Are Indians going back to cash

Vivek kaul writes that currency with public has been going up post December 2016. Nevertheless, it is still some way away from the pre-demonetisation level. Whether that level is achieved remains to be seen. It depends on whether the government decides to replace the entire currency withdrawn through demonetisation or not. As far as ATM transactions using debit cards go, they have bounced back post demonetisation. In fact, the total number of transactions in January 2017 was more than that in January 2016. Having said that the total number of transactions in January 2017 was still lower than the pre-demonetisation level. The usage of credit cards and debit cards spiked up in the aftermath of demonetisation. But the value of goods bought using credit and debit cards through the point of sale route, fell by 8.4 per cent between December 2016 and January 2017, as more currency became available in the market. If we look at just debit cards, the fall is around 16 per cent. He also highlights that ATM withdrawals in rupee terms went up by around 79 per cent between December 2016 and January 2017. If ever there was a data point that showed that Indians preferred cash to carry out economic transactions, this is it.

Trump Adviser Peter Navarro: Trade Deficits Endanger U.S. National Security

This is getting interesting, a country which has always run trade deficits and stuffed a fiat currency named dollar to all exporters to US since Bretton woods now thinks trade deficit is bad. The director of President Donald Trump’s newly formed National Trade Council said Monday the administration would make the reduction of U.S. trade deficits its top policy focus. Speaking to a conference of business economists, trade adviser Peter Navarro said the U.S. faced a growing economic and potential national security risk from the commercial behaviour of its major trading partners, including China and Germany. “Suppose instead that it is not a benign ally buying up our companies, our technologies, our farmland and our food supply chain, and ultimately controlling much of our defense-industrial base. Rather it is a rapidly militarizing strategic rival intent on hegemony in Asia and perhaps world hegemony,” Mr. Navarro said. He warned the U.S. could lose a “broader cold war…not by shots being fired but by cash registers ringing. Here comes a trade war and the way UN has become toothless expect WTO also to disintegrate into boxing arena

Meet SEDRIC, a bizzare looking ride from volkswagen

The Volkswagen Group has taken us from the Beetle to the Golf and it soon might take us somewhere very, very boring with the new Sedric concept car.The pod-like high-tech vision of future mobility doesn’t even have a steering wheel, thanks to its Level 5 autonomous driving systems, and is the strongest statement yet from Volkswagen’s ‘Together Strategy 2025’ program. The Sedric is crammed full of the thinking Volkswagen believes it will need to transform itself from an engineering-driven car company today into an across-the-board integrated mobility services organization. Shown at a limited-access media presentation prior to the Geneva motor show, the Sedric is a development prototype of a different kind for the Volkswagen Group. Instead of engineering and building new hardware pieces and swapping them in, the idea of the Sedric is to allow all the brands in the Group to explore how their mobility concepts could work in the real world. Sedric brings in speech-controlled driving, with voice commands governing the car’s throttle systems. There are no pedals, nor steering wheel! Beneath the floor, the Sedric uses a lithium-ion battery pack with enough capacity to move the car for around 400km, Volkswagen claims. The Group’s plan is to begin launching driverless cars after 2020.

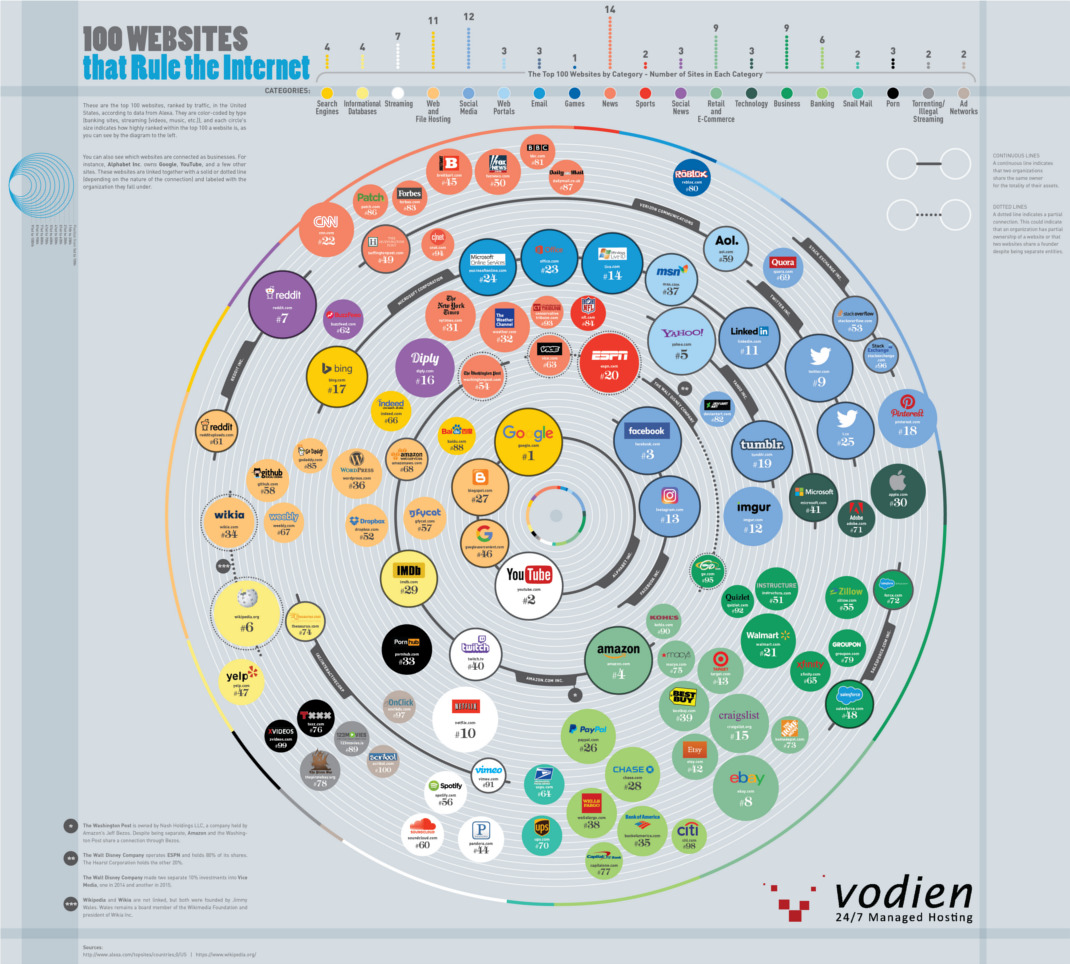

Death Knell for US retailers

In the US Brick-and-mortar retailers, many of them subject to leveraged buyouts during the LBO boom before the Financial Crisis and now burdened with way too much debt, are keeling over one after the other, in a dense wave of debt restructurings and bankruptcies. And creditors are getting skinned. The crash of brick-and-mortar retail is due to structural causes – including the shift to online retail. These issues will not go away. They will only get worse. Even profitable retailers, like Macy’s, are shuttering stores. They’re all doing it, profitable or in bankruptcy. Nine chain-store retailers that have filed or are considering filing for bankruptcy, or restructuring their debts, so far in 2017, six of them in the last seven days! These are just the largest ones. And the year is barely into its third month. Even Warren Buffett who believes in America’s future seems more doubtful about that of Walmart and other traditional retailers. The billionaire’s Berkshire Hathaway sold off about $900 million worth of Wal-Mart Stores stock in the last quarter, or about 90% of what he had left after years of paring his investment in the discount retailer. As recently as last summer, Buffett’s holdings in Walmart were worth $3 billion, and are now down to less than $100 million. The Oracle of Omaha first invested in the company in 2005.