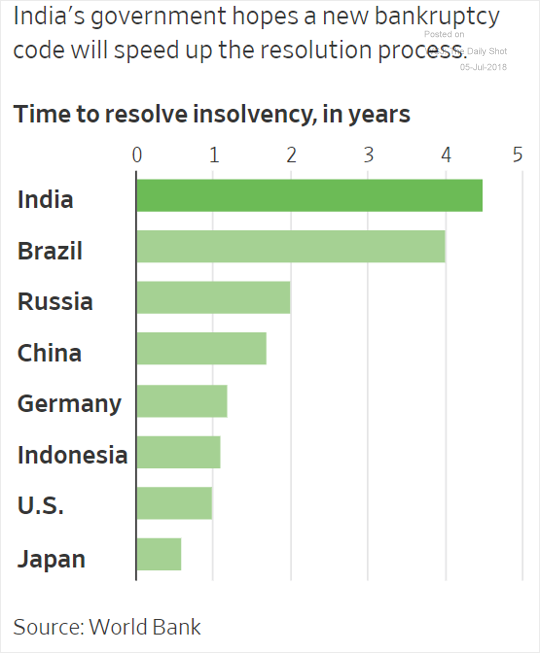

Hence there is lot of expectation from new bankruptcy code which sets a tight timetable for a defaulting company to deal with its debt: If it doesn’t come up with a solution in nine months, the company is liquidated. In May, Bhushan Steel Ltd, became the first of a group of large defaulters pushed into the bankruptcy court by the central bank to be resolved under the new rules. It was sold for $5.2 billion, and creditors recovered almost two-thirds of what they were owed.

“New investors have come in, taken out the old investors and the banks can get on with business.”

An insolvency industry—which has been waiting years for distressed assets to come on the market—is at last emerging in India, and the law has prompted more distressed debt funds to come to the country.

The teething trouble are already there and new code is already facing legal challenges. Some cases are expected to drag well beyond the 270-day deadline as controlling shareholders and bidders contest points in court.