This week i have written about

1.Hunt for taxes

2. Raoul Pal on his next big Idea

3.Blackrock prefers robots to stockpiclers

4.whatever happened to free trade

Making sense out of Chaos

This week i have written about

1.Hunt for taxes

2. Raoul Pal on his next big Idea

3.Blackrock prefers robots to stockpiclers

4.whatever happened to free trade

Raoul Pal is a great macro thinker and is author of Global Macro Investor ,a highly acclaimed institutional newsletter. Raoul identifies big trends ahead of time and has 24000 twitter followers . His next big call is

INDIA

By Raoul Pal

March 2017

I’m going to blow your mind with this following article. My mind is still reeling from my discovery and from writing this piece.

Let me enlighten you…

Companies that create massively outsized technological breakthroughs tend to capture the investing population’s attention and thus their share prices trade at huge multiples, as future growth and future revenues are extrapolated into the future.

From time to time, entire countries re-model their economies and shift their growth trajectory. The most recent example was the liberalisation of China’s economy and massive spending on infrastructure, which together created an incredibly powerful force for growth over the last two decades.

But it is very rare indeed that a country develops an outsized technological infrastructure breakthrough that leaves the rest of the world far behind.

But exactly this has just happened in India… and no one noticed.

India has, without question, made the largest technological breakthrough of any nation in living memory.

Its technological advancement has even left Silicon Valley standing. India has built the world’s first national digital infrastructure, leaping at least two generations of financial technologies and has built something as important as the railroad was to the UK or the interstate highways were to the US.

India is now the most attractive major investment opportunity in the world.

It’s all about something called Aadhaar and a breathtakingly ambitious plan with flawless execution.

What just blows my mind is how few people have even noticed it. To be honest, writing the article last month was the first time I learned about any of the developments. I think this is the biggest emerging market macro story in the world.

Phase 1 – The Aadhaar Act

India, pre-2009, had a massive problem for a developing economy: nearly half of its people did not have any form of identification. If you were born outside of a hospital or without any government services, which is common in India, you don’t get a birth certificate. Without a birth certificate, you can’t get the basic infrastructure of modern life: a bank account, driving license, insurance or a loan. You operate outside the official sector and the opportunities available to others are not available to you. It almost guarantees a perpetuation of poverty and it also guarantees a low tax take for India, thus it holds Indian growth back too.

Normally, a country such as India would solve this problem by making a large push to register more births or send bureaucrats into villages to issues official papers (and sadly accept bribes in return). It would have been costly, inefficient and messy. It probably would have only partially worked.

But in 2009, India did something that no one else in the world at the time had done before; they launched a project called Aadhaar which was a technological solution to the problem, creating a biometric database based on a 12-digit digital identity, authenticated by finger prints and retina scans.

Aadhaar became the largest and most successful IT project ever undertaken in the world and, as of 2016, 1.1 billion people (95% of the population) now has a digital proof of identity. To understand the scale of what India has achieved with Aadhaar you have to understand that India accounts for 17.2% of the entire world’s population!

But this biometric database was just the first phase…

Phase 2 – Banking Adoption

Once huge swathes of the population began to register on the official system, the next phase was to get them into the banking system. The Government allowed the creation of eleven Payment Banks, which can hold money but don’t do any lending. To motivate people to open accounts, it offered free life insurance with them and linked bank accounts to social welfare benefits. Within three years more than 270 million bank accounts were opened and $10bn in deposits flooded in.

People who registered under the Aadhaar Act could open a bank account just with their Aadhaar number.

Phase 3 – Building Out a Mobile Infrastructure

The Aadhaar card holds another important benefit – people can use it to instantly open a mobile phone account. I covered this in detail last month but the key takeaway is that mobile phone penetration exploded after Aadhaar and went from 40% of the population to 79% within a few years…

The next phase in the mobile phone story will be the rapid rise in smart phones, which will revolutionise everything. Currently only 28% of the population has a smart phone but growth rates are close to 70% per year.

In July 2016, the Unique Identification Authority of India (UIDAI), which administers Aadhaar, called a meeting with executives from Google, Microsoft, Samsung and Indian smartphone maker Micromax amongst others, to talk about developing Aadhaar compliant devices.

Qualcomm is working closely with government authorities to get more Aadhaar-enabled devices onto the market and working with customers – including the biggest Android manufacturers – to integrate required features, such as secure cameras and iris authentication partners.

Tim Cook, CEO of Apple, recently singled out India as a top priority for Apple.

Microsoft has also just launched a lite version of Skype designed to work on an unstable 2G connection and is integrated with the Aadhaar database, so video calling can be used for authenticated calls.

This rise in smart, Aadhaar compliant mobile phone penetration set the stage for the really clever stuff…

Phase 4 – UPI – A New Transaction System

But that is not all. In December 30th 2016, Indian launched BHIM (Bharat Interface for Money) which is a digital payments platform using UPI (Unified Payments Interface). This is another giant leap that allows non-UPI linked bank accounts into the payments system. Now payments can be made from UPI accounts to non-UPI accounts and can use QR codes for instant payments and also allows users to check bank balances.

While the world is digesting all of this, assuming that it is going to lead to an explosion in mobile phone eWallets (which is happening already), the next step is materializing. This is where the really big breakthrough lies…

Payments can now be made without using mobile phones, just using fingerprints and an Aadhaar number.

Fucking hell. That is the biggest change to any financial system in history.

What is even more remarkable is that this system works on a 2G network so it reaches even the most remote parts of India!! It will revolutionise the agricultural economy, which employs 60% of the workforce and contributes 17% of GDP. Farmers will now have access to bank accounts and credit, along with crop insurance.

But again, that is not all… India has gone one step further…

Phase 5 – India Stack – A Digital Life

In 2016, India introduced another innovation called India Stack. This is a series of secured and connected systems that allows people to store and share personal data such as addresses, bank statements, medical records, employment records and tax filings and it enables the digital signing of documents. This is all accessed, and can be shared, via Aadhaar biometric authentication.

Essentially, it is a secure Dropbox for your entire official life and creates what is known as eKYC: Electronic Know Your Customer.

Using India Stack APIs, all that is required is a fingerprint or retina scan to open a bank account, mobile phone account, brokerage account, buy a mutual fund or share medical records at any hospital or clinic in India. It also creates the opportunity instant loans and brings insurance to the masses, particularly life insurance. All of this data can also in turn be stored on India Stack to give, for example, proof of utility bill payment or life insurance coverage.

What is India Stack exactly?

India Stack is the framework that will make the new digital economy work seamlessly.

It’s a set of APIs that allows governments, businesses, startups and developers to utilise a unique digital infrastructure to solve India’s hard problems towards presence-less, paperless and cashless service delivery.

Presence-less: Retina scan and finger prints will be used to participate in any service from anywhere in the country.

Cashless: A single interface to all the country’s bank accounts and wallets.

Paperless: Digital records are available in the cloud, eliminating the need for massive amount of paper collection and storage.

Consent layer: Give secured access on demand to documents.

India Stack provides the ability to operate in real time, transactions such as lending, bank or mobile account opening that usually can take few days to complete are now instant.

As you can see, Smart phones will act as key to access the kingdom.

This is fast, secure and reliable; this is the future…

This revolutionary digital infrastructure will soon be able to process billions more transactions than bitcoin ever has. It may well be a bitcoin killer or at best provide the framework for how blockchain technology could be applied in the real world. It is too early to tell whether other countries or the private sector adopts blockchain versions of this infrastructure or abandons it altogether and follows India’s centralised version.

India Stack is the largest open API in the world and will allow for massive fintech opportunities to be built around it. India is already the third largest fintech centre but it will jump into first place in a few years. India is already organizing hackathons to develop applications for the APIs.

It has left Silicon Valley in the dust.

Phase 6 – A Cash Ban

The final stroke of genius was the cash ban, which I have also discussed at length in the past. The cash ban is the final part of the story. It simply forces everyone into the new digital economy and has the hugely beneficial side-effect of reducing everyday corruption, recapitalising the banking sector and increasing government tax take, thus allowing India to rebuild its crumbling infrastructure…

India was a cash society but once the dust settles, cash will account for less than 40% of total transactions in the next five years. It may eliminate cash altogether in the next ten years.

The cash ban digitizes India. No other economy in the world is even close to this.

Phase 7 – The Investment Opportunity

Everyone thinks they know about the Indian economy – crappy infrastructure, corruption, bureaucracy and antiquated institutions but with a massively growing middle class. Well, that is the narrative and has been for the last 15 years.

But that phase is over and no one noticed. So few people in the investment community or even Silicon Valley are even vaguely aware of what has happened in India and that has created an enormous investment opportunity.

The future for India is massive technological advancement, a higher trend rate of GDP and more tax revenues. Tax revenues will fund infrastructure – ports, roads, rail and healthcare. Technology will increase agricultural productivity, online services and manufacturing productivity.

Telecom, banking, insurance and online retailing will boom, as will the tech sector.

Nothing in India will be the same again.

FDI is already exploding and will rise massively in the years ahead as technology giants and others pour into India to take advantage of the opportunity…

***Hot off the press***

I decided to test the waters on Twitter on Sunday and Monday to find out how many non-Indians were aware of India Stack/Aadhaar. I have 24,000 followers on Twitter, many of which are you guys, and hosts of others heavily engaged in financial markets i.e. it’s a decent data sample.

In the 12 hours since the survey began, around 900 people have responded. It appears that 90% of the investment world knows absolutely nothing about the biggest IT project ever accomplished and have never even heard of it.

Now, that is an informational edge.

BACKGROUND

Raoul Pal has been publishing Global Macro Investor since January 2005 to provide original, high quality, quantifiable and easily readable research for the global macro investment community hedge funds, family offices, pension funds and sovereign wealth funds. It draws on his considerable 26 years of experience in advising hedge funds and managing a global macro hedge fund.

Global Macro Investor has one of the very best, proven track records of any newsletter in the industry, producing extremely positive returns in eight out of the last twelve years.

Raoul Pal retired from managing client money at the age of 36 in 2004 and now lives in the tiny Caribbean island of Little Cayman in the Cayman Islands.

He is also the founder of Real Vision Television, the world’s first on-demand TV channel for finance: www.realvisiontv.com

Previously he co-managed the GLG Global Macro Fund in London for GLG Partners, one of the largest hedge fund groups in the world.

Thousands of mall-based stores in US are shutting down in what’s fast becoming one of the biggest waves of retail closures in decades.More than 3,500 stores are expected to close in the next couple months.Department stores like JCPenney, Macy’s, Sears, and Kmart are among the many companies shutting down stores, along with middle-of-the-mall chains like Crocs, BCBG, Abercrombie & Fitch, and Guess.Some retailers are exiting the brick-and-mortar business altogether and trying to shift to an all-online model.For example, Bebe is reportedly closing all 170 of its stores to focus on growing online sales, according to a Bloomberg report . The Limited also recently shut down all 250 of its stores , while still selling merchandise online.

As stores continue to close, many shopping malls will be forced to shut down as well.When an anchor store like Sears or Macy’s closes, it often triggers a downward spiral in performance for shopping malls.

There has to be a winner in all this misery and that is JEFF BEZOS of Amazon who leapfrogged Warren buffet and spanish fashion tycoon ortega to become the second richest person in world yesterday.The Bloomberg Billionaires Index shows Bezos is now worth $75.6 billion. His worth jumped by nearly $1.5 billion dollars on Wednesday, powered by a record high for Amazon’s stock.

After World War II, the global economy rose on a wave of trade and finance, lifting hundreds of millions of people out of poverty in developing countries and providing rich countries with cheaper goods, lucrative investments and hopes for a more peaceful planet.

That tide is now receding.

Nine years after the financial crisis, global trade is barely growing when compared with overall economic output. Cross-border bank lending is down sharply, as are international capital flows. Immigration in the U.S. and Western Europe faces a deepening public backlash.

Nationalist politicians are on the ascent. On Wednesday, the U.K. formally started proceedings to remove itself from the European Union. In the U.S., President Donald Trump pulled out of a Pacific trade pact on his first working day in the Oval Office, declaring, “Great thing for the American worker, what we just did.”

In G-20 ,India is having probably lowest linkages to global trade and that way we are more insulated than most other economies, hence the impact of deglobalisation will be less for our economy.

Its not just Google that is quantifying everything you do – pretty much every website is tracking you in some shape or form. Here’s what you need to know, and also a way to keep the trackers at bay.

These trackers are intended to allow websites to tailor their experience to each user. This way, you’ll see more relevant ads, and your individual preferences will be remembered. While many people appreciate these benefits, others do not believe the trade-off with their privacy is worth it.

If you are a privacy-oriented person and want to take action, the infographic gives you step-by-step instructions on how to change your browser preferences on a number of devices to avoid such extensive tracking.

These days, robots and algorithms are everywhere, replacing not just manufacturing jobs but all kinds of jobs in air-conditioned offices that paid big salaries and fat bonuses.Blackrock, the world’s largest asset manager, with $ 5.1 trillion in total assets has started a shake-up of its stock picking business, relying more on robots rather than humans to make decisions on what to buy and sell.The firm has dominant position in low-cost, passive investment such as exchange-traded funds.But its stock-picking unit – which depends on money managers to choose investments – has lagged rivals in performance and clients have been withdrawing their money.

The company has taken the view that it is difficult for human beings to beat the market with traditional bets on large U.S. stocks. So the firm on Tuesday announced an overhaul of its actively-managed equities business that will include job losses, pricing changes and a greater emphasis on computer models that inform investments.

BlackRock announced a plan to consolidate $30 billion of their actively managed mutual fund activities with funds that are managed by algorithms and quantitative models. As these software robots take over, “53 stock pickers are expected to step down from their funds. Dozens more are expected to leave the firm,” as the New York Times put it.

“We have to change the ecosystem – that means relying more on big data, artificial intelligence, factors and models within quant and traditional investment strategies,” BlackRock CEO Laurence Fink told The Times.The firm is offering its Main Street customers lower-cost quantitative stock funds that rely on data and computer systems to make predictions, an investment option previously available only to large institutional investors. Some existing funds will merge, get new investment mandates or close.

In a similar vein, “robo-advisors” are starting to give a cheap and hot alternative for many customers , replacing human financial advisors. A lot of the grunt work that used to be done during all-nighters by highly paid law school grads in big law offices is now done by computers.

So job destruction due to automation is not a blue-collar thing anymore. It’s everywhere

In India portfolio managers http://www.business-standard.com/article/markets/majority-of-active-funds-lag-benchmark-returns-in-past-one-year-117032700844_1.html are struggling to beat the benchmark, although over long periods they have beaten their benchmarks.

I believe the structure of indian economy has changed and low inflation coupled with lower nominal GDP is the new normal.Where as high inflation leads to lower barrier of entry in any business and thereby more competition and more companies in any business, low inflation with high cost of compliance and tackling bearucracy kills the enetrpreneurship and competition there by leading to few large succesfull oligopolies in any business. GST will further hasten this process.In this kind of enviroment i think this will lead to more and more fund managers finding it difficult to beat the benchmarks and India will also see emergence of passive funds as new asset class.

The Indian real estate market is currently grappling with a double whammy, one from the cash shortage caused by the impact of demonetisation and the second by the imminent introduction of the Real Estate Regulator (RERA). This, along with the increasing refinancing risk, would shake-up the sector, with developers with high leverage losing out.

Come July 1 and leasing of land, renting of buildings as well as EMIs paid for purchase of under-construction houses will start attracting the Goods and Services Tax. Sale of land and buildings will be however out of the purview of GST, the new indirect tax regime.The Central GST (CGST) bill — one of the four legislations introduced, states that any lease, tenancy, easement, licence to occupy land will be considered as supply of service. Also, any lease or letting out of the building, including a commercial, industrial or residential complex for business or commerce, either wholly or partly, is a supply of services as per the CGST bill. This will further lead to delayed decision making on the part of buyer and add to real estate develops woes.

I think like many other sector this sector is also on the verge of shakeup .Real estate will also have only few winners as debt hangover will lead to emergence of regional and national oligopolies .Private investor (institutional investors) with deep pocket and easy access to cheap funding will be the new landowners of India.

Statista’s Made-In-Country-Index (MICI) 2017 has shed light on the worldwide reputation of products produced in 49 different countries (plus the EU). The survey of more than 43 thousand consumers – representing 90 percent of the global population – delves into the standing of ‘Made in’ labels around the world, revealing the national brands with the most respect.

The ‘Made in’ label was originally introduced by the British at the end of the 19th century to protect their economy from cheap, low quality and sometimes counterfeit imports from Germany. It is therefore rather ironic that Germany now sits atop the ranking as the most respected label in the world. Coming in a close second is Switzerland while the founders of the system find themselves in a still very respectable fourth place. The United States is joint eighth with France and Japan.

India is not on this chart but as per data by (MICI)India ranks 42 in the list of most respected labels with an index value of 36

This chart shows the world’s most respected ‘made in’ labels in 2017.

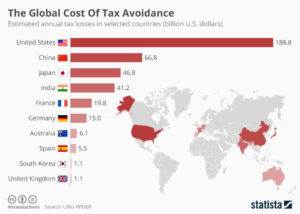

Every year, the world’s economies lose billions of dollars to tax avoidance. Estimates of the sheer scale of the losses fluctuate wildly with the IMF reporting that around $600 billion is lost due to profit shifting every year. A new paper published by UNU-WIDER took a closer look at the issue at country level, finding that the United States loses the highest amount in absolute terms by far.Every year, the U.S. loses an estimated $189 in tax, around 1.13 percent of GDP. China has the second highest annual losses in absolute terms with $66.8 billion while Japan is also badly effected with $47 billion unaccounted for.

India is not far in the list and looses more than 2% of GDP annually to tax avoidance. The cost of avoidance looks more stark when we consider that India is a developing economy and higher revenues with govt can deliver more bang for the buck than when the economy is developed

Loan Waivers , burning effigy and Micro finance downgrades

When 67 per cent of India’s farms are below one hectare, a size that is not optimal for ensuring higher investments in raising productivity and incomes, how can endless subsidies solve farm loan waiver problem. The call for repeated farm waivers is a sign that farmers need to get out of farming when they can and It is the government’s duty to aid this change, not retard it. Put the emaciated picture of a poor farmer on the front page, add a graph on farmer suicides, obtain sound-bites from unemployed farm labour and it is easy to make out a strong emotional case for farm loan waivers. After promising waivers as part of its Uttar Pradesh manifesto, BJP’s Maharashtra Chief Minister, Devendra Fadnavis, has been under pressure to write off farm loans in the state, with estranged partner Shiv Sena too getting vociferous on this count. SBI chief Arundhati Bhattacharya spoke bitter truth for which her effigy was burnt “We feel that in case of a (farm) loan waiver there is always a fall in credit discipline because the people who get the waiver have expectations of future waivers as well. As such future loans given often remain unpaid”. “Today the loans will come back as the government will pay for it but when we disburse loans again then the farmers will wait for the next election expecting another waiver. The collateral damage of farm loan waiver and demonetisation is already felt by Micro finance companies with a rating agencies downgrading the credit rating of two leading MFI last week because of increase in delinquencies.

Read More

Antimicrobial resistance still does not ring alarm bell for us

The Review on Antimicrobial Resistance (AMR) determined that, left unchecked, in the next 35 years antimicrobial resistance could kill 300,000,000 people worldwide and stunt global economic output by $100 trillion. There are no other diseases we currently know of except pandemic influenza that could make that claim. In fact, if the current trend is not altered, antimicrobial resistance could become the world’s single greatest killer, surpassing heart disease or cancer. With each passing year, we lose a percentage of our antibiotic firepower. In a very real sense, we confront the possibility of revisiting the Dark Age where many infections we now consider routine could cause severe illness, when pneumonia or a stomach bug could be a death sentence, when a leading cause of mortality in the United States was tuberculosis. Think of a couple, both of who work fulltime. One day, their 4-year-old son wakes up crying with an earache. Either mom or dad takes the child to the paediatrician, who has probably seen a raft of these earaches lately and is pretty sure it’s a viral infection. There is no effective antiviral drug available to treat the ear infection. Using an antibiotic in this situation only exposes other bacteria that the child may be carrying to the drug and increases the likelihood that an antibiotic resistant strain of bacteria will win the evolutionary lottery. But the parent knows that unless the child has been given a prescription for something, the daycare center isn’t going to take him and neither partner can take off from work. It doesn’t seem like a big deal to write an antibiotic prescription to solve this couple’s dilemma, even if the odds the antibiotic is really called for are minute. We see another frightening example of the mess we’re in China, with the use of colistin, an absolute last-ditch antibiotic for bacteria that react to nothing else. They don’t use it for people in China, but are using it in agriculture—thousands of tons a year. Likewise, in Vietnam it is only approved for animal use, but physicians obtain it from veterinarians for their human patients.Colistin is used for people, though, in much of the rest of the world, including India. As other antibiotics with fewer harmful side effects have become resistant, colistin is about the only agent still effective against certain bloodstream infections in newborn infants. In early 2015, as reported by Bloomberg, physicians treating two babies with life-threatening bloodstream infections at King Edward Memorial Hospital in Pune, India, found that the bacteria were resistant to colistin. One of the babies died.“If we lose colistin, we have nothing,” stated Umesh Vaidya, head of the hospital’s neonatal intensive care unit. “It’s an extreme, extreme worry for us.” Some hospitals in India are already finding that 10 to 15 percent of the bacterial strains they test are colistin-resistant.

Read More

US tourism faces a Trump slump

How many of you are reconsidering their plans to visit US for a holiday ?Flight app Hopper released research earlier this month that showed flight search from international origins to the US has dropped 17% since Trump’s inauguration, compared with the final weeks of the Obama administration. It found a similar pattern to Kayak, with San Francisco and Las Vegas seeing the largest declines in search interest. Hopper found there has been a sharp drop in flight searches to the US since Trump’s travel ban, with a 30% decrease in predominantly Muslim countries regardless of whether they were included in the ban. In Saudi Arabia flight searches dropped by 33% and in Bahrain by 37%, even though neither were included in Trump’s executive order. Though flight demand to the US dropped in 94 of 122 countries, Hopper found a notable exception in Russia, where flight search demand to the US was up by 88%.It is the latest in a string of reports from the travel industry that suggests a “Trump slump”, with the Global Business Travel Association (GBTA) estimating that since being elected President Trump has cost the US travel industry $185m in lost revenue. On March 3, the European Parliament voted to end visa-free travel for US citizens visiting the EU. Enforcement could begin within two months. This isn’t even related to the Trump administration’s new rules. It’s been a long-running dispute about travellers from Bulgaria, Croatia, Cyprus, Poland, and Romania. Those countries are EU members, but—contrary to agreements—the US government still requires their citizens to obtain visas to enter the United States.This kind of tit-for-tat could be the beginning of a trade war for people instead of goods.

Read More

https://www.theguardian.com/travel/2017/feb/28/us-tourism-experiences-a-trump-slump

Emergence of Populism to shape Economic conditions

Billionaire Ray Dalio, assessing the impact of President Donald Trump’s surprise election, warned that global populism will be an economic force more powerful than monetary and fiscal policies over the next year. We have seen similar forces at play in India’s recent election as well. In an 81-page paper published Wednesday that details the history of populists in 10 countries from Franklin Roosevelt to Hugo Chavez, Dalio analyzed the phenomenon to make sense of today’s current political environment. “We believe that populism’s role in shaping economic conditions will probably be more powerful than classic monetary and fiscal policies. “We will learn a lot more over the next year or so as those populists now in office will signal how classically populist they will be and a number of elections will determine how many more populists enter office.”Populism today is at its highest level since the late 1930s, said Dalio, 67. Bridgewater notes that populism is commonly brought about by gaps in wealth and opportunity, as well as xenophobia and frustration with government inefficiencies. Those factors lead to the emergence of a strong leader to serve the common man, as well as protectionism, nationalism, militarism, conflict and greater attempts to influence and control the media. Populism has been a key focus of Dalio’s in recent months, as it’s emerged in countries including the U.S., U.K., Italy and the Philippines. In mid-January at the World Economic Forum in Davos, he said that the rise of populism threatens multinational corporations and is the biggest force in the world today.