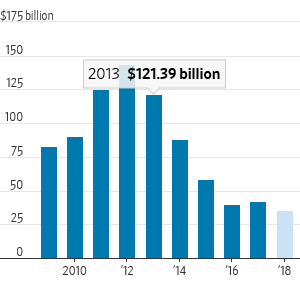

WSJ writes….”Global miners are spending a third of what they did five years ago on new projects. They’re on track to invest roughly $40 billion for the third straight year—down from more than $120 billion five years ago and $80 billion almost a decade ago, according to commodities consultancy Wood Mackenzie”.

I know it is almost unpatriotic to be bullish raw materials these days ,but couple of years back the same phenomenon played out in OIL markets. The dream investment for tomorrow will have investors apathy today, bankruptcy at small players, almost no media or sell side coverage and as

WSJ quotes

“A prolonged period of underinvestment by commodity producers is setting the stage for large price increases in raw-materials markets, say bullish investors who focus on the metals and energy industries“.

Very solid information!