When I talked about “INFLATION” few days back I could sense that I was not able to answer some questions to your satisfaction and possibly I myself did not have those answers. Russell Napier gave this interview over weekend where he clarified the path over next couple of years.

Finally it boils down to velocity of money and I will give some headlines over the weekend.

The Canadian government wants to expand the emergency wage subsidy programme so that all businesses suffering losses from the virus will benefit, Finance Minister Bill Morneau said.

U.S. Treasury Secretary Steven Mnuchin has said that he is considering “forgiving all small (PPP) loans”. As of now, the government has approved USD518.1bn of loans spread over 4.9m PPP loans. He did not specify what “small” would constitute.

After 3 days, EU leaders have so far failed to come to any agreement on a bailout package, however negotiations will resume this afternoon and Bloomberg says that the Netherlands, Austria, Denmark and Sweden are prepared to accept EUR390bn of the fund being made available as grants with the rest coming as low interest loans.

The Australian Treasury will extend its loan guarantee scheme for small businesses and increase the credit limit up to AUD1m from AUD250,000, Treasurer Josh Frydenberg said.

INTERVIEW below https://themarket.ch/interview/die-zentralbanken-sind-irrelevant-geworden-ld.2327

“The central banks have become irrelevant”

Market watcher Russell Napier warns that investors should prepare for inflation rates of 4% and more in the coming year. Governments have taken control of the money supply.

In the years following the financial crisis, numerous economists and market observers have warned of rising inflation rates given the central banks’ expansionary monetary policy. They were always wrong.

Russell Napier was never one of them. The Scottish market strategist has correctly viewed disinflation as the dominant issue for financial markets for two decades. For this reason, investors should listen to him when he warns of rising inflation rates.

“Politicians have gained control over monetary control, and they will no longer give up this tool,” said Napier. For him, we are at the beginning of a new era of financial repression in which governments are ensuring that inflation rates remain consistently above interest rates for years. This is the only way to reduce horrendous debt.

In the interview, Napier says how investors can protect themselves and why central banks have lost their power.

Mr. Napier, for over two decades you have written that investors should be prepared for deflation. Now you warn that we are at risk of inflation. Why and why now?

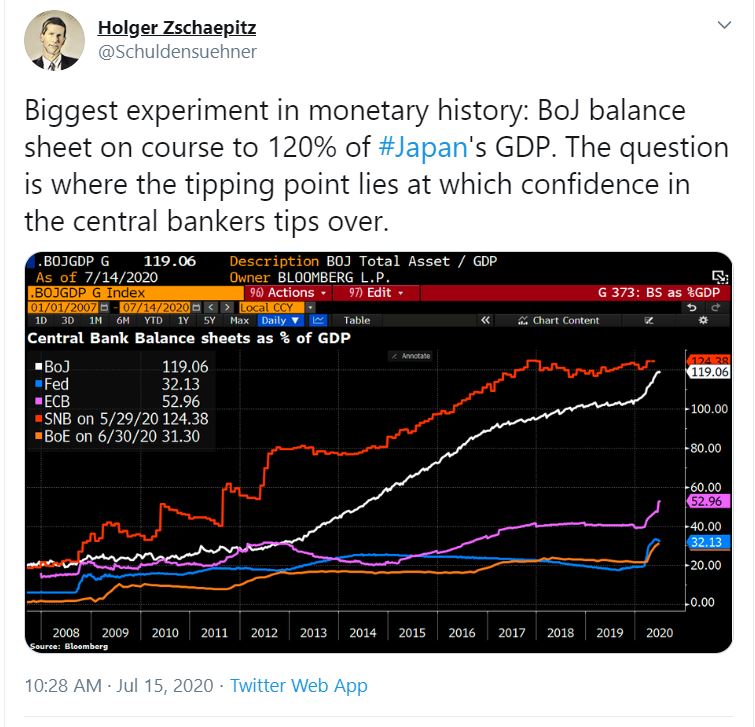

The reason is the way money is created today. Most investors only look at the tight monetary aggregate and the size of the central bank balance sheets. But the broad money supply is much more important. This has grown very slowly over the past 30 years. That was, along with China’s integration into the world trading system, a main reason for low inflation.

And has that changed now?

Yes, fundamental. We are currently experiencing the worst recession since World War II, and yet we are seeing the fastest growth in the broad money supply in at least three decades. In the United States, M2, the widest aggregate available, is currently growing at an annual rate of over 23%. You have to go back at least to the time of the civil war to find comparable strong growth. In the eurozone, M3 rose 8.9% in June. It is only a matter of months before the previous record level of 11.5% from 2007 is leveled out.

Why is that relevant?

The big question is: Does the growth of the broad money supply matter? Investors are obviously not of this opinion because the breakeven rates of inflation-linked bonds are extremely low. The market therefore sees no relevance in the current growth of M2. He is probably only considering this as a short-term exception due to the Covid 19 shock. But I think it matters. The key point is knowing who is responsible for this money creation.

Who then?

The broad monetary growth is created by government intervention in the commercial banking system. Governments provide guarantees to banks to lend to businesses. This is money creation in a way that completely bypasses central banks. I am therefore convinced that this money supply growth will lead to inflation. More importantly, the money supply will no longer be controlled by the central banks, but by the governments – and thus by politicians. Politicians have different goals than central bankers. You need inflation to get rid of the high debt. Now they have the mechanism to create inflation.

In the aftermath of the financial crisis, central banks began quantitative easing policies. They tried with all their might to create inflation – without success.

The QE policy was a fiasco. Everything central banks have created over the past decade is a large amount of debt outside the banking system. QE kept interest rates low, driving up asset prices and allowing companies to get cheap debt by issuing bonds. Instead of growth of the broad money supply and higher nominal economic growth, they have only provoked high debt growth. We have to understand that most of the money is not created by central banks, but by commercial banks. After the financial crisis, central banks never managed to get commercial banks to lend and create money.

If central banks failed to increase nominal GDP growth, why should governments succeed?

By exercising control over the commercial banking system, governments can bring money to those parts of the economy that central banks can never penetrate. Politicians give credit guarantees and the banks are happy to answer the call, of course. They are now issuing the loans that they have never granted in the past ten years.

Are not the state credit guarantees just a one-off measure to combat the economic impact of the pandemic?

Politicians will recognize that they have a powerful tool in their hands. We saw a fine example two weeks ago: the Spanish government has increased its bank guarantee program from € 100 billion to € 150 billion. Just because. There will be a gradual expansion of measures, for example to finance green investment programs. In addition, these loans often have a term of several years. The credit pulse is already in the system.

In the years since the financial crisis, central banks have never been able to persuade commercial banks to lend. So governments are taking power and they won’t let go of this instrument?

Exactly. Even before Covid-19, debt to GDP was far too high in most industrialized countries. We know that debt must go down. For politicians, inflation is always the cheapest way out of this mess. Thanks to the Covid crisis, they have found a way to take control of the money supply and generate inflation. A credit guarantee is not a fiscal expenditure, it does not appear to burden the state budget, since it is only a contingent liability. So if you are an elected politician, you have a cheap way to fund the economic recovery. Politically speaking, it’s incredibly powerful.

A magical source of finance?

Yes. Theresa May made a speech a few years ago saying that there is no magic tree on which money grows. Well we found him. As an economic historian and investor, I know that this policy will be a disaster in the long run, but in the eyes of a politician, this is the magic money tree.

A prerequisite for this miraculous source of money is that governments keep control of their commercial banking system, don’t they?

Correctly. In 2016 I wrote a study entitled “Capital management in the age of financial repression”. In it I wrote that the final step in the next financial repression would be triggered by the next crisis. So Covid-19 is just the trigger for the start of an aggressive financial repression.

Do you expect a repeat of the era of financial repression that marked the decades after World War II?

Yes. At that time, numerous governments used financial repression tools that were only abolished in the 1980s. They also used it to overcome a financial emergency; this emergency was called World War II. It is often an emergency that gives governments extreme powers. Again, the debt-to-GDP ratio was way too high before Covid-19. Our governments know that this debt needs to be reduced.

And the best way to do that is financial repression by making nominal GDP grow faster than debt?

This is what we learned after World War II: higher nominal GDP growth thanks to higher inflation rates works wonders to lower debt to GDP.

Which countries will choose this path in the coming years?

The entire developed world: the USA, Great Britain, Europe, Japan. I see only a few exceptions, such as Switzerland and Singapore. If Germany and Austria were not part of the euro zone, they would not have to do any repression. Of course there is a catch: if the Swiss do not become financially repressive, a great deal of escape money will flow into the Francs.

So there will be more upward pressure on the Swiss franc?

With certainty. Financial repression will also lead to capital controls. Switzerland will have to adopt capital controls to ward off money, while other countries will implement capital controls to prevent money from flowing away.

The cornerstones of the period of financial repression from World War I to the early 1980s were capital controls and the compulsion for domestic financial institutions to buy domestic government bonds. Do you expect these two measures to be reintroduced?

Yes. Domestic savings institutions such as pension funds can easily be forced to buy domestic government bonds at low interest rates.

But can capital controls really be implemented in today’s financial world?

For sure. There are two countries in the euro area that have had capital controls in recent history: Greece and Cyprus. Iceland introduced capital controls after the financial crisis, which many emerging markets are using. If you can successfully implement them in two members of the European Monetary Union, you can implement them anywhere.

When do you expect inflation to rise?

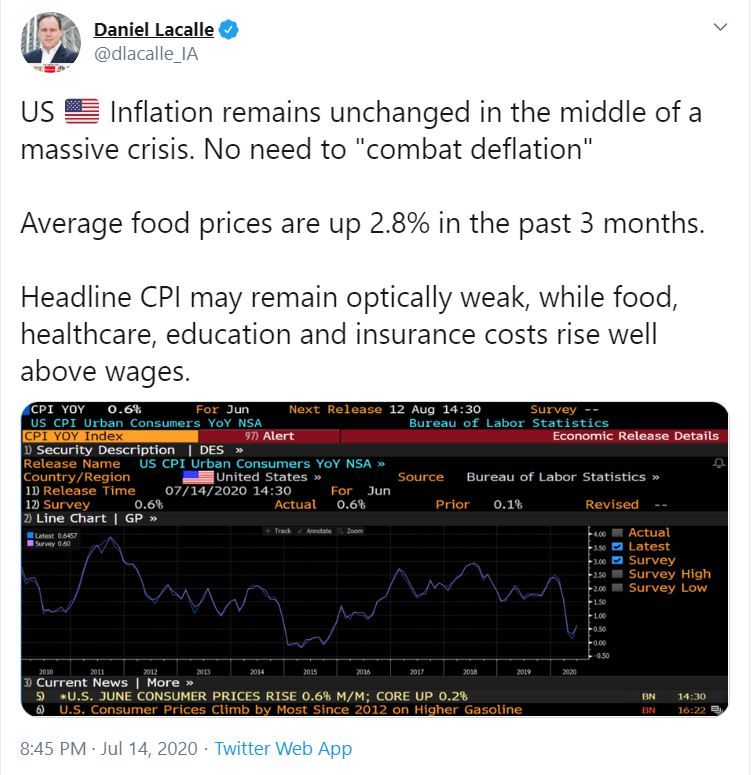

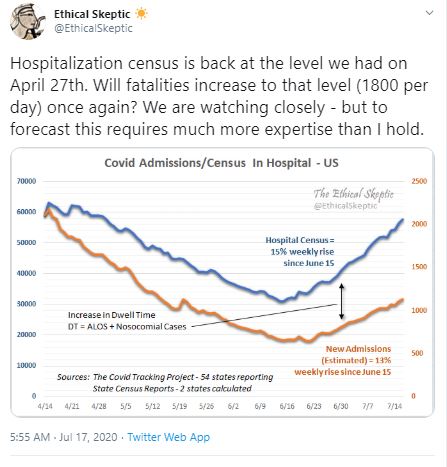

I see 4% inflation in the U.S. and most industrialized countries by 2021. My expectation is primarily based on a normalization of the speed of money. This is currently likely to be around 0.8 in the United States. The lowest prior value was 1.4 in December 2019, at the end of a multi-year downward trend. QE has been an important factor in declining orbital velocity, as central bank liquidity poured into the financial system but never reached the real economy.

What will increase the speed of circulation again?

The money that the banks are distributing today thanks to the state guarantee goes directly to companies and consumers. They are not currently spending it, but with a normalization of the economy, the money will come into circulation. I think the speed of circulation will increase to around 1.4 again next year. Given the monetary expansion we have already seen, this would quickly result in an inflation rate of 4%. There is another factor, China: For the past three decades, China has been a source of deflation. But we are at the beginning of a new Cold War with China, which will mean higher prices for many goods.

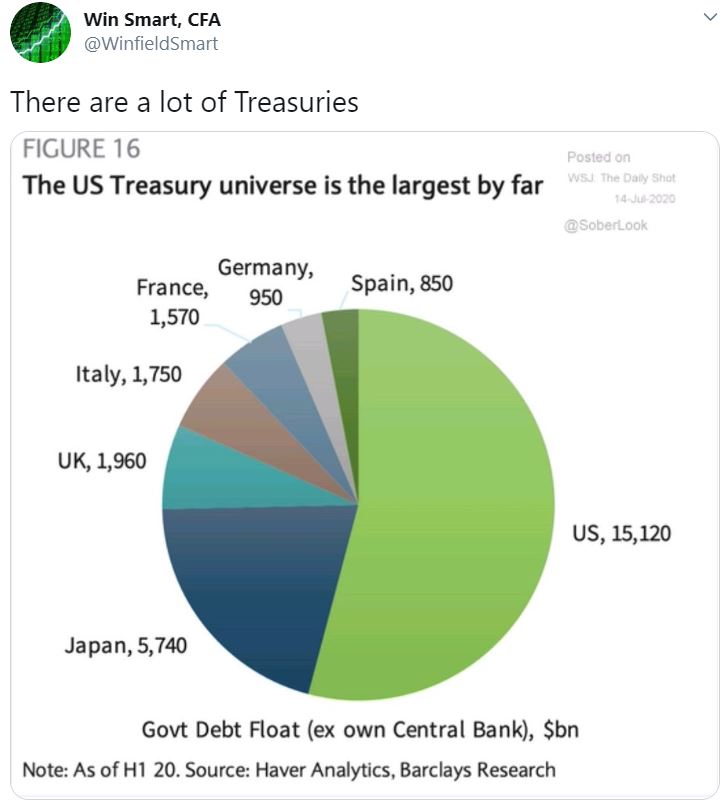

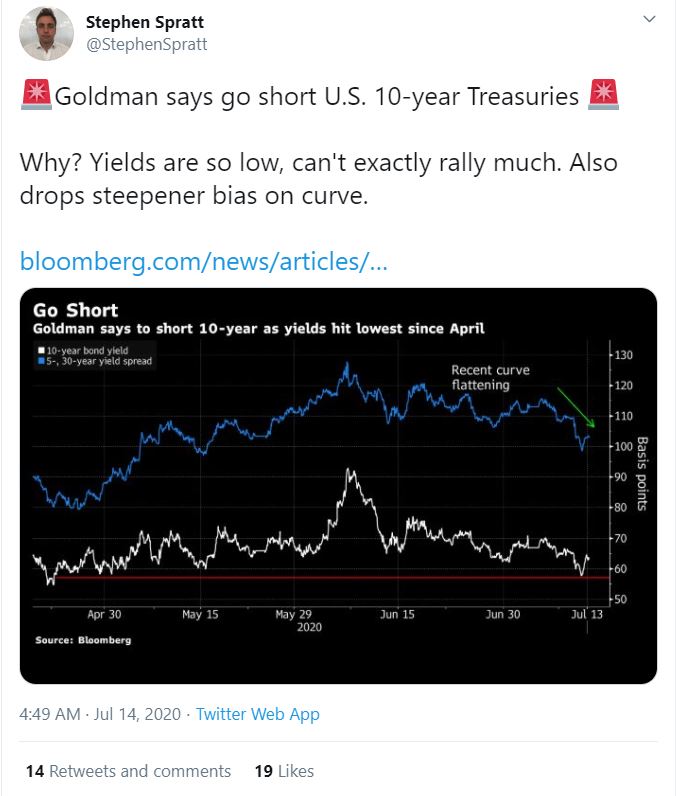

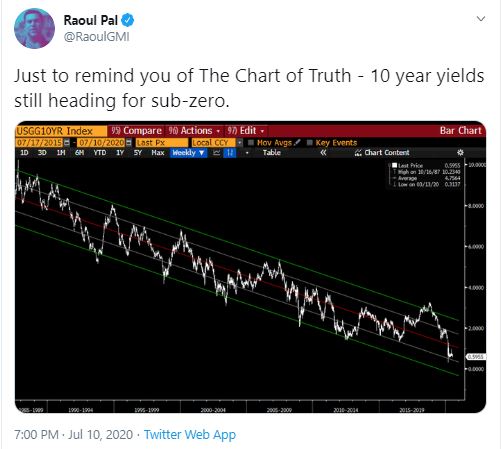

The yield on ten-year US government bonds is currently around 0.6%. What will happen to the bond market when investors realize that we are heading for an inflationary world?

Bond yields will rise sharply. This is because the markets are beginning to realize that politicians are now controlling the money supply. That will cause a shock.

For successful financial repression, governments and central banks must keep bond yields below the inflation rate. How does that work?

Governments will force their austerity institutions to buy government bonds to keep yields low. The central banks will be unable to do anything to limit the rise in bond yields.

Why not? Even the US Federal Reserve is playing with the idea of yield curve control, an instrument it used between 1942 and 1951 to cap ten-year interest rates at 2.5%.

This is an inappropriate parallel, because back then there was rationing, price and credit controls. This made it easy for the Fed to limit bond yields. Yield curve control is easy when everyone expects deflation, as the current example from the Bank of Japan shows. But once market participants start to seriously expect inflation, they will want to sell their bonds. It is then hardly possible for the central bank to control the yield curve.

They say that politicians are now controlling the money supply. Then what will the future role of central banks be?

They are marginalized and primarily focus on regulatory rather than monetary policy tasks. The next few years will be fascinating: imagine you and I run a central bank and we have an inflation target of 2%. Now we have to see how our government creates money with a growth rate of 12%. What we gonna do? Will we attack our democratically elected government and threaten higher interest rates?

Paul Volcker did it in the early 1980s.

Yes, but Paul Volcker was brave. I don’t think any of today’s central bankers will have the courage. Ultimately, governments will argue that there is still an emergency. I see a parallel to the 1960s when the Fed took no action against rising inflation because the United States was waging a war in Vietnam and the Lyndon B. Johnson government had launched the Great Society Project to reduce inequality in America. With this in mind, the Fed did not have the courage to pursue a tighter monetary policy. Today we are back to this point.

So central banks will become irrelevant?

Yes. That’s an irony of fate: most investors believe in the unlimited power of today’s central banks. In fact, their power is as low as 1977.

How should you adjust to your inflation scenario as an investor?

Under no circumstances should you buy government bonds. By contrast, inflation-linked bonds in Europe are attractive because they price in low inflation rates. Gold is a long-term, first-class asset. Equities are also likely to perform well over the next few years. Slightly more inflation and higher nominal growth create a good environment for the stock exchanges. Historically, inflation rates above 4% were no longer good for stocks. I currently particularly like Japanese stocks. With the perspective of financial repression, however, there is an aggravating factor: as soon as governments force their savings institutions to buy government bonds, they will have to sell something. And that will be stocks.

How high will inflation rise?

If we look at the next ten years, I see inflation rates between 4 and 8%. Over a period of several years and in conjunction with low interest rates, this will be enormously effective in reducing debt to GDP.

What does an investor need to move successfully in the markets in the coming years?

First of all, we have to recognize that we are dealing with a long-term phenomenon. I’m talking about decades, not years. Everyone is so busy with the current crisis that they don’t see long-term change. The financial system has changed fundamentally. It has become a very dangerous place for savers. Many skills that we have learned over the past 40 years are superfluous because we have been through a long period of disinflation. It was a time when markets became more important and governments became less important. Now the wind has changed. Those who have dealt with emerging markets for a long time will have an advantage. Investors in emerging markets know how to deal with higher inflation rates, government intervention and capital controls. That will be our future.

“Maybe the mind’s best trick of all was to lead its owner to a feeling of certainty about inherently uncertain things. Over”

“Maybe the mind’s best trick of all was to lead its owner to a feeling of certainty about inherently uncertain things. Over”

Other pieces of data are furthering the head scratching “disconnect”. Complicating the interpretation of volatility in continuing claims (which will continue), the widely ISM Manufacturing Index surged to a level not seen in a couple years and the forward-looking new orders sub-index began to garner steam as well. With any reading above 50 indicating expansion, the index is indicating growth has returned, and new orders are signalling the expansion is here to stay for a while.

Other pieces of data are furthering the head scratching “disconnect”. Complicating the interpretation of volatility in continuing claims (which will continue), the widely ISM Manufacturing Index surged to a level not seen in a couple years and the forward-looking new orders sub-index began to garner steam as well. With any reading above 50 indicating expansion, the index is indicating growth has returned, and new orders are signalling the expansion is here to stay for a while.  And it is not simply manufacturing either. The ISM Non-manufacturing (services) Index also rocketed off the COVID lows with new orders leading the charge. Employment (yes, there is a theme here) remained depressed and in contraction territory. Again, activity has begun to pick-up without a concomitant increase in the employment gauge. Employment tends to be far more volatile than the overall index, but the current 14 point spread is the widest differential between the headline index and the employment sub-index in history.

And it is not simply manufacturing either. The ISM Non-manufacturing (services) Index also rocketed off the COVID lows with new orders leading the charge. Employment (yes, there is a theme here) remained depressed and in contraction territory. Again, activity has begun to pick-up without a concomitant increase in the employment gauge. Employment tends to be far more volatile than the overall index, but the current 14 point spread is the widest differential between the headline index and the employment sub-index in history.  That is how you get this type of surge in economic surprises without much in the way of labor market improvement. Is the Citi US Economic Surprise Index broken? Is it lying? No. It is simply measuring the unbelievable surge in the all of the “other” data outside of the labor market.

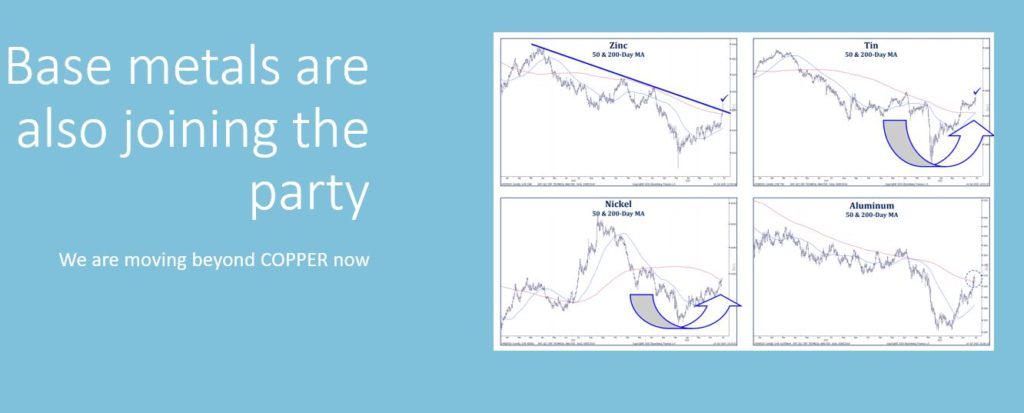

That is how you get this type of surge in economic surprises without much in the way of labor market improvement. Is the Citi US Economic Surprise Index broken? Is it lying? No. It is simply measuring the unbelievable surge in the all of the “other” data outside of the labor market.  And that is where the nonsensical data meets a sensical reaction. Normally, “Dr. Copper” and U.S. Treasury yields react in a similar manner to a cyclical upturn in the U.S. economy. Copper rises as demand increases for industrial/manufacturing purposes, and yields rise due to the relationship of a better economy meaning higher employment and increasing wages leading to inflation.

And that is where the nonsensical data meets a sensical reaction. Normally, “Dr. Copper” and U.S. Treasury yields react in a similar manner to a cyclical upturn in the U.S. economy. Copper rises as demand increases for industrial/manufacturing purposes, and yields rise due to the relationship of a better economy meaning higher employment and increasing wages leading to inflation.