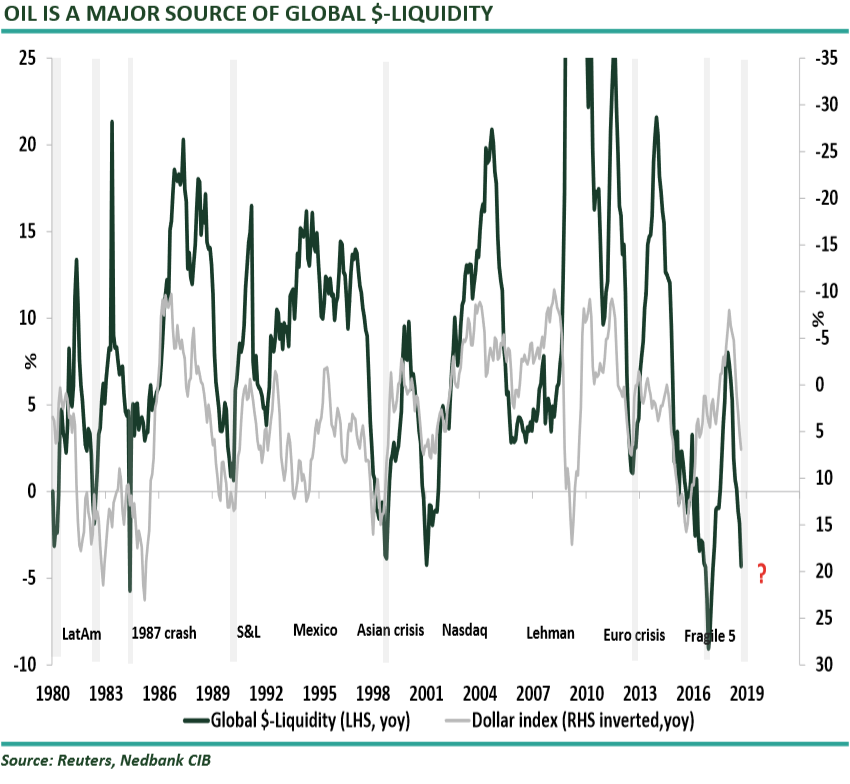

Mehul Daya and Neel Heyneke of Ned Bank Writes” The link between the oil price, the US dollar and Global $-Liquidity was born after the collapse of the Bretton-Woods system (the gold standard) in the 1970s. The official agreement between the US and Saudi Arabia to standardise the trading of oil in US dollars for geo-political and economic reasons resulted in oil becoming part of the monetary system. Shortly after this, many other oil-producing nations also began to invoice oil in US dollars. Today, this is what we know as the petrodollar system. This was the single most important factor for propelling the US dollar as the world’s reserve currency. The oil price became a major source of Global $-Liquidity. As the oil price rises, petrodollar balances around the world rise. Oil-producing nations then recycle their excess US dollars back into the US economy (purchasing US assets) or into the offshore dollar banking system (Eurodollar). From this perspective, the financial system would be flooded with US dollars, leading to a weaker US dollar and easier financial conditions (the opposite is true as well).

Hence, NEDBANK is concerned that the falling oil price would put further pressure on Global $Liquidity and exacerbate US dollar shortages, triggering another US dollar bull phase.