By Doug Noland

The Shanghai Composite surged 7.3% this week, increasing y-t-d gains to 10.9%. The CSI 300 rose 7.6%, with 2020 gains of 16.0%. China’s growth-oriented ChiNext Index’s 12.8% surge boosted year-to-date gains to 54.5%. Copper jumped 7.1% this week. Aluminum rose 4.6%, Nickel 4.0%, Zinc 8.3%, Silver 4.2%, Lead 4.2%, and Palladium 3.5%. China’s renminbi advanced 0.9% this week to a four-month high versus the less-than-king dollar.

July 9 – Bloomberg: “Like millions of amateur investors across China, Min Hang has become infatuated with the country’s surging stock market. ‘There’s no way I can lose,’ said the 36-year-old, who works at a technology startup… ‘Right now, I’m feeling invincible.’ Five years after China’s last big equity boom ended in tears, signs of euphoria among the nation’s investing masses are popping up everywhere. Turnover has soared, margin debt has risen at the fastest pace since 2015 and online trading platforms have struggled to keep up. Over the past eight days alone, Chinese stocks have added more than $1 trillion of value — far outpacing gains in every other market worldwide.”

China’s Total Aggregate Financing (TAF) expanded a much stronger-than-expected $490 billion in June, up from May’s $455 billion expansion and 30% above growth from June 2019. TAF surged a remarkable $2.976 TN during the first-half, 43% ahead of comparable 2019 (80% ahead of first-half 2018).

It’s not easy to place China’s ongoing historic Credit expansion in context. While not a perfect comparison, U.S. Total Non-Financial Debt (NFD) expanded a record $3.3 TN over the four quarters ended March 31st. In booming 2007, U.S. NFD expanded about $2.5 TN. Chinese Total Aggregate Financing has expanded almost $3.0 TN in six months.

In the face of economic contraction, TAF increased a blistering $4.39 TN, or 12.8%, over the past year. For perspective, y-o-y growth began 2020 at 10.7% – and is now expanding at the strongest pace since February 2018. Beijing is targeting TAF growth of $4.3 TN (30 TN yuan) for 2020, about 25% ahead of record 2019 growth (and up 45% from 2018 growth).

China’s New Bank Loans expanded $259 billion in June, up from May’s $212 billion and 9% ahead of June 2019. At $1.727 TN, year-to-date New Loans are running 25% ahead of comparable 2019. Consumer lending has bounced back, likely fueled by some pent-up demand for mortgage Credit. At $140 billion, Consumer Loan growth was up from May’s $101 billion and 29% above June 2019 growth. The $509 billion year-to-date expansion in Consumer Loans was 4% below comparable 2019. Yet Consumer Loans were up 14% y-o-y; 33% in two years; 59% in three; and 135% over five years.

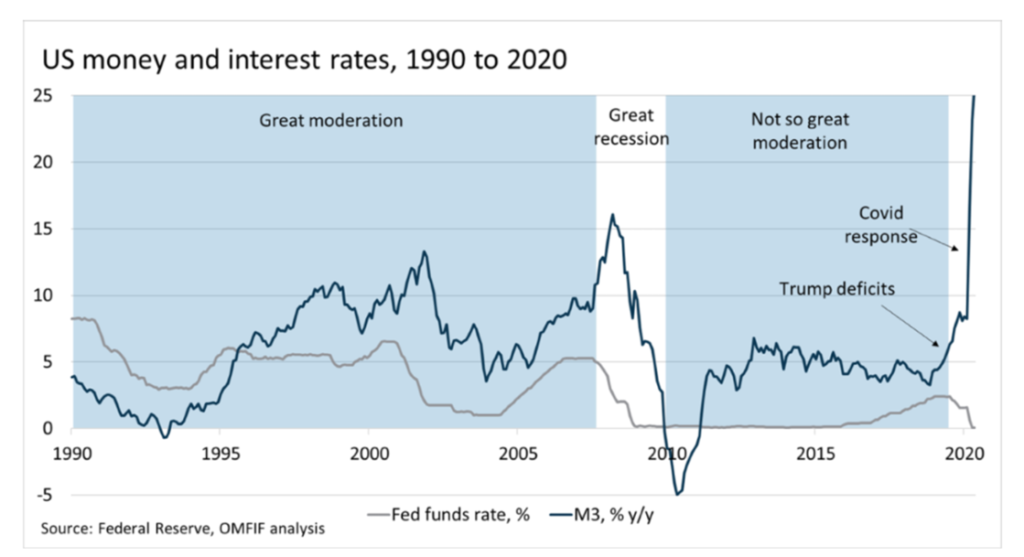

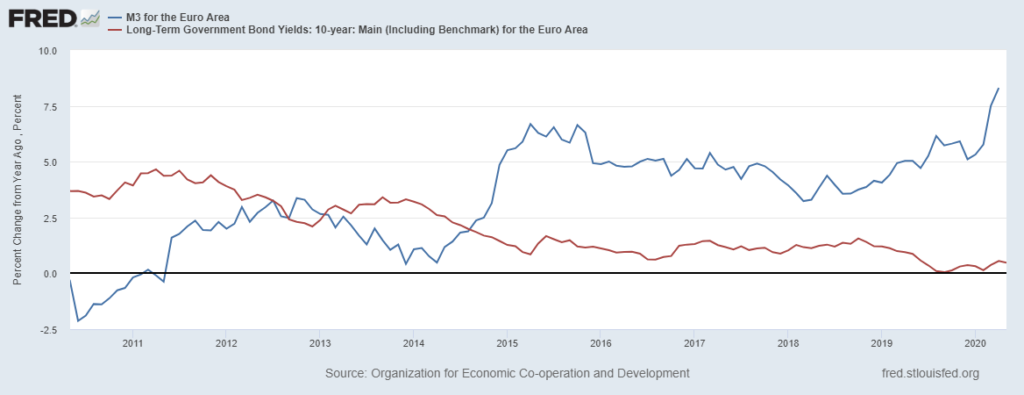

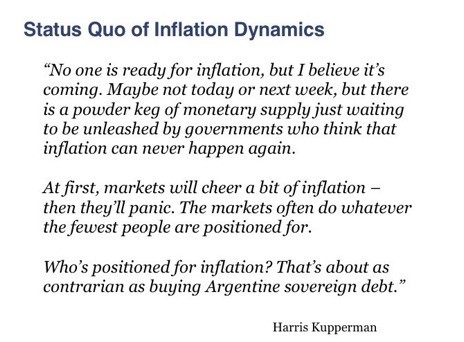

China’s M2 money supply expanded $496 billion during June to $30.5 TN, an almost 20% annualized pace. Over six months, M2 surged $2.120 TN, or 14.7% annualized. At 11.1%, year-over-year M2 growth has been running at the strongest pace since January 2017. M2 expanded 20.6% over two years; 30.9% over three; and 60.1% in five years, in one of history’s spectacular monetary expansions.

For perspective, U.S. M2 rose a record $950 billion during 2019. China’s M2 expansion more than doubled this amount in only six months. And with U.S. M2 up over $3 TN, combined Chinese and U.S. first-half “money” supply growth approached an incredible $5.2 TN.

July 7 – Wall Street Journal (Jacky Wong): “Analysts fret that U.S. markets have become irrational thanks to so-called ‘Robinhood’ retail traders with plenty of time on their hands. But American markets have nothing on China. Chinese stock markets have been on a tear lately: the CSI 300 index, a gauge of the largest companies listed in Shanghai and Shenzhen, has gained 14% just in the past week… What really seems to have gotten Chinese investors excited however, is state media’s sudden switch to a bullish tone. A Monday front-page editorial in the state-owned China Securities Journal said it’s now important to foster a ‘healthy bull market’—in part because of more ‘complicated’ global trade and economic relations.”

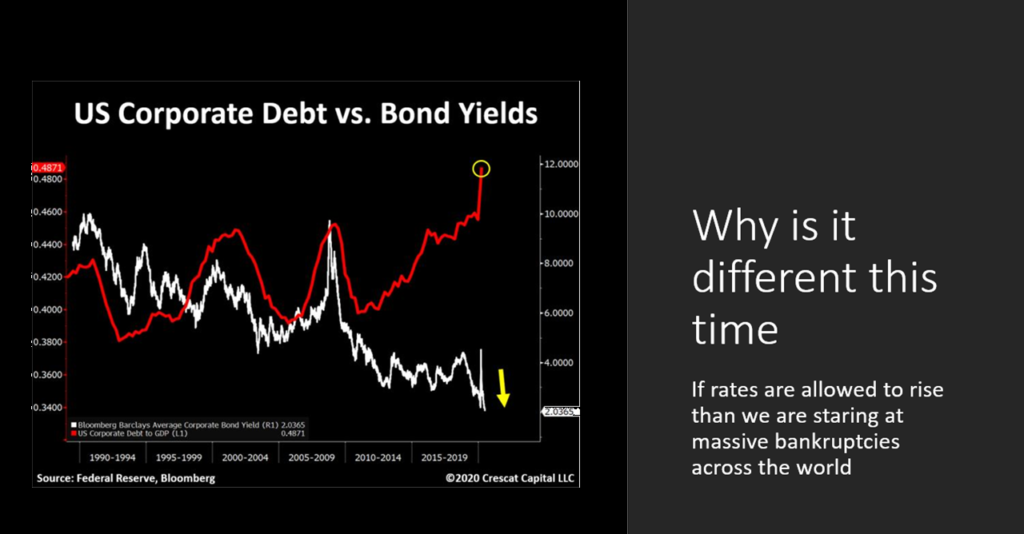

It is a central tenet of Credit Bubble Analysis that things turn “Crazy” near the end of cycles. And with the thesis that we’re in the concluding (“Terminal”) phase of a multi-decade, super-cycle global Bubble, there’s been every reason to foresee Utmost Craziness.

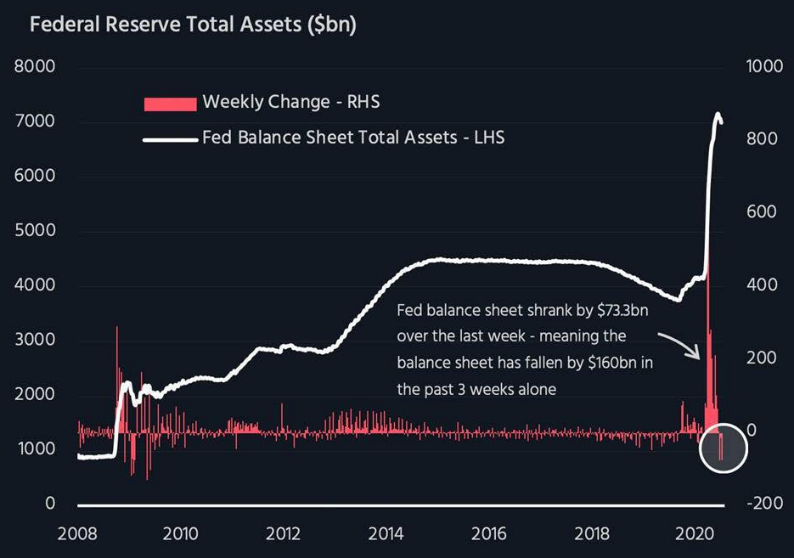

In the most simplified terms, Bubbles inherently gather momentum and inflate to dangerous extremes. Mounting fragilities ensure policymakers employ the increasingly outrageous measures demanded to hold collapse at bay. Craziness is cultivated by a confluence of late-cycle intense monetary inflation (i.e. QE and speculative leverage) and deeply ingrained speculative impulses.

The bigger the Bubble, the more intense the speculative fervor; the greater the attendant government intervention; and the more convinced market participants become that officials won’t allow a bust. Throw Trillions at systems already acutely prone to Bubble excess and you’re courting disaster (that’s you, Washington and Beijing).

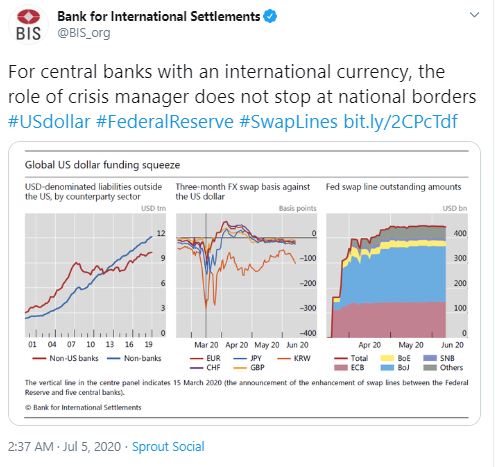

The global nature of Bubble Dynamics makes this period unique. And while Europe, Japan and EM are important contributors, the global Bubble is foremost underpinned by historic U.S. and Chinese monetary inflation. That these two countries are increasingly bitter rivals adds unique challenges to Bubble analysis.

The irony of it all: China’s communist party readily promoting the stock market. Do they have much choice? The Federal Reserve over three decades shifted away from the traditional model of affecting bank lending – elevating the financial markets to the primary policy stimulus mechanism. Instead of measured interest-rate reductions, on the margin, stimulating bank lending, the Fed has resorted to Trillions of securities purchases (QE) and zero rates to directly trigger market speculation and asset inflation. This model proved an absolute boon to U.S. markets, the economic expansion, the dollar and broader U.S. global influence. To compete, Beijing knew what it had to do.

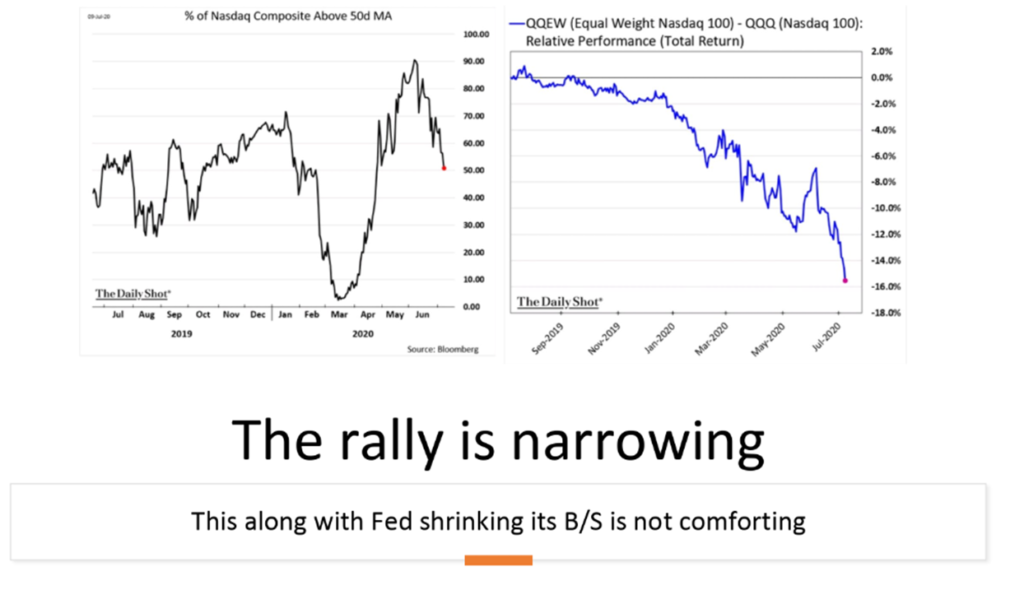

The Nasdaq100 is up 23%, lagging China’s ChiNext Index’s 54% 2020 gain. These competing superpowers are increasingly in hand-to-hand combat for technological supremacy and global dominance. It is also apparent that these two economies will be “decoupling” – in an increasingly unsettled, bi-polar world. The relationship has of late commenced an ominous free-fall.

They do, however, share some commonality. The U.S. and China are both targeting securities markets to reflate their faltering Bubbles. Typically, the primary risks associated with exacerbating Bubble excess would be domestic-focused – i.e. increasingly unstable markets, economic maladjustment/fragility, and heightened social and political instability. Yet today’s backdrop adds a critical geopolitical component. Both face the momentous consequences that collapsing markets would entail for their competing global interests. Stakes are incredibly high – and policymakers respond accordingly.

Chinese equities have been booming, and sentiment has turned bullish on China’s economic recovery. I’m unimpressed. Considering the unprecedented monetary stimulus along with pent-up demand, recovery is thus far unremarkable. Especially with surging COVID cases globally, China export sector struggles will be ongoing. And I question the wisdom of further stoking China’s historic apartment Bubble. I’ll be surprised if Chinese consumers don’t remain at least somewhat cautious for months to come. But if Beijing is hellbent on spurring a recovery, I wouldn’t bet against them in the short-term.

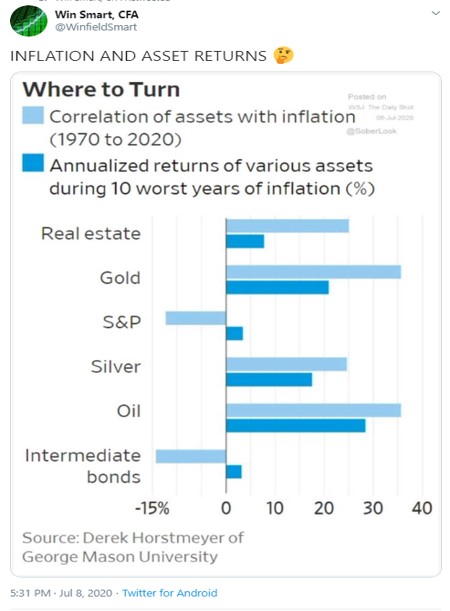

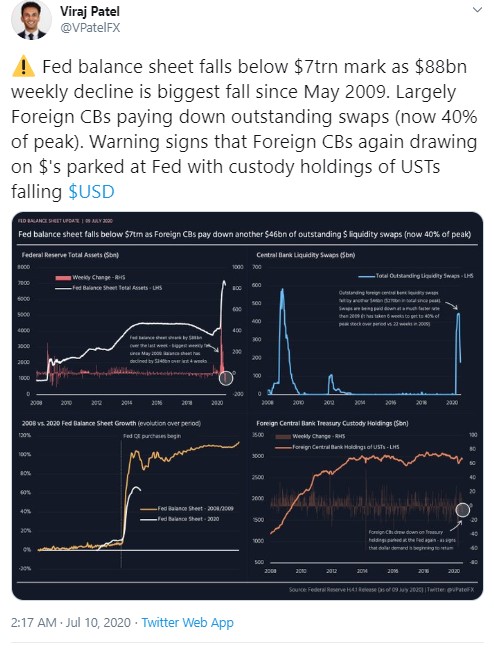

A combined $5.0 TN of new (U.S. and Chinese) “money” supply ensures epic distortions. For one, “money” has flooded into global securities markets. This has fomented an extraordinary reversal of short positions and hedges across global risk markets – equities, corporate Credit, commodities and currencies. Financial conditions have loosened markedly, with risk markets in the throes of a historic short squeeze.

July 8 – Financial Times (Laurence Fletcher): “Lansdowne Partners’ decision this week to shut its flagship hedge fund has dealt a big blow to a key strategy — equity long/short — that is already struggling to find losers in stimulus-soaked markets. The move by the… fund… marks a major retreat by an industry pioneer. It also highlights how tough life has become in the years since the financial crisis for managers trying to pick out overpriced stocks during a seemingly unstoppable bull run. ‘It is much harder to see opportunities in the short book, either in terms of generating specific value or as a hedging offset to the long investments,’ wrote Peter Davies and Jonathon Regis, managers of the Lansdowne Developed Markets fund… Lansdowne’s problems reflect the wider challenges facing the $830bn-in-assets equity long/short hedge fund sector.”

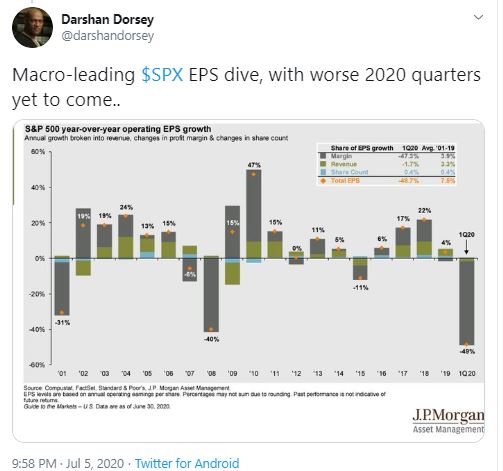

Tesla was up another 28% this week, boosting one-month gains to 51% and its year-to-date advance to 269%. With market capitalization of $287 billion, Tesla is the poster child for stock prices divorced from underlying fundamentals. Yet this dynamic is anything but limited to big Nasdaq stocks. At this point, panic buying and short squeeze dynamics have destabilized markets – from U.S. and Chinese equities to global stocks, corporate bonds and commodities. Did Beijing this week willfully administer a deathblow to shorts in Chinese equities and the renminbi – a squeeze that quickly broadened to the industrial commodities and global equities, more generally?

It’s not unusual for short squeezes to unfold even in the face of deteriorating fundamentals. There is often a final “blow-off” fueled by a confluence of speculative excess, panicked short covering, and derivative-related trading. It’s a key facet of late-cycle Craziness.

That sick feeling in my stomach returned this week: this is out of control. COVID is out of control. Market speculation is out of control. And it’s this combination that recalls the unease I was experiencing back in February, as a speculative marketplace was content to completely disregard mounting pandemic risk.

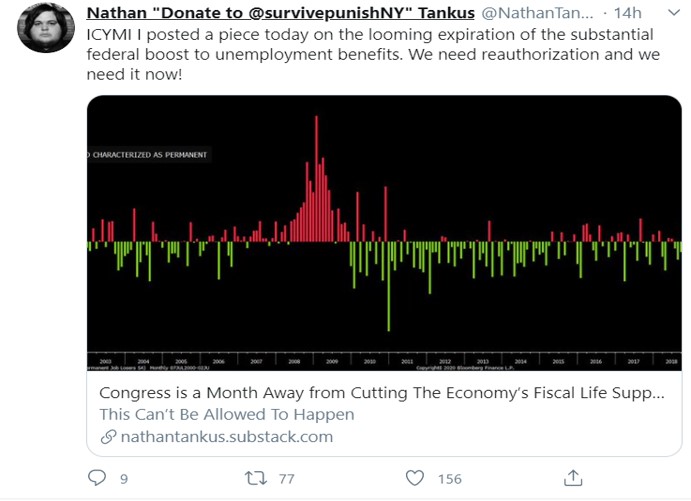

It’s difficult to fathom the almost 400,000 new U.S. COVID infections since last Friday’s CBB. Hopes from just a few weeks ago of a return to a semblance of normalcy have been crushed. The specter of overflowing ICUs and hospital wards has returned – but instead of NYC it will unfold in cities and towns across the entire southern U.S. And it looks like a replay of PPE and COVID test shortages.

And what the future holds appears more unsettled today than even in March and April. Back then we believed there was a curve to flatten. With shared sacrifice, we’d overcome the pandemic. It was not that many weeks ago when the estimate for COVID-related deaths was revised sharply lower to 60,000. Our nation has lost 134,000.

A harsh reality has begun to set in. At this point, no one – or any model – has a clue as to how many will perish – or even the general trajectory of this pandemic. The relatively low daily death rate was early in the week still a talking point for the dismissive. The daily death count surpassed 800 by the end of the week – on the way to 1,000, 2,000 or even higher?

Will the most populated states in the country be forced to dramatically tighten restrictions? Texas, Georgia, California and others are contemplating a return to “lockdown” conditions. Does this widely dispersed outbreak portend a major nationwide spike in infections – in cities, towns and rural communities? Are we prepared? Have we procured sufficient supplies?

Stocks are surging, so the economic recovery must not be at risk, right? Yet it’s difficult for me to see how the economy – at home and abroad – isn’t facing serious chronic problems. We’re only weeks away from the start of a new school year – and there’s little clarity. College football games are being cancelled and the entire season is slipping away. It’s simply difficult to comprehend what a mess we’ve made of things. Outrage is justified.

In Miami, apparently only 17% of new infections are generating follow-up contact tracing. Beyond the lack of sufficient tracer personnel, many newly infected are simply refusing to cooperate with local authorities. As a nation – from top leadership to us common citizens – we’ve got to quickly get our crap together and approach this crisis with more of a wartime mindset. Surging stock prices notwithstanding, there’s more than a small probability (10%, 20% – 50%?) of a quite problematic scenario.

Meanwhile, divisions, partisan infighting and a proliferation of nonsense are inflicting irreparable damage. Zerohedge uses this photo of Putin with a mischievous grin enjoying his bucket of popcorn. I imagine Xi and Putin chatting affably on a secure line in utter amazement – giggling.