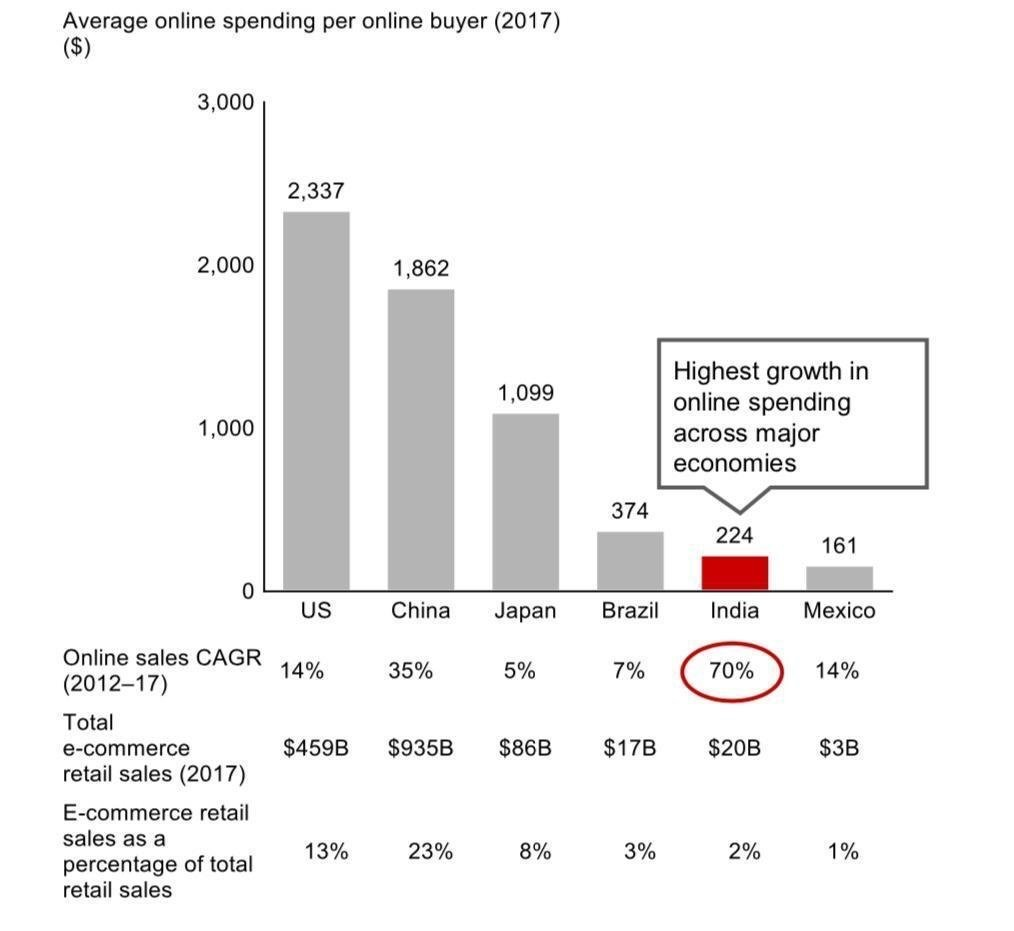

1.When you have 1.3 billion people with huge under penetration, then any chart can be made to look Bullish . What analysts need to look at is Per capita GDP because that will determine the extent of growth. India’s per capita GDP today is less than that of Phillipines and Morrocco and just ahead of Dijibouti. 2012-17 in India , online Ecommerce started alongwith explosion in Mobile phones and aggresion in consumption financing by banks and NBFC’s. It would be foolish to extrapolate this growth into future.

So hold your horses, if we cant grow incomes than consumption will also not grow.

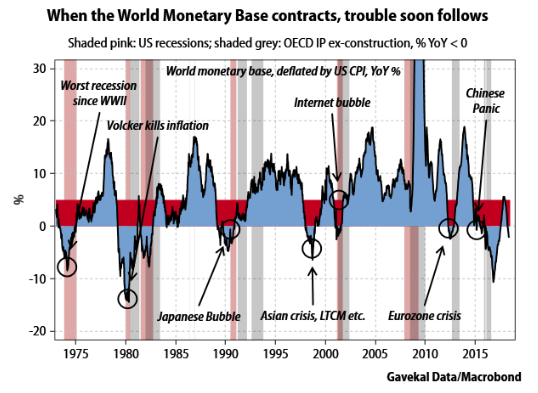

2. IF we take the US monetary base, and add to it the reserves deposited by foreign central banks at the Fed, we get figure for the World Monetary Base. From this aggregate, we can get a rough idea of the pace of base money creation around the world, either through direct intervention by the Fed in the US banking system, or indirectly through US dollar accumulation by foreign central banks. When the WMB is growing,we can be relatively confident about the future nominal growth of the global economy. And when it’s contracting, it makes very good sense to worry about a recession.As the chart above shows, it is contracting now. So, based on the experience of the past 45 years, it seems likely that the world is entering its seventh international dollar liquidity crisis since 1973.

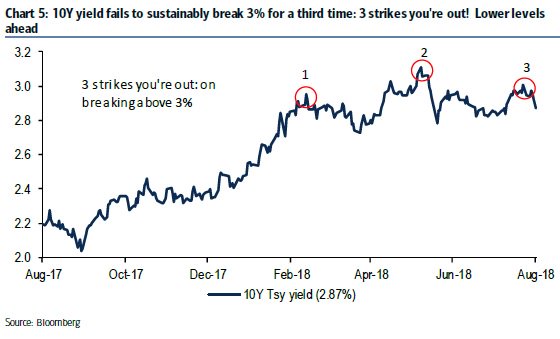

3.Given softening in housing, and need for lower mortgage rates to help restore affordability and positive housing momentum, BOFA thinks the chances are good that this is a “3 strikes you’re out” situation and that rates now have decent downside potential in months ahead but it seems everybody is bearish on US bonds.

4.All Parabolic rise fail without exception and this one will also fail. The chart is stock prices of Amazon and HDFC Bank. Amazon is already among top 5 holding in almost all US diversified Mutual Funds and ETF. HDFC Bank is also in top 5 among most diversified and large cap mutual fund. That means you as an investor is alredy betting on 5-10% of your investment (depending upon the weight your portfolios are holding) invested in these stocks and hoping that this will continue into future

Sir, what could be the repercussion of $ liquidity crisis this time?? Thanks

selloff in Emerging markets and Europe and repatriation of capital back to US and we are just starting