Uday Kotak (executive vice chairman and MD)is my favorite banker not only because of the successful empire he has created, also because he is probably the best risk manager .

Dhananjay writes his take on Uday’s speech this Diwali https://www.kotaksecurities.com/diwali2018/v1/index.html

A) There are significant challenges facing the economy and markets. However, the long term story is encouraging.

B) key challenges come from global trade protectionism and Instability in the BFSI space.

C) Trade protectionism epitomised in the US-Sino conflict reflects the challenges of de-globalisation for countries like India as they will have to fend for themselves.

C) Despite the make in India mission, India has been importing most things,specially electronic items which has doubled in last 5 years. Make in India has to fructify in reality for India CAD to be managed well, <3% of GDP.

D) Political outlook is uncertain; hopes for a stable govt, essential for growth.

E) On IL&FS- the problems are deep rooted; some stake holders will have to endure

considerable pain (=> large haircuts).

G) Financialization seen in the aftermath of demonetisation was temporary, the flood of money that came in has receded; NBFC problems have resulted from high concentration of mutual fund’s exposure when money was in surplus. The pain in the NBFC sector has thus arisen due to withdrawal of surplus liquidity. Hopes that authorities will manage it well lest it translate into a contagion.

The best outcome for NBFCs and HFCs is a soft landing vs a hard landing; implying slower growth is a given thing for them.

H) Banking sector also has its own set of challenges. However, private lenders have a better future.

I) stock markets have corrected enough; sees range of 5-10% +/-.

Investors need to have a good grip on

1) Macros, (most portfolio manager in India neither understand nor care about macros….. they all call themselves bottom up stock pickers…emphasis mine)

2) Politics and

3) Cyclical positioning of sectors.

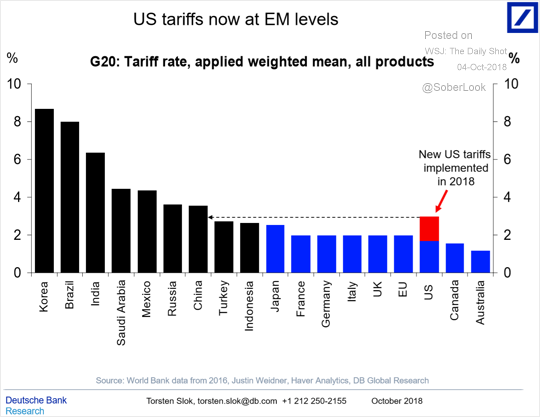

My take: I respect UDAY for his macro calls and plain speaking. While he has alluded to the risk from protectionism, I think his focus on CAD management only reflects the symptom. Emkay earlier research show a wide ranging implications ranging from investments-savings, corporate performance, Employments, financial sector

impairment and indeed receding global liquidity & market outlook. My take is that this trade frictions is going to last for longer than anticipated, and India may will up responding with Inward looking policies, as it is we are having one of the highest Tariff barriers

.

.

His take on Financialisation of household savings and NBFC sector is correct.

Uday’s comment on contagion risk arising from the prevailing liquidity crunch a real one. The fracas between the Govt and RBI essentially centered around this issue. The hope is that the liquidity infusion provided by the RBI is sufficient enough for a soft landing for the NBFC sector and this RBI and Govt conflict will resolve amicably .

hi sir,

can u please name few fund manager that have a strong grip on macro just like u ? ..so that we can gain from their knowledge and experience

thanks

it would not be wise for me to comment on this.