1.Brent Oil jumps to the highest level since Nov2014, >$81,following Opec meeting where the cartel agreed to no immediate supply boosts here. OPEC gives tepid response to Trump’s demand for lower oil prices. Saudi Arabia says the market has all the oil it needs for now. Pump prices in India getting ready for their next big hike. This will certainly eat into discretionary demand and I foresee a slowdown in household consumption

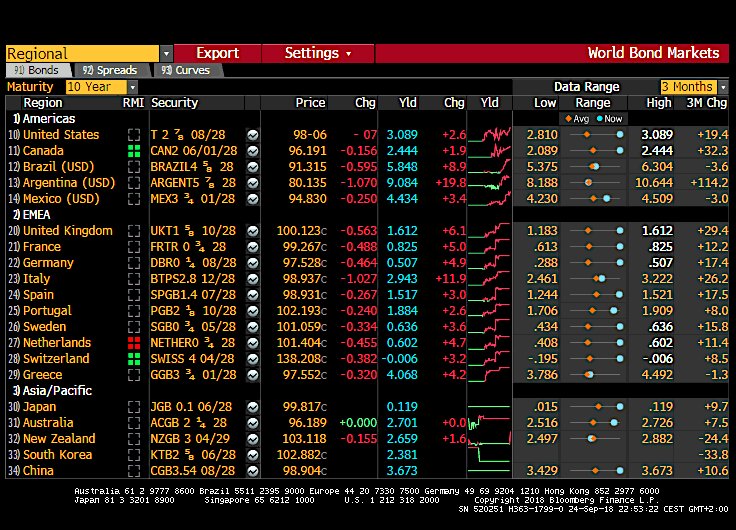

2.Sell off in Bonds continue. US 10y yields rise to 3.09%, highest since May, German 10y yields jump above 0.5% mark, highest since May as well.Indian 10 year bond yield also traded above 8.10%

3.Gold is set to soar above $1,300 an ounce, Bank of America says. Growing budget gap in US is viewed as ‘pretty positive’ for bullion. Historically, rising US deficit is accompanied with rising Gold prices.

4.Trump’s overconfidence may bring ‘major miscalculation,’ JPMorgan warns. The more US Stock-market remains resilient more are chances of major miscalculation. Potential error on sanctions could be ‘tough to calibrate