved, and I hope they get involved soon… They’re all going in, they’re all putting in a lot of money. Our Fed sits there, doesn’t do what they’re supposed to do. They’ve done this country a great disservice.”

Central bankers have done the world incredible disservice. I have referred to 2019 as a “monetary fiasco.” The Fed and global central banks applied aggressive monetary stimulus in the midst of historic “Terminal Phase” financial excess. This misguided stimulus propelled speculative “blow-off” dynamics that significantly exacerbated underlying financial and economic fragilities. Not only making the problem more acute, so-called “insurance” rate cuts reduced stimulus measures available for when speculative Bubbles burst, Credit stumbles and economies falter.

The initial fallout is upon us. The so-called Fed (and global central bank) “put” created dangerous market distortions. Markets were emboldened to disregard risk, while the gaping divergence between inflating asset markets and deflating fundamental prospects grew only more outrageous.

Suddenly so much has changed. For one, markets began to appreciate that a coronavirus pandemic has the clear potential to incite severe global financial and economic upheaval. With markets under pressure, President Trump held a Wednesday afternoon news conference to calm fears. In contrast to well-timed market placation throughout Chinese trade negotiations, his comments fell flat. Coronavirus fears were immune to the Trump “put.”

Of course, the coronavirus will be similarly immune to central bank stimulus, with the short half-life of Chairman Powell’s Friday market-supporting statement worth noting. Yet markets still resolutely embrace the notion central bank rate cuts and QE will eventually spur buying while restoring confidence. And while most of the attention is focused on the Fed’s equities market “put”, probably the more consequential central bank-induced market distortions have flourished throughout the derivatives markets. Why not sell flood insurance when central banks ensure drought? And with insurance so cheap, why not indulge in risk-taking – build that dream home on the riverbank? Why not leverage in higher-yielding debt instruments with global central banks vowing to keep booming markets highly liquid?

Major cracks emerged this week in key global derivatives markets, as de-risking/deleveraging dynamics took hold (with lightning speed).

Investment-grade corporate Credit default swaps (CDS) surged 20 bps this week to 66.5 bps, trading to the highest level since June 3rd. It was the largest weekly gain in data going back to 2011. High-yield CDS jumped 75 to 370 bps, trading intraday Friday at the highest level (390) since June 4th. It was the largest weekly gain since the week of December 11, 2015. With derivatives markets dislocating, liquidity vanished and corporate bond issuance came to a screeching halt. There were no investment-grade deals for the first time in 18 months, as $25bn of sales were postponed awaiting more favorable market conditions.

Goldman Sachs (5yr) CDS jumped 23 this week to 71 bps, the high since October. After trading on February 14th to the low since 2007 (28bps), JPMorgan CDS closed this week at 52.5 bps (highest close since February ’19). Citigroup CDS jumped 20 bps this week to a four-month high 67.5 bps. Morgan Stanley CDS rose 21 to 76 bps.

With derivatives in disarray and “risk off” rapidly attaining powerful momentum, safe haven sovereign bonds went into panic-buying melt-up. Two-year Treasury yields collapsed a stunning 44 bps to 0.915%. Ten-year Treasury yields sank 32 bps to a record low 1.15%. Chaotic Friday trading saw ten-year yields drop 11 bps. Spreads to Treasuries widened significantly – for investment-grade and high-yield corporates, as well as mortgage-backed securities.

German 10-year bund yields sank 18 bps this week to negative 0.61%. Indicative of de-risking/deleveraging, European “Periphery” yields rose – wreaking havoc for “carry trades” (i.e. short bunds to finance levered holdings in higher-yielding Italian bonds). With Italian 10-year yields jumping 19 bps and Greek yields surging 35 bps, the spread to bunds widened a notable 37 bps in Italy and 53 bps in Greece. Yields rose 12 bps in Portugal and six bps in Spain (with spreads widening 29 and 23 bps).

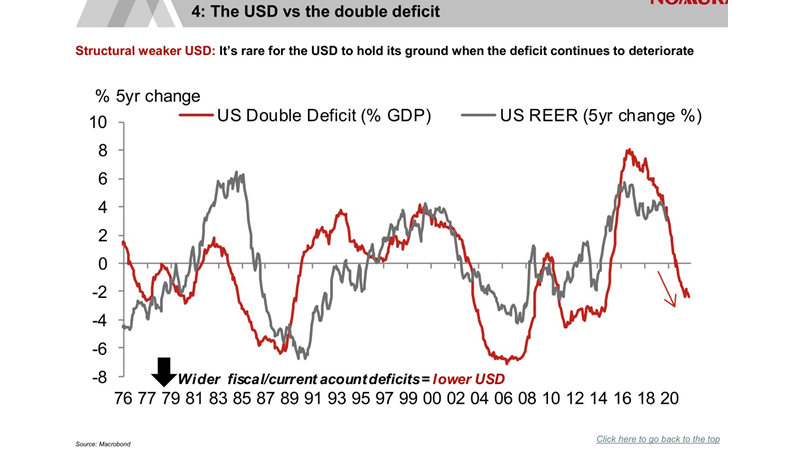

The funding currencies (low-yielding currencies used as funding sources for leveraging in higher-yielding instruments) were on fire. The Japanese yen gained 3.5% versus the dollar, with the euro up 1.7% and the Swiss franc rising 1.4%.

Emerging markets were under intense pressure this week – especially for the higher-yielding currencies popular for “carry trade” leveraged speculation. The Russian ruble declined 4.2%, the South African rand 4.2%, the Colombian peso 4.2%, the Indonesian rupiah 3.9%, the Mexican peso 3.8%, the Turkish lira 2.4%, the Chilean peso 2.2% and the Brazilian real 1.9%.

De-leveraging dynamics abruptly altered the liquidity backdrop, with prospects for illiquid global markets inciting a major repricing of risk throughout the EM universe. CDS prices for a basket of EM bonds surged 60 bps this week to 255 bps, the high going back to December 2016. This was the largest weekly gain since December 2014.

In Asia, Indonesia CDS surged 35 bps (to 94), Malaysia 24 bps (59), Philippines 20 bps (55) and Vietnam 25 bps (109). China sovereign CDS jumped 16 to a six-month high 51 bps. Egypt CDS jumped 69 to 334 bps and Bahrain rose 28 to 201 bps. Latin America was under pressure, with CDS up 39 bps in Brazil (132), 34 bps in Colombia (103), 32 bps in Mexico (104), 21 bps to Peru (63), and 20 bps in Chile (65). Argentina CDS spiked 700 bps higher to 4,895, and Costa Rica jumped 49 to 300 bps. Ukraine CDS surged 107 to 408 bps.

Key higher-yielding “carry trade” EM local currency bond markets came under intense pressure. In chaotic Friday trading, 10-year yields surged 30 bps in South Africa, 26 bps in Colombia, 22 bps in Russia, 18 bps in Indonesia and 15 bps in Mexico. For the week, yields were up 43 bps in Turkey (to 12.46%), 37 bps in Indonesia (6.87%), 31 bps in Mexico (6.80%), 31 bps in Colombia (6.05%), and 28 bps in South Africa (9.10%). Turkish and Russian yields jumped to highs since November.

It was systematic global de-leveraging, the type of backdrop where members of the leveraged speculating community can quickly find themselves in trouble. Commodity markets succumbed to panic selling. WTI crude collapsed 16% to a 14-month low. The Bloomberg Commodities index sank 6.9% for the week to a 20-year low. Even gold was caught up in the liquidation frenzy, sinking $60 in disorderly Friday trading.

February 28 – New York Times: “From eastern Asia, Europe, the Middle East, the Americas and Africa, a steady stream of new cases on Friday fueled fears the new coronavirus epidemic may be turning into a global pandemic, with some health officials saying it may be inevitable. In South Korea, Italy and Iran — the countries with the biggest outbreaks outside China — the governments reported more than 3,500 infections on Friday, about twice as many as two days earlier.”

Since last Friday’s CBB, coronavirus cases in Italy have surged from nine to 889, with 21 deaths. South Korea saw infections jump from 346 to 2,931 (one death). Japanese (non-Diamond Princess) infections jumped from 92 to 234 (five deaths). Perhaps most alarming, cases in Iran jumped from 18 to 388. The 34 Iranian deaths (second only to China) suggest infections in the thousands. German cases jumped to 60, up from 18 on Wednesday. Germany’s health minister stated the country was at “the beginning of a coronavirus epidemic.” After detecting its first case Tuesday, infections had jumped to 38 in Spain by Friday.

U.S. cases rose to 66. In an alarming development, three “community transmission” cases were reported (two in California and one in Oregon).

Searching for historical comparisons, experts are increasingly referencing the 1918/19 “Spanish flu” pandemic. Meanwhile, financial market experts are struggling for historical precedent. There was an interesting discussion on Bloomberg Television highlighted in John Authers’ article: “But the stock market’s reaction appears more dramatic than after the two most recent comparable external shocks — the invasion of Kuwait by Iraq in 1990, and the 9/11 terrorist attacks of 2001. Stocks recovered after 9/11, and languished after the Kuwait invasion, so there is no clear precedent for what comes next.”

I wouldn’t dedicate much time studying past market shocks. We’re in the throes of something unique. Both the 1990 Kuwait invasion and the 2001 terrorist attacks were in post-Bubble backdrops. Moreover, they were pre-QE – prior to monetary stimulus dictating market perceptions, dynamics and prices. Today’s environment is incredibly precarious specifically due to myriad global Bubble fragilities – market, financial and economic. And especially after last year’s fiasco, Bubble markets are susceptible to waning confidence in central banks’ capacity to sustain liquidity excess and inflating securities and derivatives prices.

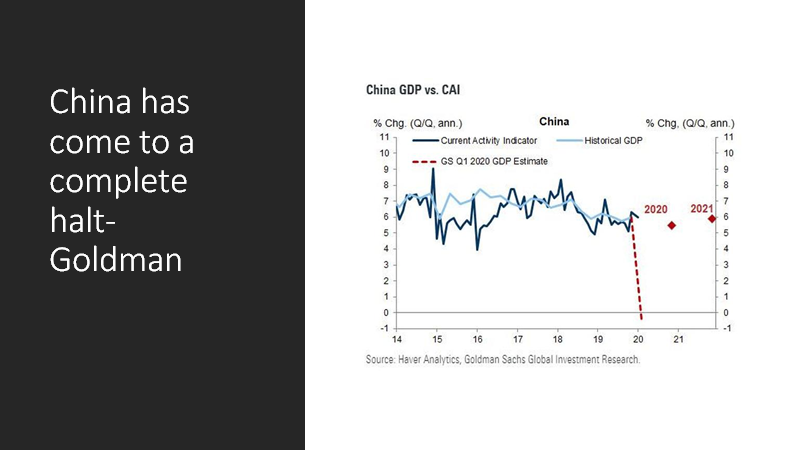

I believe there is a reasonably high probability the historic global Bubble has been pierced. The coronavirus had already demonstrated the potential to puncture China’s epic financial and economic Bubble. A faltering Chinese Bubble – the marginal source of Credit and demand for so many things globally – is a likely catalyst for piercing Bubbles around the world. Now the coronavirus has the capacity to directly strike at the heart of Bubble Delusions.

The central bank “put” – the capacity to slash rates and employ open-ended QE – has been fundamental to this environment’s incredible capacity to disregard risk. Virtually all market and economic issues would be papered over with monetary stimulus. And as more countries moved to participate in this incredible securities market, central bank and economic growth miracle, markets became even more commanding. The greater Bubbles inflated the more confident markets became that no country or leader would risk behavior upsetting to the markets. Markets rule – over populations, central banks and governments. Even geopolitical risks could now be ignored.

The past week has seen a momentous development. Markets, for the first time in a long while, must come face-to-face with the harsh reality they don’t in fact have everyone and everything obediently under their thumb. COVID-19 couldn’t give a rat’s ass about the financial markets. And there’s great risk that highly vulnerable markets will struggle with the process of repricing for rapidly mounting financial, economic, social, political and geopolitical risks. Throughout global markets, many must move to reduce risk. Leverage must be lowered. Risk intermediation will be severely challenged, as a colossal derivatives complex operating on the assumption of liquid and continuous markets will confront illiquidity and discontinuities. De-leveraging will face challenges associated with illiquid markets, likely exposing latent issues in the ETF complex.

Whether it’s Sunday, next week or next month, more monetary stimulus is on the way. There’s simply no one else to accommodate de-leveraging (i.e. “buyers of last resort”). And markets will surely rally on the prospect of more QE. But this is turning dangerous. The coronavirus doesn’t care about the central bank “put” either.

If central bank measures don’t immediately resuscitate speculative Bubbles, faith in almighty central bankers might dissolve right along with market confidence. After last year’s melt-up, central banks may be hesitant to move quickly with huge QE programs. But following years of mounting speculative leverage across the globe, I expect central bankers will be shocked by the scope of QE necessary to keep the global system from deflating.

This unsettling week provided important confirmation of the Bubble thesis. I believe unprecedented global speculative leverage creates a high probability of a major accident – a “seizing up” of global markets. And from my experience analyzing market Bubbles throughout the nineties and up to 2008, things are surely even worse than I think.

February 26 – Bloomberg (Hannah Benjamin, Tasos Vossos and Molly Smith): “The global credit machine is grinding to a halt. The $2.6 trillion international bond market, where the world’s biggest companies raise money to fund everything from acquisitions to factory upgrades, has come to a virtual standstill as the coronavirus spreads fear through company boardrooms. In the U.S., Wall Street banks are facing their third straight day without any bond offerings, a rarity outside of holiday and seasonal slowdowns. European debt bankers had their first day of 2020 without a deal… And bond issuance in Asia… has slowed to a trickle. It’s a remarkable turn of events for a market where investors had been snapping up almost anything on offer amid a global dash for yield. Europe had been enjoying its strongest ever start to a year for issuance, and sales of U.S. junk bonds have been on the busiest pace in at least a decade.”

http://creditbubblebulletin.blogspot.com/2020/02/weekly-commentary-hair-of-dog.html