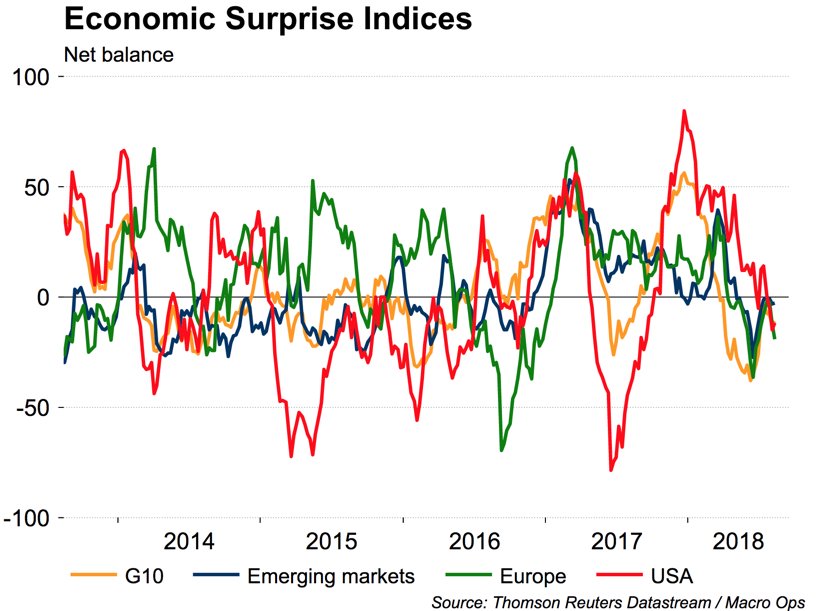

Citigroup economic data surprise for US has also fallen into negative territory. Recall that US was enjoying a period of positive economic surprise and that also led to rise in US bond yields. The red line below is now cautioning that we might be getting into bit of soft patch over here. FED raising rates and QT has finally started to weigh on the market.

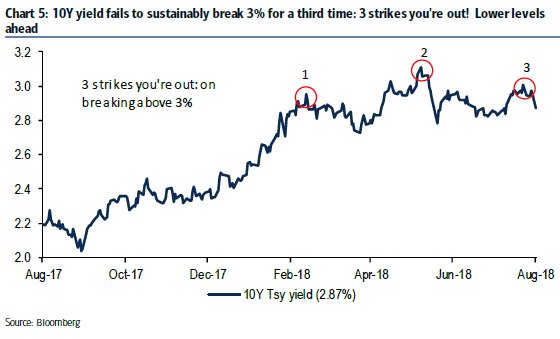

Bond market seems to be sensing this and have rejected 3% on US 10 year again.

I think we are headed much lower on US bond yields over next few months against the expectation of MAJORITY.