The Traditional 60/40 Portfolio ( balance funds)Has Done Exceedingly Well Over the Past Five Years, But the Path Ahead Is Now Becoming Much More Challenging, in the Future

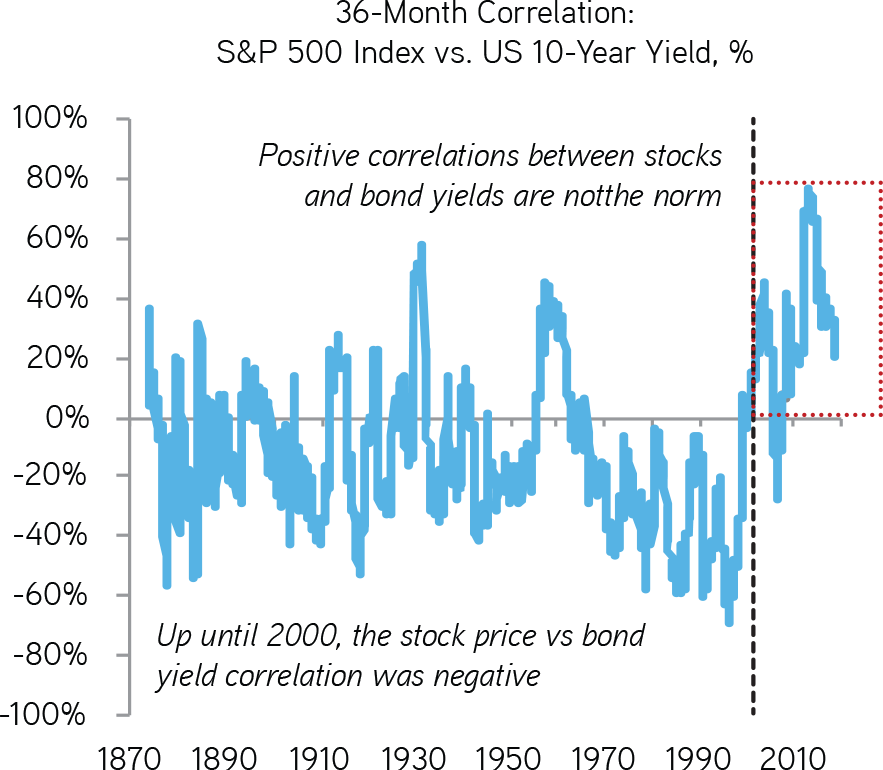

The other relationship that is changing, which we think could be a big deal for all macro and asset allocation professionals, is the correlation between stocks and bonds. To review, since the tech bubble peak in 2000, stocks and bond prices have been negatively correlated. As a result, weakness in the stock market has actually largely been offset with strong bond market performance amidst falling interest rates. One can see this in Exhibit 7. Not surprisingly, this macro backdrop has been a boon for multi-asset class investors, particularly levered ones such as Risk Parity.

However, this relationship is actually somewhat anomalous – an input that we think many current investors may be underappreciating. In fact, if you take a longer term perspective, the relationship between stocks and bonds since 2000 is actually an outlier, as stock and bond performance is traditionally positively correlated, not negatively correlated. So, in the event of a market dislocation in the future, we believe that many multi-asset class portfolios could endure much greater downside capture than in the past. The catalyst, we believe, will be the notable shift that we are now seeing amongst the global ‘Authorities’ away from monetary policy towards more fiscal policy (which likely means bigger deficits). As a result, bond prices will likely no longer rally in the event of an equity sell-off.

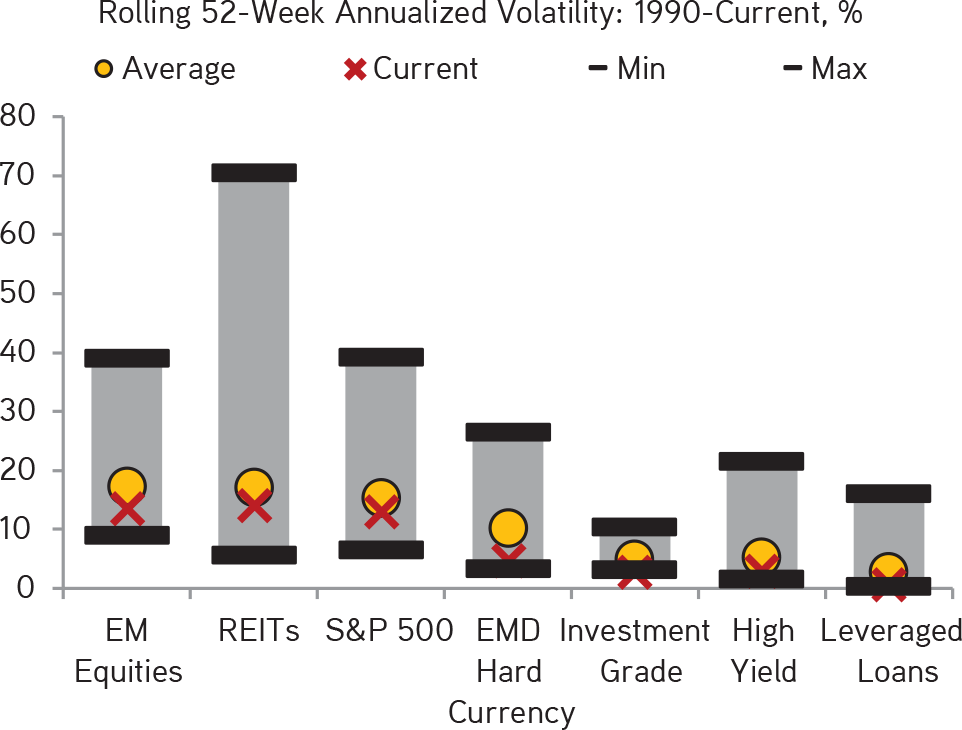

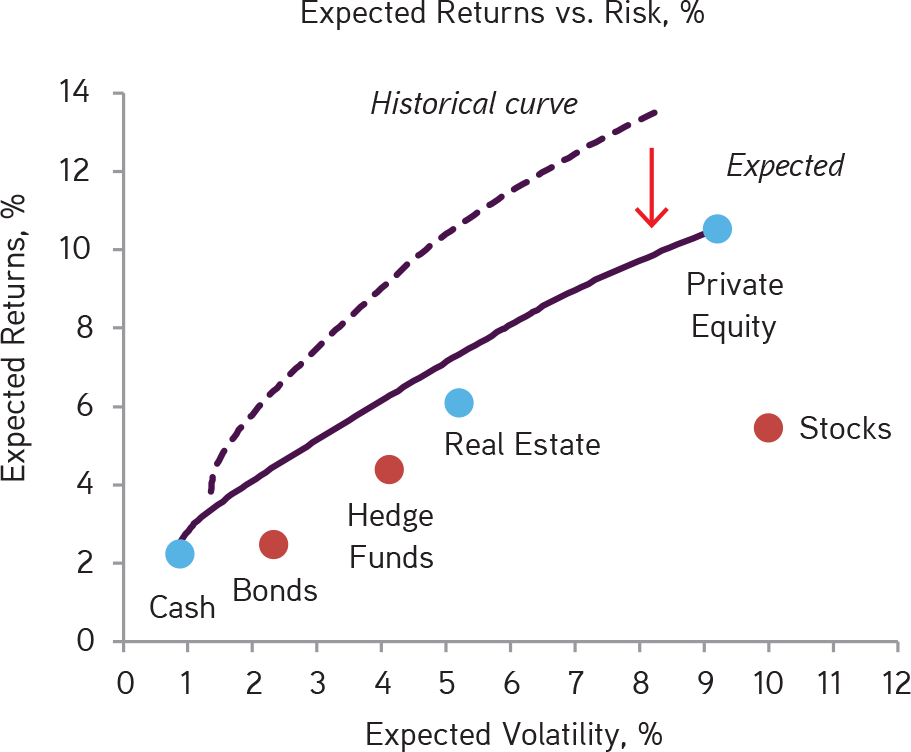

Consistent with this view, there is also the risk of much higher volatility ahead across the global capital markets. So, beyond the threat of lower absolute returns, our work also shows that the Sharpe ratio, or return per unit of risk, could be poised to fall. A mean reversion in Sharpe ratios would come as a significant jolt to many investors as return per unit of risk has been running well above trend line across most asset allocation accounts we monitor in recent years. We link the boost in return per unit of risk to the notable increase in coordinated global QE that started with the Federal Reserve and accelerated following the ECB’s commitment to do ‘whatever it takes’ in 2012. However, with QE shifting towards quantitative tightening (QT), we think that a secular shift in asset allocation is now upon us.

if we are correct in our macroeconomic forecasts, then all allocators of capital need to consider either lowering their liability payout amounts and/or shifting their allocations towards higher returning products. Just consider, if volatility remains constant from current levels, risk adjusted returns will fall a full 40% on average across asset classes as returns are expected to be lower across the board. This automatically results in lower Sharpe ratios, even before making any adjustments for potentially higher levels of volatility (which we think is inevitable).

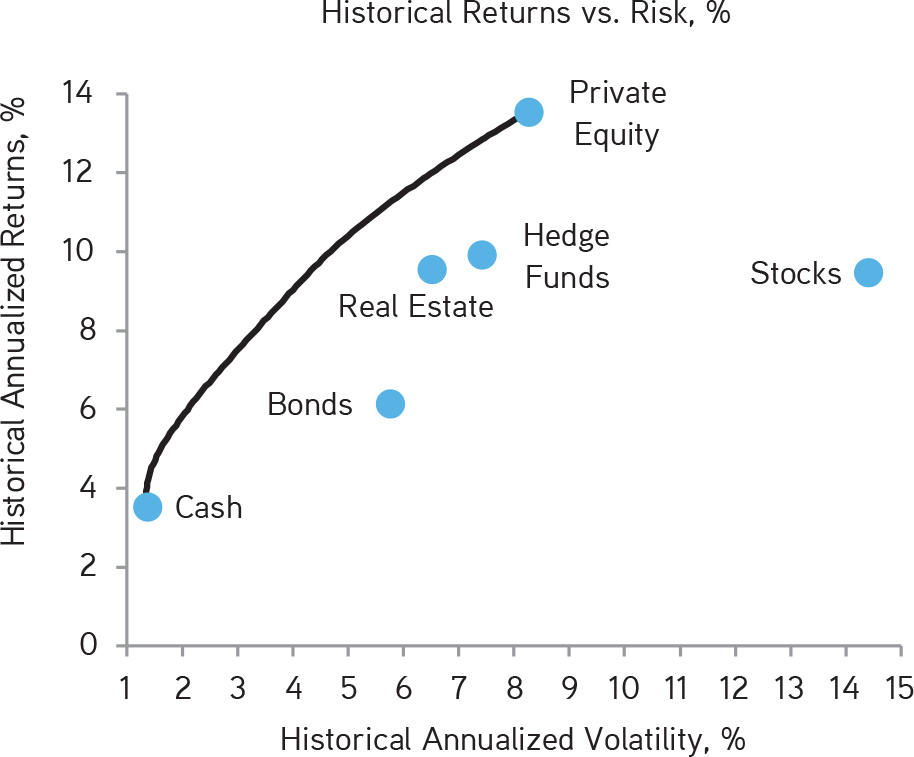

KKR believes that private equity and complex illiquid strategies can handily outperform Public Equity at the asset class level in this part of the cycle.