Niels Jenson writes in this month Absolute return letter….

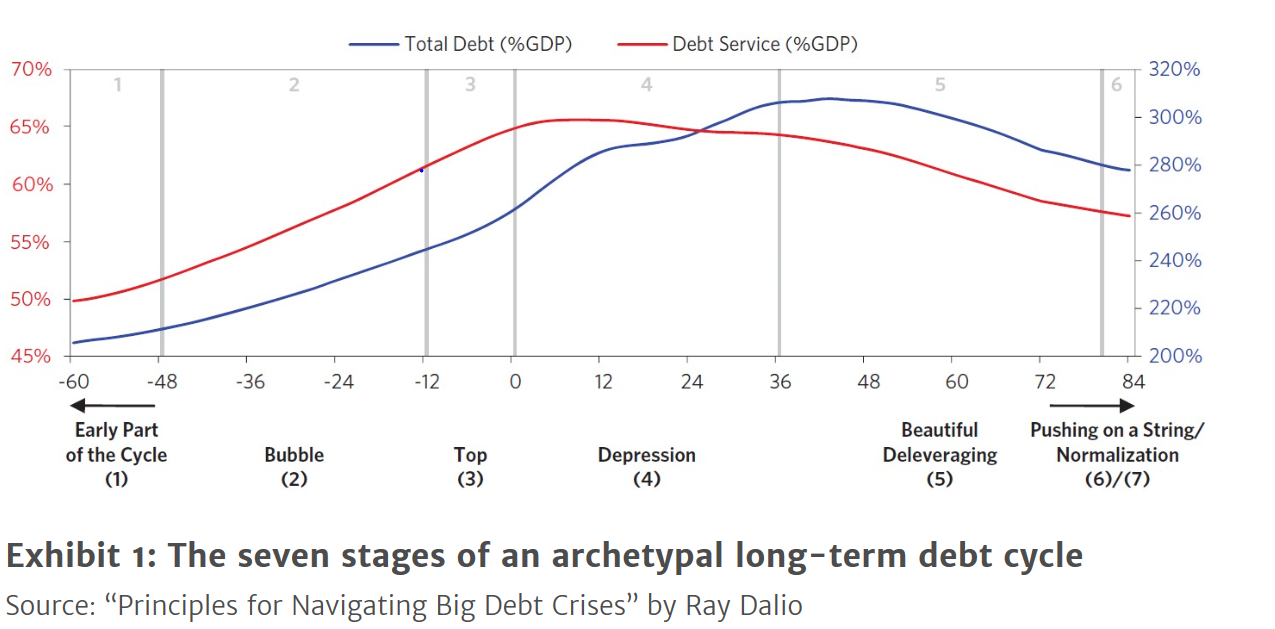

Three conditions are typically prevalent during the bubble stage (see chart below)

1. Debt grows faster than income.

2. Equity markets rally.

3. The yield curve flattens.

All three conditions have been prevalent in recent years. I should also point out that monetary authorities don’t always play ball at this stage of the debt cycle. Where they should seek to constrain the bubble, they often inflate it instead by being far too lenient.

But debt and GDP grows more or less in line during the early stages of debt super-cycles. As the bubble in stage 2 gets bigger and bigger, it takes more and more debt to deliver a dollar of GDP growth. As you near the end of the bubble stage, the debt-to-GDP ratio, which was about 1:1 earlier on, changes dramatically. It now takes about $5 of additional debt to generate a dollar of GDP growth. In some of the largest economies in the world, and that would include both China and the United States, the ratio is now 0.20-0.25; i.e. we are not far from hitting the proverbial wall.

Borrowings eventually peak (stage 3), and depression follows (stage 4) which Ray, as mentioned earlier, defines as a dive in GDP of 3% or more. All the debt cycles that he reviews in his book go through a slump in GDP of that magnitude or more.

Deleveraging (stage 5) follows, which Ray calls Beautiful Deleveraging. He assumes (which is almost always the case) that the stimulation offered by monetary authorities is powerful enough to offset the deflationary forces. In practice, this is done by providing ample liquidity and credit support.

Most of the time, that is it. Stage 5 marks the end of the debt cycle. Conditions normalise, and a new cycle can commence, but that is not always the case. Every now and then, consumers and companies don’t react to central bank policies the way the theory books prescribe. Consequently, monetary policy becomes inefficient.

This was a condition first recognised by central bankers in the 1930s, and they even coined a phrase to describe it: Pushing on a String, they called it. When that happens, you have come to the end of the debt super-cycle.

Read The full letter below

https://www.arpinvestments.com/arl/the-art-of-defaulting#.XAaKLVsI0Cw.twitter

Awesome writeup. Tx.