There are Rare parallel declines in capital markets could result in biggest contraction post financial crisis

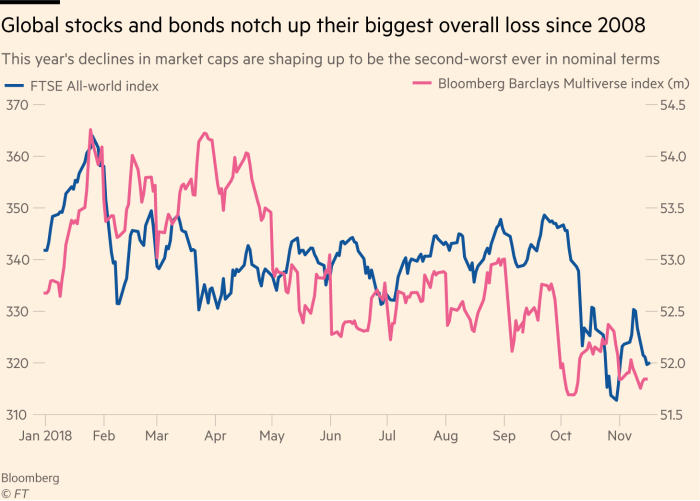

Rising US interest rates have tripped up the global bond market this year, with almost every corner of the fixed income universe losing money in 2018. While issuance has continued to be robust, that has meant that the Bloomberg Barclays Multiverse — the biggest, broadest bond market benchmark — has lost $1.34tn of its market capitalisation this year.

At the same time, stock market momentum initially triggered by a robust global growth spurt and corporate earnings-enhancing tax cuts in the US has faded lately. Rising bond yields, the spluttering global economy and investors starting to factor in less ebullient corporate profits next year triggered a drop in the US stock market last month, which added to the malaise in Europe and Asia. As a result, the FTSE-All World stock market index has lost 5 per cent this year, shaving off more than $3.6tn of market capitalisation, which in nominal terms is the biggest dollar loss since 2011.

Of the international equity index’s 3,208 members, more than 500 are down by at least 30 per cent this year, over 1,000 have fallen by at least 20 per cent and less than a third are up for the year.