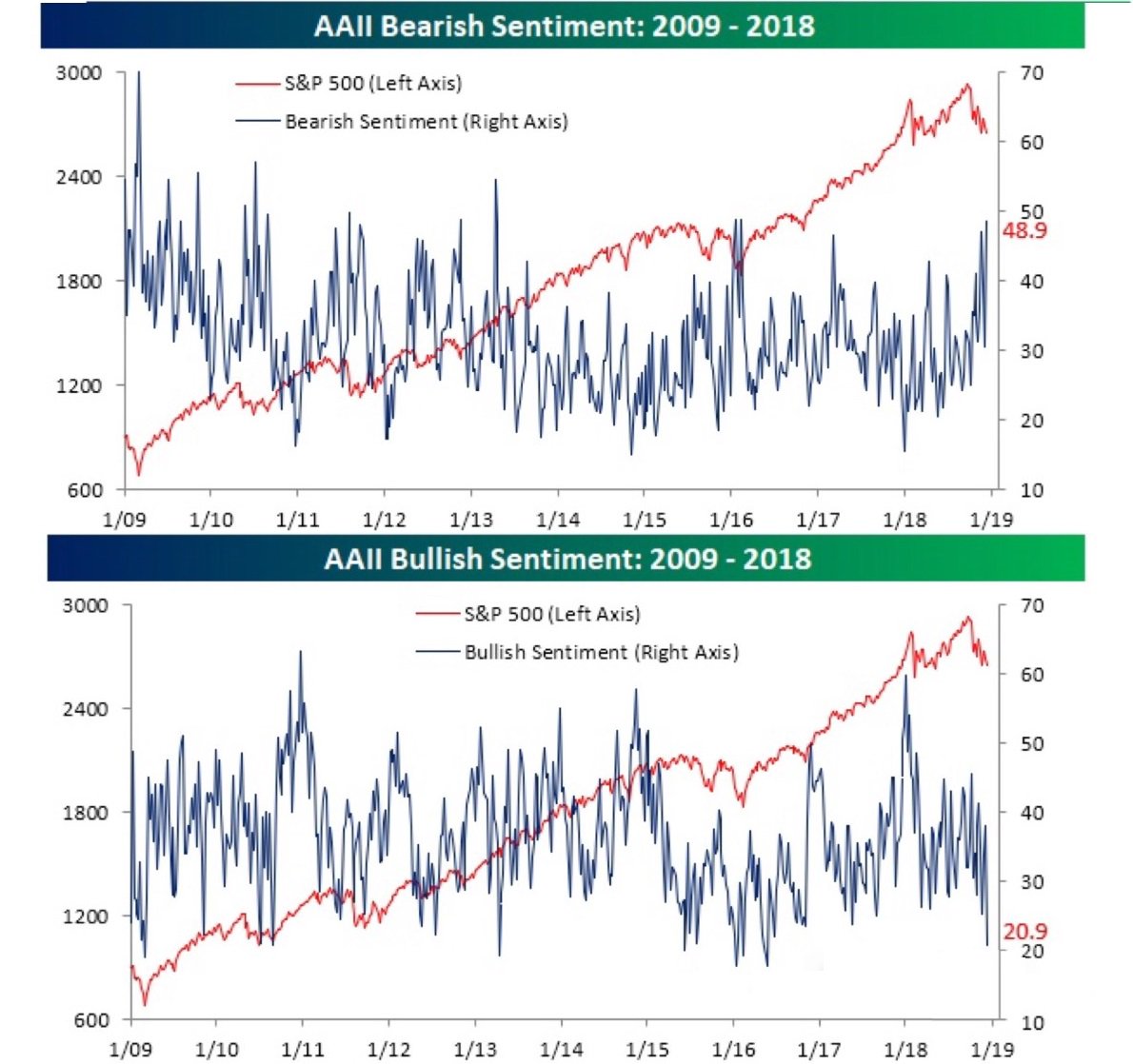

I think we are in early stages of bear market, with very poor returns for equity investors in the years to come. But it seems looking at the chart below there is just too much bearishness

The smart money index just continues to plunge. what are they seeing that a normal investor is missing?

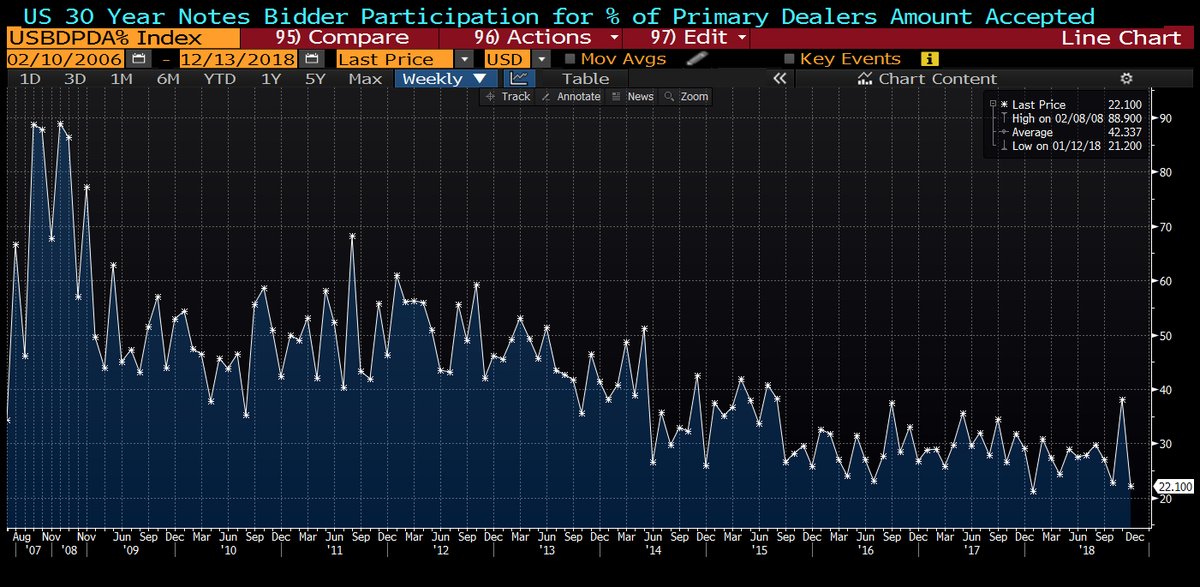

There was strong demand an Friday’s $16 billion auction of 30-year Treasuries, at least by one measure – primary dealers ended up taking down the second-lowest proportion of the debt on record. This speaks to the growing conviction of slowing growth ahead.

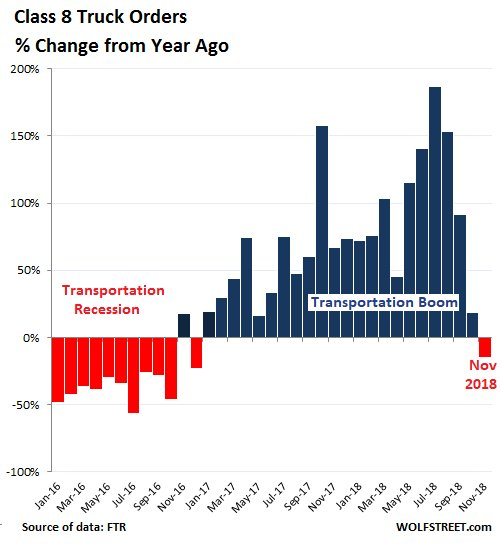

The US Trucking Boom Ends.It was fun while it lasted: One more indicator of slowing growth

Here is an interesting divergence.It seems Emerging markets are sniffing US slowdown and coming change in FED policy. Money already moving to EEM

Thanks for d info sir, even Indian markets r still trading at a premium, corrections might happen here also very shortly.