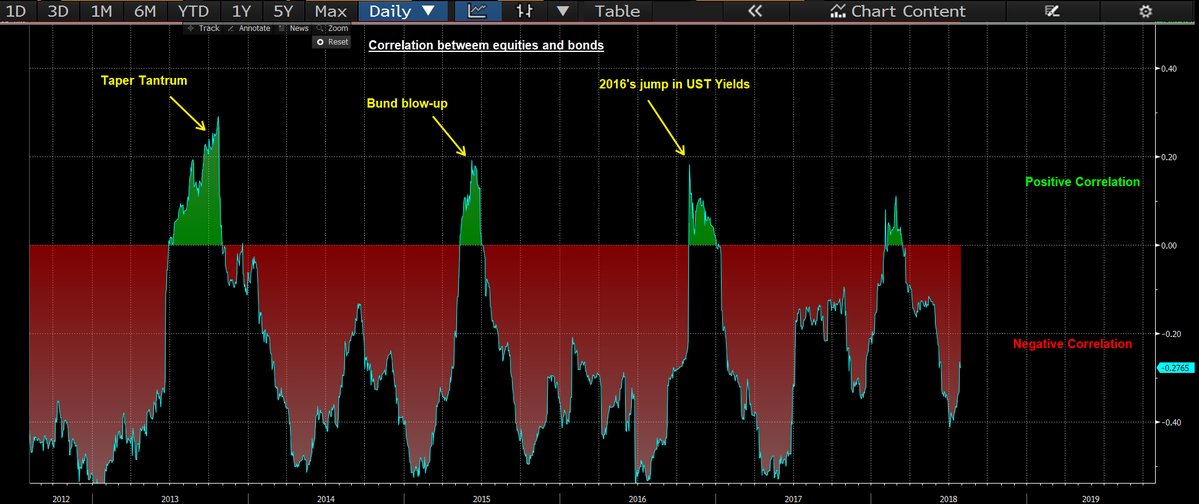

1.In an inflationary environment … do NOT expect bonds to act as a hedge to lower equities ( very evident today). As the correlation between prices moves positive modern portfolio theory i.e. long “a diversified pool of assets” will get crushed, especially Risk Parity (Julian Brigden)

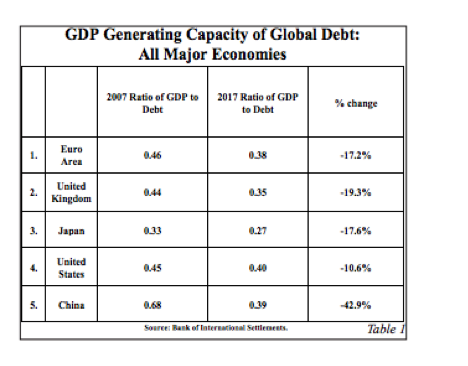

2.Dimnishing Returns-Consequences of Excess Debt

One of the most important concepts in the world to understand e.g why debt globally is expanding at 3,4,5X the rate of GDP growth.We might be in awe of china growth but see the sharp fall in GDP created per dollar of Debt.

I wish I had this data for India to compare, although I am pretty sure that our debt productivity is higher than all other economies shown in this chart (because of higher inflation).

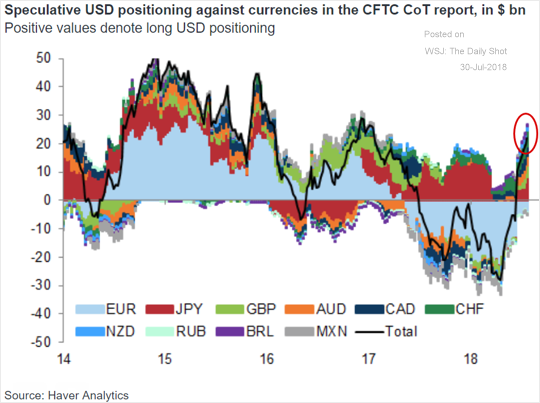

3. It seems everybody is long dollar at same time and I think if dollar stalls here, we might see some short term relief rally in Emerging Markets

.

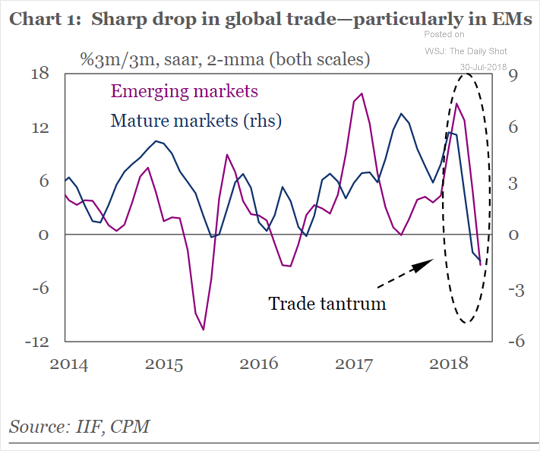

4. Great chart from IIF , they have named it “Trade Tantrum”

Sir, could you pl elaborate on point 2. Thanks

when equities fall money moves into bonds acting as a cuchion to diversified portfolio. but yesterday US equities fell and US bonds also fell and this would happen when underlying investment enviroment is changing. So JULIAN believes that underlying inflationary trends are becoming so strong that bonds might not act as a hedge to falling equities