Nedbank strategist Mehul and Neels writes some exciting stuff and like me, they don’t confuse Fundamentals with LIQUIDITY. They write in a strategy note

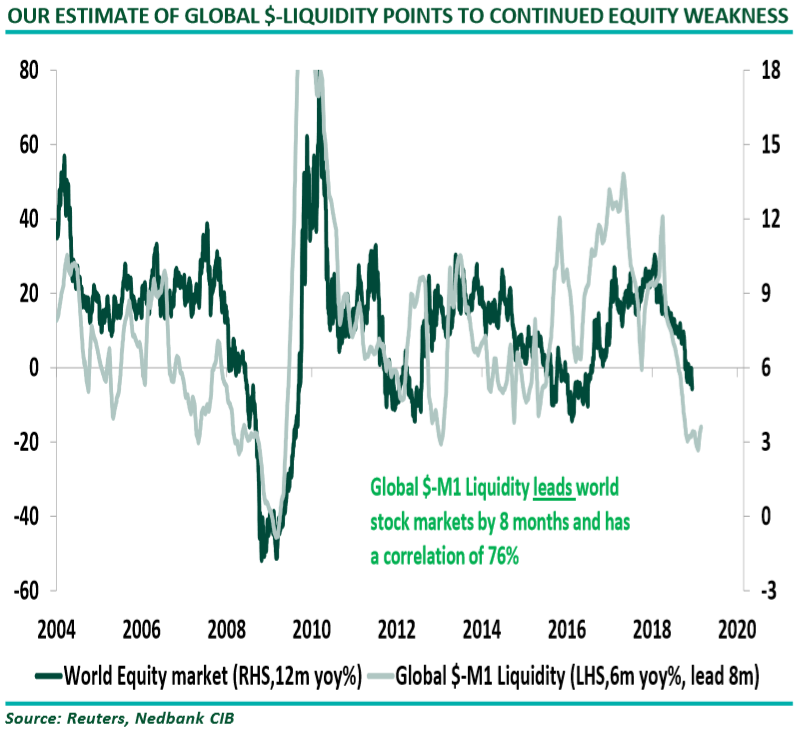

There is a strong relationship between the change in Global $-Liquidity (M1) and the performance of the global stock market.(76% correlation)

• Global $-Liquidity leads the global stock market by an average of eight months.

• If there is no boost to Global $-Liquidity, we expect this relationship to hold. As a result, the risk of further downside potential for stock markets across the world would remain intact.

Further..The EMBI(USD-denominated corporate debt) spread is very close to a breakout level.

• We believe this is the “canary in a coal mine” for risk assets.

• USD-denominated debt of EMcorporates has grown from USD650bn in 2009 to the current USD3.2tn and there significant mismatches i.e. USD-denominated debt as a percentage of GDP is 70% and as a percentage of reserves is 75%.

• Amid a slowdown in global growth, coupled with a tighter Global $-Liquidity environment, if EM$-corporate spreads continue to widen, it would negate our view below on EM equities, i.e., that a short-term bounce is possible.

My two cents

So it comes down to LIQUIDITY and the global money supply is not expanding, infact it is contracting. FED is already in QT mode ( forget rate increase, that’s only the cost of providing LIQUIDITY) and In a widely expected decision ECB has also decided to stop its QE so how will the existing debt be serviced and how will the new debt be created if Private sector and consumer is already leveraged?