Posted on March 28, 2022 by Gail Tverberg

Most people have a preconceived notion that there will be a clear winner and loser from any war. In their view, the world economy will go on, much as before, after the war is “won” by one side or the other. In my view, we are basically dealing with a no-win situation. No matter what the outcome, the world economy will be worse off after the fighting stops.

The problem the world economy is up against is the depletion of many kinds of resources simultaneously. This depletion is made worse by rising population, meaning that the resources available need to provide an adequate living for an increasing number of world inhabitants. Because of depletion, the world economy is reaching a point where it can no longer grow in the way it has in the past. Inflation, food shortages and rolling blackouts are likely to become increasing problems in many parts of the world. Eventually, the population is likely to fall.

We are living in a world that is beginning to behave like the players scrambling for seats in a game of musical chairs. In each round of a musical chairs game, one chair is removed from the circle. The players in the game must walk around the outside of the circle. When the music stops, all the players scramble for the remaining chairs. Someone gets left out.

In this post, I will try to explain some of the issues.

[1] In a world with inadequate resources relative to population, conflicts are likely to become increasingly common.

The Russia-Ukraine conflict is one example of a resource-associated conflict. The allies underlying the NATO organization have chosen to escalate the Russia-Ukraine conflict, in part, because the existence of the conflict helps to hide resource shortages and accompanying high prices that are already taking place. No matter how the war is stopped, the underlying resource shortage issue will continue to exist. Therefore, the conflict cannot end well.

If sanctions lead to less trade with Russia, (or even worse, less trade with Russia and China), the world economy will have an even greater problem with inadequate resources after the war is over. In fact, many parts of the current economic system are in danger of failing, primarily because depletion is leading to too little energy and other resources per capita. For example, the US dollar may lose its reserve currency status, the world debt bubble may pop, and globalization may take a major step backward.

[2] There is a huge resource depletion issue that authorities in many countries have known about for a very long time. The issue is so frightening that authorities have chosen not to explain it to the general population.

Mainstream media (MSM) practically never mentions that there is a major issue with resource depletion. Instead, MSM tells a narrative about “transitioning to a lower carbon economy,” without mentioning that this transition is out of necessity: The world is up against extraction limits for many kinds of resources. Besides oil, coal and natural gas, resources with limits include many other minerals, such as copper, lithium, and nickel. Other resources, including fresh water and minerals used for fertilizer are also only available in limited supply. MSM fails to tell us that there is no evidence that a transition to a low carbon economy can actually be made.

[3] The big depletion issue is affordability of end products made with high priced resources. The cost of extraction rises, but the ability of the world’s citizens to pay for end products made using these high-cost resources doesn’t rise. Commodity prices do not rise enough to cover the rising cost of extraction. When this affordability limit is hit, it is the resource extracting countries, such as Russia, that find themselves in a terrible situation with respect to the financial well-being of their populations.

The big issue that hits because of depletion is a price conflict. Businesses extracting resources need high prices so that they can reinvest in new mines, in ever more costly locations, but consumers cannot afford these high prices.

In a sense, the higher cost is because of “inefficiency.” As a result of depletion, it takes more hours of labor, more machine time, and a greater use of energy products to extract the same quantity of a given resource that was previously extracted elsewhere. Growing efficiency tends to help wages, but growing inefficiency tends to work the opposite way: Wages don’t rise, certainly not as rapidly as prices of end products.

As a result, commodity exporters, such as Russia, are caught in a bind: They cannot raise prices enough to make new investments profitable. The problem is that the world’s consumers cannot afford the resulting high prices of essentials such as food, electricity and transportation. Russia reports very high reserve amounts, especially for natural gas and coal. It is doubtful, however, that these reserves can actually be extracted. Over the long term, selling prices cannot be maintained at a sufficiently high level to cover the huge cost of extracting, transporting and refining these resources.

The success of a country’s economy can, in some sense, be measured by the country’s per capita GDP. Russia’s GDP per capita has tended to lag far behind that of the US (Figure 2).

Russia’s inflation-adjusted GDP per capita fell after the collapse of the central government of the Soviet Union in 1991. It was able to grow again, once oil prices began to rise in the early 2000s. Since 2013, Russia’s GDP per capita growth has again fallen behind that of the US, as increases in oil and other commodity prices again lagged the rising cost of production. Given these difficulties with depletion, Russia is becoming increasingly unwilling to ignore poor treatment it receives from Ukraine.

There may be another factor, as well, leading especially to the escalation of the conflict. The US seems to covet Russia’s resources. Some powers behind the throne seem to believe that Western forces supporting Ukraine can quickly win in this conflict. If such an early win occurs, the aim is for Western forces to step in and inexpensively ramp up Russian resource extraction, allowing the world a new source of cheap-to-produce fossil fuels and other minerals.

In this context, Russia launched an attack on Ukraine on February 24, 2022. Ukraine has presented Russia with problems for many years. One issue has been transit fees for natural gas passing through the country; is Ukraine taking too much gas out? Another problem area has been the rise of the far-right Azov regiment. Russia has also expressed concern that NATO has been training soldiers within Ukraine, even though Ukraine is not a member of NATO. Russia doesn’t want military, trained by NATO, at its doorstep.

[4] World economic growth very much depends on growing energy consumption.

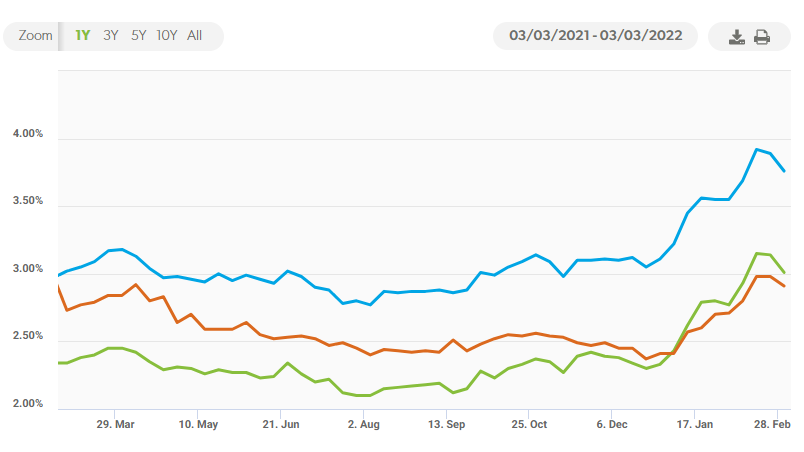

There are two ways of measuring world GDP. The standard one is with the production of each country measured in inflation-adjusted US$, with the changing relative value to the US$ considered. The other approach uses “Purchasing Power Parity” GDP. The latter is supposedly not affected by the changing level of the dollar, relative to other currencies. Inflation-Adjusted Purchasing Power Parity GDP is only available for 1990 and subsequent years. Figure 3 shows the high correlation between energy consumption and PPP GDP during the period from 1990 through 2020.

The reason for a strong association between GDP growth with energy consumption growth is a physics-based reason. Producing goods and providing services requires the “dissipation” of energy products because the laws of physics tell us that energy is required to move any object from one place to another, or to heat any object. In the latter case, it is the individual molecules within a substance that move faster and faster as they get hotter. The economy is a “dissipative structure” in physics terms because of the need for energy dissipation to provide the work needed to make the system operate.

Human beings are also dissipative structures. The energy that humans get comes from the dissipation of the energy found in foods of every kind. Food energy is commonly measured in Calories (technically, kilocalories).

[5] World economic growth also seems to depend on factors besides energy consumption.

The fitted equation on Figure 3 (the equation beginning with “y”) implies that GDP is rising much more rapidly than energy consumption, almost twice as rapidly. Over the entire 30-year period, the actual growth rate in energy consumption averages about 1.8% a year. If energy consumption growth had really been 1.8% per year, the fitted equation implies that growth in GDP would have greatly sped up over the period. (In fact, the growth rate in energy consumption was falling over the 30-year period, but GDP grew at closer to a constant rate. In terms of the fitted equation, these two conditions are equivalent.)

How can GDP rise so much more rapidly than energy dissipation? There seem to be several ways such a higher rate of increase can occur, on a temporary basis:

[a] A worldwide trend toward an economy using more services. The production of services tends to require less energy consumption than the production of essential goods, such as food, water, housing and local transportation. As the world economy gets wealthier, it can afford to add more services, such as education, healthcare, and childcare.

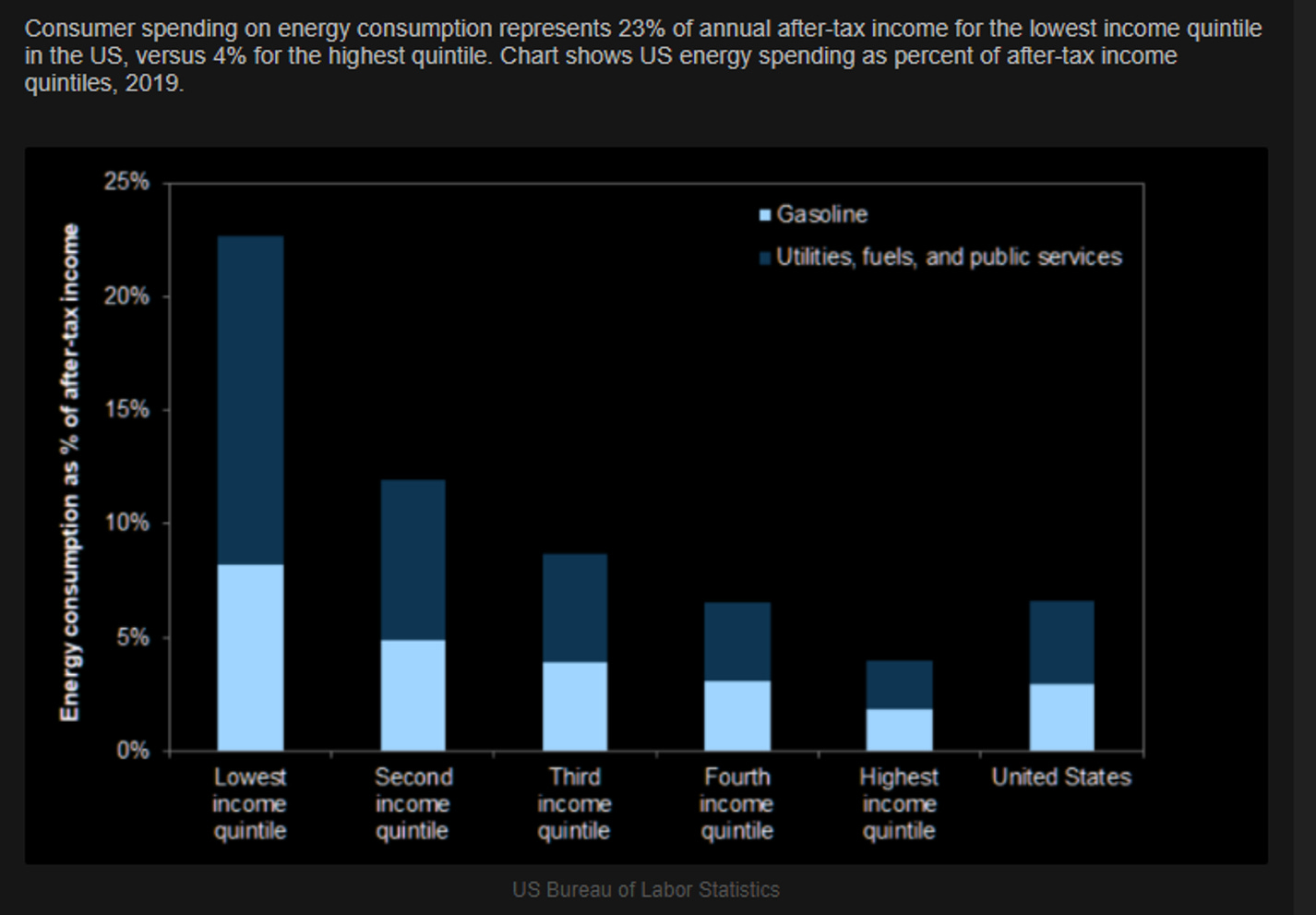

[b] A worldwide trend toward more wage and wealth disparity. Such a trend tends to happen with more specialization and more globalization. Strangely enough, a trend to more wage disparity allows the world economy to continue to grow without adding a proportionately greater amount of energy consumption use because of the different spending patterns between low-paid workers and high-paid workers.

Analyzing the situation, the world is filled mostly with low-paid workers. To the extent that the pay of these low-paid workers can be squeezed down, it can prevent these workers from buying goods that tend to use relatively high amounts of energy products, such as automobiles, motorcycles and modern homes. At the same time, growing wage disparity allows the higher-paid workers to be paid more. These higher-paid workers tend to spend a disproportionate share of their income on services, such as education and healthcare, which tend to use less energy consumption.

Thus, greater wage disparity tends to shift spending away from goods and toward services. The main beneficiaries are the top 1% of workers (who buy mostly services, requiring little energy consumption), rather than the remaining 99% (who would really like goods such as a car and their own home, which require much more energy consumption).

[c] Improvements in technology. Improvements in technology are helpful in raising GDP because technological improvements tend to make finished goods and services more affordable. With greater affordability, more people can afford goods and services. This effect is favorable for allowing the economy, as measured by GDP, to grow more quickly than energy consumption.

There is a catch associated with using improved technology to make goods and services more affordable. Improved technology tends to increase wage disparity because it nearly always leads to owners and a few highly educated workers being paid more, while workers doing the more routine parts of processes are paid less. Thus, it tends to lead to the problem discussed above: [b] A trend toward wage and wealth disparity.

Also, with improved technology, available resources tend to be depleted more quickly than without improved technology. This happens because finished goods are less expensive, so more people can afford them. Once resources start getting exhausted, improved technology can’t fix the situation because resource extraction costs are likely to rise more rapidly than can be offset with the impact of new technology.

[d] A worldwide trend toward more debt at ever-lower interest rates.

We all know that the monthly payment required to purchase a car or home is lower if the interest rate on the debt used to finance the purchase is lower. Thus, falling interest rates can make paychecks go further. Both businesses and citizens can afford to purchase more goods and services using credit, so the overall level of debt tends to rise with falling interest rates.

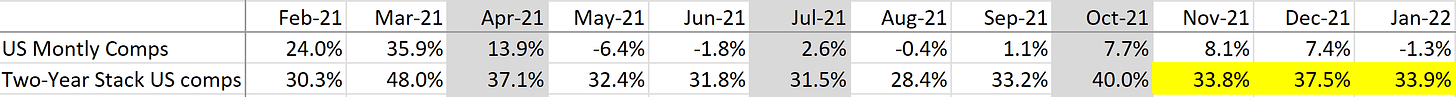

If we are only considering the period from 1990 to the present, the trend is clearly toward lower interest rates. These lower interest rates are part of what is making the GDP growth higher than what would be expected if interest rates and debt levels remained constant.

[6] The world economy now seems to be reaching limits with respect to many of the variables allowing world economic growth to continue as it has in the past, as discussed in Sections [4] and [5], above.

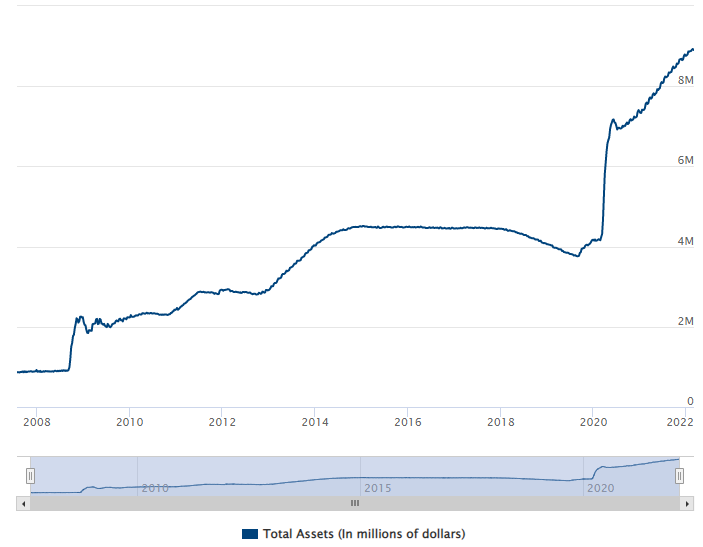

Figure 6 shows that there have been two major step-downs in world inflation-adjusted per capita PPP GDP. The first one occurred in the 2008-2009 period; the second one occurred in 2020. Figure 7 shows the sharp dips in energy consumption occurring in the same time periods.

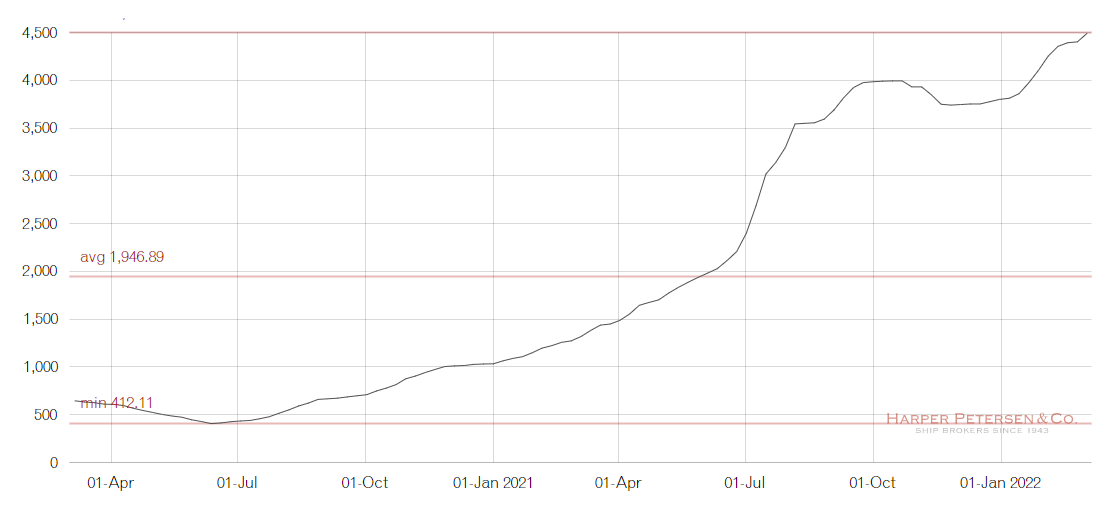

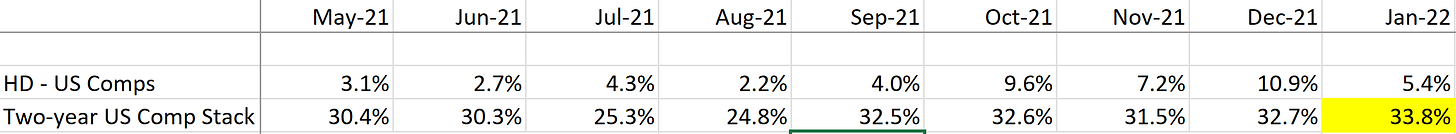

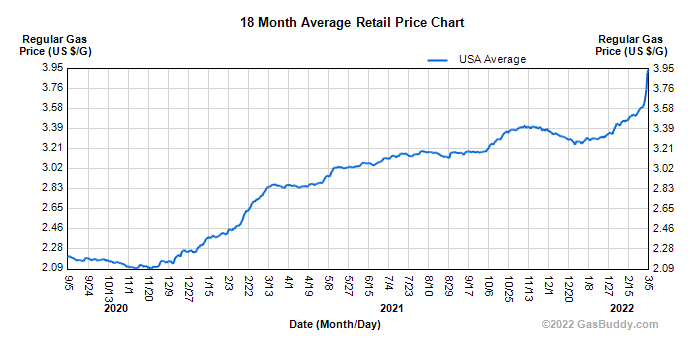

In 2021, energy prices started to rise rapidly when the world economy tried to reopen. This rapid rise in prices strongly suggests that energy extraction limits are being reached.

Another clue that energy production limits are being reached comes from the fact that the group of oil exporters, OPEC+, found that they couldn’t actually ramp up their oil production as quickly as they promised. Once oil production is cut back because of inadequate prices, it is hard to get production to rise again, even if prices temporarily rise because the many pieces of the chain supporting this extraction are broken. For example, trained workers leave and find jobs elsewhere, and contractors go out of business because of inadequate profits.

If we think about it, Items [5a], [5b], [5c] and [5d] are all reaching limits as well. Item [5d] is probably clearest: Interest rates can no longer be lowered. In fact, nearly everyone says that interest rates should now be raised because of the high inflation rates. If interest rates are raised, commodity prices, including prices for fossil fuels, will fall.

With lower fossil fuel prices, there will be pressure for oil, gas and coal producers to reduce their production, even from today’s lower levels. Because of the tight connection between energy and GDP, lower energy production will tend to push economies further toward contraction. Of course, this will make resource exporters, such as Russia, worse off.

As the world economy enters recession, we can expect that Item [5a], the shift from goods toward services, to turn around. People with barely enough money for necessities will reduce their use of services such as haircuts and music lessons. Item [5b], globalization and related wage disparity, is already under pressure. Countries are finding that with broken supply chains, more local production is needed. In the US, recent wage gains have tended to go to the lowest-paid workers. Item [5c], technology growth, cannot ramp up as resources needed from around the world are increasingly unavailable, due to broken supply chains and depletion.

[7] We are likely facing a collapsing world economy because of the limits being reached. Adding sanctions against Russia will further push the world economy in the direction of collapse.

Many sources report that Russian exports of wheat, aluminum, nickel, and fertilizers will be “temporarily” disrupted. A few sources note that Russia plays an important role in the processing of uranium fuel used in nuclear power plants. According to the Conversation:

Most of the 32 countries that use nuclear power rely on Russia for some part of their nuclear fuel supply chain.

We have become used to efficient air travel, but sanctions against Russia make this less possible, especially for flights to Southeast Asia. A Bloomberg article called Siberian detour requires airlines to retrace cold war era routes gives the example of direct flights from Finland to Southeast Asia being canceled because they have become too expensive and are too time-consuming with the required detours. It becomes necessary to fly indirect connecting routes if a person wants to travel. Many other routes have similar problems.

US President Joseph Biden is warning that food shortages are likely in many parts of the world as a result of the sanctions placed against Russia.

According to a video shown on Zerohedge,

“It’sgoing to be real. The price of the sanctions is not just imposed upon Russia. It’s imposed upon an awful lot of countries as well, including European countries and our country as well.”

If the world economy was doing well, and if Russia was a tiny part of the world economy, perhaps the sanctions could be tolerated by the world economy. As it is, the Russia-Ukraine conflict acts to hide the underlying resource shortage problem. This is possible because, with the conflict, the resource shortages can be described as “temporary” and “necessary” in the context of the terrible things the Russians are doing. The way the West frames the problem provides a scapegoat to deflect anger toward, but it doesn’t fix the problem.

Russia started out being very disadvantaged because commodity prices, in recent years, have not been rising high enough to ensure an adequate living for Russian citizens and high enough tax revenue for the Russian government. Adding sanctions against Russia will simply make Russia’s problems worse.

[8] There is little reason to believe that Russia will “give up” in response to sanctions imposed by the United States and other countries.

The attacks by Russia of Ukrainian sites seems to be occurring, for many related reasons. It can no longer tolerate being inadequately compensated for the resources it is extracting and selling to Ukraine and the rest of the world. It is tired of being “pushed around” by the rich economies, especially the United States, as NATO adds more countries. It is also tired of NATO training Ukrainian soldiers. Russia seems to have no plan to gain the entire territory of Ukraine; it is more of a temporary police action.

Russia’s underlying problem is that it can no longer produce commodities that the world wants as inexpensively as the world demands. Building all the infrastructure needed to extract and ship more fossil fuel resources would take more capital spending than Russia can afford. The selling price will never rise high enough to justify these investments, including the cost of the Nord Stream 2 pipeline. Russia has nothing to lose at this point. The current situation is not working; going back to it is no incentive for stopping the current conflict.

Russia is in some ways like a heavily armed, suicidal old man, who can no longer earn an adequate living. The economic system of Russia is no longer working as it should. Russia is incredibly well-armed. The situation reminds a person of the story of Samson, in his old age, taking down the temple of the Philistines and losing his own life at the same time. Russia has no reason to back down in response to sanctions.

[9] Leaders of the world, including Joe Biden, appear to be oblivious to the situation we are facing.

Leaders of the world have created ridiculous narratives that overlook the critical role commodities play. They seem to believe that it is possible to cut off purchases from Russia with, at most, temporary harm to the rest of the world economy.

The history of the world shows that the populations of many civilizations have outgrown their resource bases and have collapsed. Physics points out that this outcome is almost inevitable because of the way the Universe is constructed. Everything is constantly evolving, even economies. The climate is constantly evolving, as are the species inhabiting the Earth.

Elected leaders need a story of everlasting growth that they can tell their citizens. They cannot even consider the physics-based way the world economy operates, and the resulting expected pattern of overshoot and collapse. Modelers of what are intended to be long-lasting structures cannot accept this outcome either.

Limits which are defined based on affordability of end products are incredibly difficult to model, so creative narratives have been developed suggesting that humans can move away from fossil fuels if they so desire. No one stops to think that economies cannot continue to exist using a much lower quantity of energy, any more than an adult human can get along on 500 calories a day. Both are dissipative structures; the ongoing energy requirement is built in. Factories close when electricity, diesel and other energy products are cut off.

[10] The sanctions and the Russia-Ukraine conflict cannot end well.

The world economy is already on the edge of collapse because of the resource limits it is hitting. Intentionally stopping Russia’s output of resources like fertilizer and processed uranium is certain to make the situation worse, not better. Once Russia’s output is stopped, it is likely to be impossible to restart Russia’s production at the same level. Trained workers who lose their jobs will likely find jobs elsewhere, for one thing. The shortfall in output will affect countries around the world.

The United States dollar is now the world’s reserve currency. The sanctions being applied indirectly encourage counties to use other currencies to work around the sanctions. There seems to be a substantial chance that the US economy will lose its role as the center of international trade. If such a change takes place, the US will no longer be able to import far more than it exports, year after year.

A major issue is the huge amount of debt most countries of the world have. With a rapidly slowing world economy, repaying debt with interest will become impossible. Debt defaults will further wreak havoc with the world economic system.

We don’t know the exact timing of how this will play out, but the situation does not look good.