Scott Minerd, CIO at Guggenheim Partners write…Economic growth has been strong—second quarter 2018 gross domestic product (GDP) growth came in at a robust 4.2 percent and third quarter surprised to the upside at 3.5 percent—but while others trumpet the current moment of peak growth in this business cycle, our investment team is focused on the recession that we foresee beginning in the first half of 2020.

Expansions do not die of old age; they end because important capacity constraints are reached. Every recession since 1970 was preceded by a decline in the unemployment rate to a level below full employment. This kind of overshoot in the labor market typically causes the Fed to tighten policy to quell the potential inflationary reaction, only to tighten too far and push the economy into recession. I find it highly unlikely that the Fed will negotiate a soft landing this time either.

If a recession begins in 2020, investors must understand the history of market performance during the run up to past recessions to appropriately position their portfolios. In credit markets, spreads tend to stay flat in the penultimate year of the expansion before widening in the final year. Rising defaults and increasing credit and liquidity risk premiums drive a sharp pullback in the performance of high-yield bonds before and during recessions.

The key here is to manage this shift in a timely manner. So as our investment management team describes in these pages, we are focused on upgrading credit quality, reducing spread duration, and maintaining a barbelled yield curve position to take advantage of further curve flattening. Call it a jog to the exit rather than a run.

We are seeing typical late-cycle excesses in many corners of the economy, but particularly in corporate credit markets. Loan covenants are lighter and underwriting standards are looser, all while corporate debt loads get heavier. BBBrated bonds now account for about half of the $5 trillion investment-grade universe, the highest in at least 30 years. According to Moody’s, BBB-rated bonds have an 18 percent chance of being downgraded to non-investment grade within five years. A wave of fallen angels this big would overwhelm the high-yield market. The bottom line is that a recession is coming, and it is imperative to prepare now for the period leading up to the downturn. As our portfolio managers explain, we have already reduced our corporate credit exposure to the lowest levels since the financial crisis.

Here are the key takeaways from their latest Fixed-Income Outlook report:

Every recession since 1970 was caused by the Federal Reserve (Fed) tightening monetary policy too far in response to a decline in the unemployment rate to a level below full employment.

The market is just now coming to grips with our base case that the Fed will hike once more this year and four more times in 2019.

We will continue to upgrade quality, position defensively, and remain underweight duration relative to the benchmark, and limit exposure to the short and intermediary parts of the curve in anticipation of higher rates and a flatter yield curve.

We are seeing late-cycle excesses in many corners of the economy, particularly in corporate credit markets. A sizable wave of fallen angels this big would overwhelm the high-yield market.

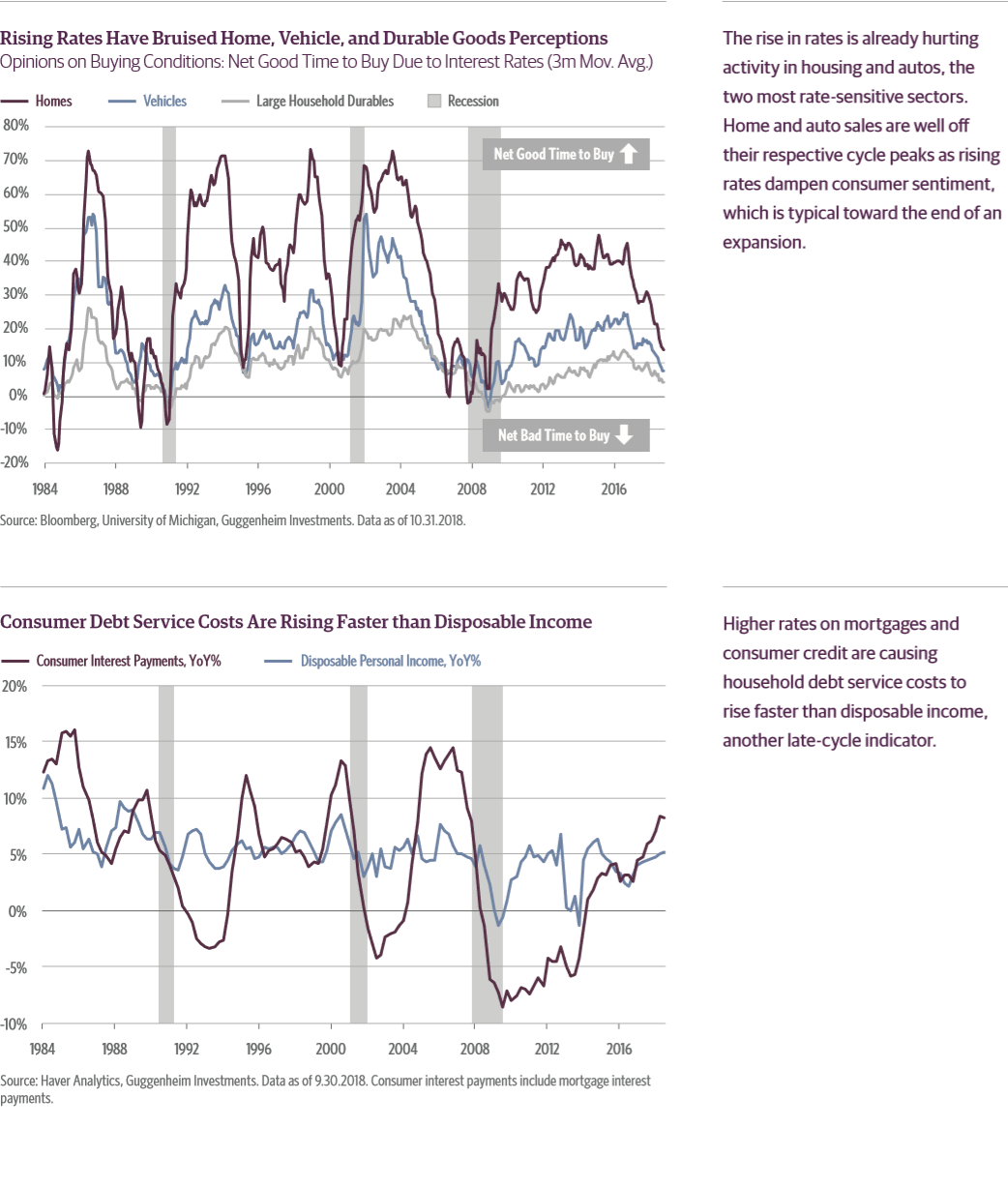

The rise in rates is already hurting activity in housing and autos, two of the most rate-sensitive sectors, as rising rates dampen consumer sentiment.

Read fourth quarter Fixed income outlook below