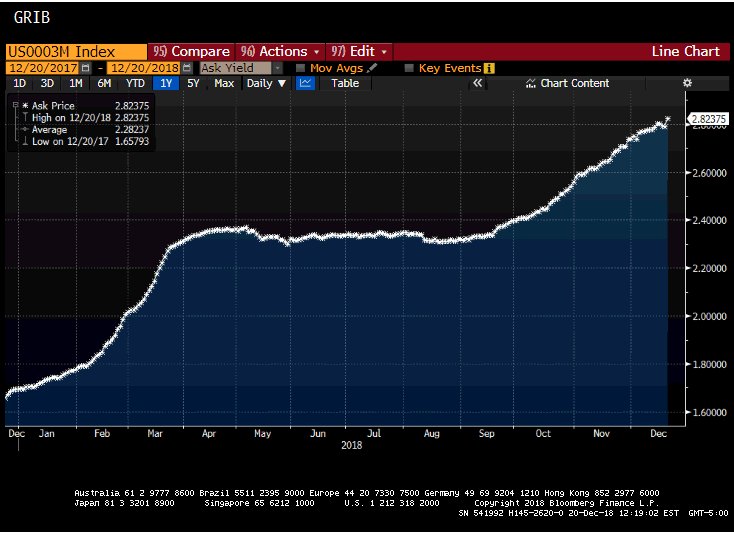

After trading lower going into the Fed meeting, Libor took a big jump higher today, up 3.4bps on 3mo Libor. That’s a large move in Libor. Seems the Libor panel participants see more rate hikes coming from the Fed.

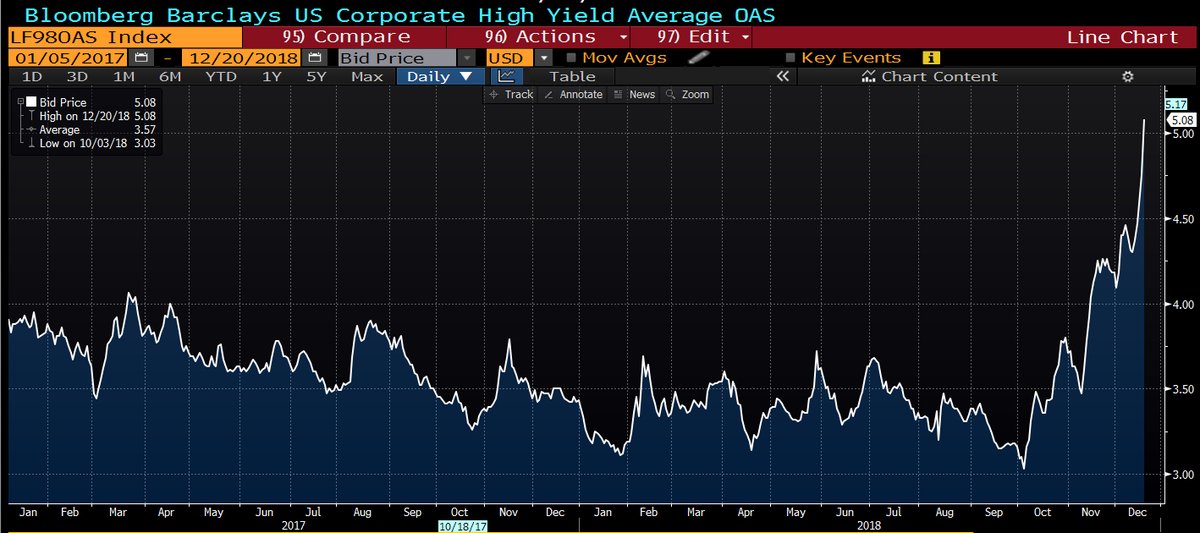

U.S. high-yield bond spreads rose yesterday the most on a percentage basis since August 2011.

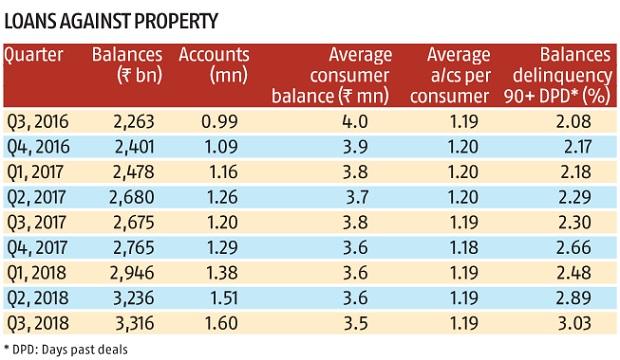

Everybody wants to milk Indian consumer but CIBIL says…….

“Defaults on credit cards, loan against properties on the rise”

what’s Happening here….. Citigroup down 12 days in a row

Wow, Mr. Jain. Your snippets and meticulous views on macroeconomics is indeed a gem to an ever enthusiast macroeconomic geek like me. Plus, I have learnt a lot from you over the months . Thank you once again for the information you share which are not that easy to find.