US credit card debt roughly half the size of India’s GDP

The US Federal Reserve reported last week that collective credit card debt in the U.S. has reached $1 trillion (roughly half the size of India’s GDP) . Even student loans in US has crossed USD 1 trillion. People like their credit cards so much, they’re using them even for the tiniest purchases, according to a new survey released this week from the credit cards site CreditCards.com. Among people with credit cards, 17% said they use them to buy items in brick-and-mortar stores that cost less than $5, up from 11% last year. CreditCards.com surveyed about 1,000 U.S. adults in March 2017.Indeed, several high-profile credit cards offer cash back and perks for spending. For example, Amazon introduced a credit card this year for Prime members that gives 5% cash back on Amazon purchases (Prime itself costs $99 per year.).

Read More

http://www.marketwatch.com/story/more-evidence-americans-are-becoming-obsessed-with-putting-everything-on-credit-2017-04-10

India likely to face shortage of quality investible companies in future

Manish Bhandari at Vallum Capital writes some very interesting points on equity investing in his annual Letter.

“I must bring an interesting observation I have been having for some time to your notice. India is likely to witness shortage of quality investable companies in the future. The seeds were sown few years back with the scrapping of press note, allowance of 100% FDI in most of the sectors, buy back by listed MNCs and regulatory arbitrage available to do buy back rather than paying dividend. Moreover, in many cases Initial Public Offers are from companies that have been, private equity funded leaving less room for upside for secondary market players. All these factors are compounding the valuation for high quality companies to stratospheric height, leaving less room for error, if forecasted earnings are not met. Moreover, my observation is that in many areas, MNC with technological edge, global relationship, brand, superior business processes have an edge, emerging as leaders or have gained dominant markets share in respective field. Many such, not represented in the listed equity universe of India. The democratization of information will pose a serious challenge to money management business. Recently, my team brought to my notice that in the Dec 2016 quarter, there were more than 450 conference calls held by corporate bodies discussing quarterly results, with discussion note available while I remember less than 50 per quarter a decade ago. Institutional Investors with their superior management access will not offer any distinction in investment performance though may suffer from their herd behavior. The sorry state of mutual fund industry in the US is a prime example in front of us.

Full letter below

https://connectvallum.wordpress.com/2017/04/11/vallum-capital-annual-letter-2016-17/

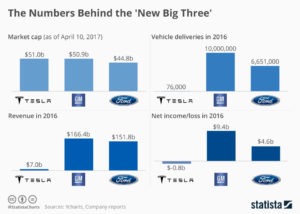

Tesla and problem of Capital Misallocation

Tesla shares rose to $313.38 this week, giving the company a market capitalization of about $51 billion, surpassing GM for a moment as the most valuable American automaker. This left some industry insiders wondering about tulip bulbs mania. https://en.wikipedia.org/wiki/Tulip_mania “It’s either one of the great Ponzi schemes of all time, or it’s all going to work out,” mused Mike Jackson, CEO of AutoNation, the largest dealer group in the US. “It’s totally inexplicable, as far as its valuation,” he said. In comparison with GM, Tesla is ludicrously overvalued. But it’s not “inexplicable.” It’s perfectly explicable by the easy money engineered stock market that has long ago abandoned any pretext of valuing companies on a rational basis. And it’s explicable by the hype – the “research” – issued by Wall Street investment banks that hope to get fat fees from Tesla’s next offerings of shares. The amounts are huge, going back ten years: Last month, Tesla raised another $1.2 billion, after having raised $1.5 billion in May 2016. There will be more. Tesla is burning a lot of cash. Investment banks get rich on these deals. The bonuses are huge. So, it’s OK to hype Tesla’s stock and sell it to their clients. Everybody wins in this As long as shares continue to rise, the whole equation is perfectly validated. Shares will rise because stock jockeys expect them to rise, and with that expectation, they buy them and drive up their price. Buy-buy-buy turns into a self-fulfilling prophecy. It won’t last forever. But until then, market share, profits, or anything else vaguely linked to reality simply don’t matter.

Read More

http://wolfstreet.com/2017/04/11/tesla-gm-comparison-market-share-income-valuation/

Pokemon GO and demise of shipping industry

The container shipping industry, and Hanjin in particular, has been spectacularly wrong about the financial crisis – twice. There was not one but two waves of container ship ordering in 2010, and then again in 2013-14. Interest rates were low and money was cheap. “Before 2008 and 2009 the world had been growing consistently, and after 10 years of growth no-one in the shipping industry expected demand to shrink so fast. “To start with they thought it was just a blip. But in reality, it was structural, and they totally missed the structural problems.” But the reality is that the slowing in global trade may have more profound causes – not to do with shipping or economic growth, but to do with how and what we consume.Last year, Mr Kapoor director at shipping consultancy Drewry Financial Research Services wrote a report using the example of his son’s excitement at buying the Pokemon Go app and comparing his own habits 15 years earlier. While his son was happy to buy something electronic, back in Mr Kapoor’s youth he would have bought something physical that may well have been shipped in a container from Asia.”In an increasingly knowledge based and services driven global economic expansion, the trade expansion is stagnating,” he wrote. “The global manufacturing engines, world trade, credit driven GDP growth model is being increasingly challenged and world trade seems to be stuck in a time warp, barely growing.”

Read More

http://www.bbc.com/news/business-38653546